Recession at the door of elections : how to strike the right balance?

Par

Eshan Dinally

Par

Eshan Dinally

Par

Eshan Dinally

Par

Eshan Dinally

2019 is an electoral year for Mauritius. Around the world, political parties in power seduce the electorates with plenty of popular measures. Nevertheless, economists are ringing an alarm bell that a recession may soon follow. The possibility for an economic slowdown worldwide is over the horizon and there is no doubt that Mauritius will bear the wrath as well. How to reconcile pre-electoral measures to the threat of a recession ?

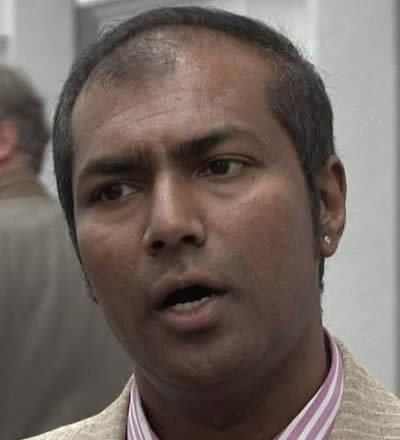

Swadicq Nuthay : “GM must adopt a cautious approach”

Swadicq Nuthay : “GM must adopt a cautious approach”Economist Swadicq Nuthay states that it is expected that the Government will maintain a relatively expansionary fiscal policy stance for 2019. “At the same time, government revenue projections are expected to be under pressure on account of a weaker economic growth than projected due to potential fall in export earnings. As mentioned above, the latest figures of the current account are already showing signs of deterioration.”

He reveals that the budget deficit is already on the high side at 3.2% of GDP for 2018/2019 and is expected to rise further should growth be lower than forecasted on account of headwinds from an economic slowdown from our main trading partners. “Our public debt is also hovering above 64% of GDP excluding the Metro Express project and other potential liabilities. The Government must adopt a cautious approach with respect to its fiscal policies as the current economic structure will not be able to bear more debt.”

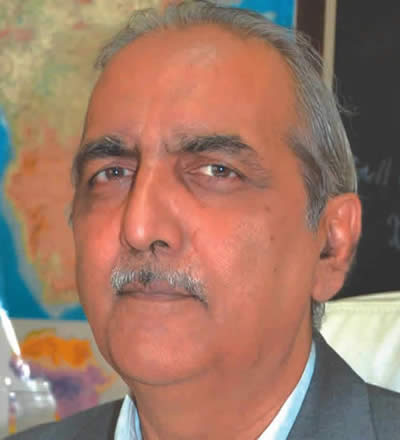

Rajiv Servansingh : “Need to secure future economic stability”

Rajiv Servansingh : “Need to secure future economic stability” Chairman of MindAfrica and economic observer, Rajiv Servansingh explains that in all electoral democracies, the year of elections is one in which the incumbent government introduces “popular” measures in order to woo the electorate. “Any responsible government must, however, keep a balance between such dispositions and the need to secure future economic stability. The Government will probably feel that on the back of mostly sound macroeconomic parameters, 2019 may be a year when it can afford to introduce what you are calling ‘popular’ measures. To be fair, it must be said that they have not waited for the election year to start taking measures to alleviate the misery of those at the bottom of the social ladder.”

He believes that the threat of a recession cannot be taken lightly. “The Government will therefore have to balance the eventual negative effects of such a slowdown in the global economy on our local context and take appropriate and adequate measures to at least alleviate its most harmful effects.”

Dr Vinaye Ancharaz : “Policymakers must stay on their guards”

Dr Vinaye Ancharaz : “Policymakers must stay on their guards”Economist and consultant, Dr Vinaye Ancharaz declares that recession or not, it is crucial that Mauritian policymakers stay on their guards. “We cannot afford to be complacent. And we certainly cannot afford to waste away years of hard-earned economic prosperity. Unfortunately, in an election year, governments do resort to populist measures that can do much economic harm in the long term, and the current government is no exception. In fact, at current trends, there is a danger of economic derailment, as the Government continues to make good economics subservient to cheap politics.”

Any good economist will tell you that there is no such thing as a free lunch, he avers. “This axiom has become a cliché to the point that it is all too often forgotten, sometimes conveniently ignored. Take, for example, the latest announcement by the PM that tertiary education will henceforth be free in all public institutions. I am an ardent supporter of free education; of which I am a living product. However, I don’t approve the Government’s approach to free university education. The same goes for free public transport. Free education, like free transport, is not free in any sense. These services come at huge cost to the Government, and it is the taxpayers who foot the bill. In a well-functioning democracy, the people should be able to signal to the Government how they wish their tax contributions to be used, and, more importantly, who should benefit.”

As an economist, he believes that some types of free public services, including transport and university education, should be targeted to those who cannot otherwise afford those services. “Providing such services free to all entails a waste of resources, and it goes against the fundamental principles of equity and fairness.”

By 2020, the conditions will be ripe for a financial crisis, followed by a global recession. This prediction is made by Nouriel Roubini,who had predicted the world recession of 2008. He and Brunello Rosa, co-founder and CEO at Rosa & Roubini Associates, have outlined 10 reasons for this.

First, the fiscal-stimulus policies that are currently pushing the annual US growth rate above its 2% potential are unsustainable. By 2020, the stimulus will run out, and a modest fiscal drag will pull growth from 3% to slightly below 2%.4.

Second, because the stimulus was poorly timed, the US economy is now overheating, and inflation is rising above target.

Third, the Trump administration’s trade disputes with China, Europe, Mexico, Canada, and others will almost certainly escalate, leading to slower growth and higher inflation.

Fourth, other US policies will continue to add stagflationary pressure, prompting the Fed to raise interest rates higher still.

Fifth, growth in the rest of the world will likely slow down – more so as other countries will see fit to retaliate against US protectionism. China must slow its growth to deal with overcapacity and excessive leverage; otherwise a hard landing will be triggered. And already-fragile emerging markets will continue to feel the pinch from protectionism and tightening monetary conditions in the US.

Sixth, Europe, too, will experience slower growth, owing to monetary-policy tightening and trade frictions. Moreover, populist policies in countries such as Italy may lead to an unsustainable debt dynamic within the Eurozone.

Seventh, US and global equity markets are frothy. Price-to-earnings ratios in the US are 50% above the historic average, private-equity valuations have become excessive, and government bonds are too expensive, given their low yields and negative term premia.

Eighth, once a correction occurs, the risk of illiquidity and fire sales/undershooting will become more severe. There are reduced market-making and warehousing activities by broker-dealers.

Ninth, Trump was already attacking the Fed when the growth rate was recently 4%. Just think about how he will behave in the 2020 election year, when growth likely will have fallen below 1% and job losses emerge. The temptation for Trump to “wag the dog” by manufacturing a foreign-policy crisis will be high, especially if the Democrats retake the House of Representatives this year.

Finally, once the perfect storm outlined above occurs, the policy tools for addressing it will be sorely lacking. The space for fiscal stimulus is already limited by massive public debt. The possibility for more unconventional monetary policies will be limited by bloated balance sheets and the lack of headroom to cut policy rates. And financial-sector bailouts will be intolerable in countries with resurgent populist movements and near-insolvent governments.

60 private-sector economists were recently surveyed by the Wall Street Journal, and their prediction is somewhat dire. 59% of them say the economic expansion that began in 2009 after the Great Recession of 2008 took the wind out of the world’s economic sails will end in 2020. Another 22% pegged the year 2021. What lies beyond that is probably another recession, the depths of which will likely become apparent as things progress — or, rather, regress.

“The current economic expansion is getting long in the tooth by historical standards, and more late-cycle signs are emerging,” said Scott Anderson, chief economist at Bank of the West, who was among those economists predicting a 2020 recession. 62% of the survey respondents indicated an overheating economy tied with the tightening of the Federal Reserve interest rates as reasons things will get worse. It’s worth noting that these kinds of things are very hard to predict, so a grain of salt is warranted. However, with a total of 81% of economists surveyed by the WSJ predicting that things will hit the fan by 2021, it seems likely that it’s coming.

Goldman Sachs does not foresee any recessions in major economies in 2019 but low profit growth is on the cards in the U.S. and Europe, its chief global equity strategist told CNBC Tuesday. “It’s still our view that we’re not headed for recession in any of the major economies,” Goldman’s Peter Oppenheimer told CNBC at the Goldman Sachs Global Strategy Conference in Frankfurt. “At the end of last year, there was a particularly sharp downgrade in expectations for the U.S. and while there has been a big tightening of policy and financial conditions in the U.S. … We don’t see a recession, but we do see a pretty sharp slowdown,” he said, adding that markets had “got too far into pricing a deeper downturn than we expect.”

J'aime

J'aime