Open Letter of Appeal to Finance Minister

Par

Shah N Kadall, Yaasiin Karimbocus

Par

Shah N Kadall, Yaasiin Karimbocus

Par

Shah N Kadall, Yaasiin Karimbocus

Par

Shah N Kadall, Yaasiin Karimbocus

Dear Minister, Many borrowers come to see me on the illegal capitalisation of interest, unfair contracts terms and exorbitant charges on their loan account. I represent borrowers at the Mediation Court, the Commissioner for Borrowers Protection and the Supreme Court.

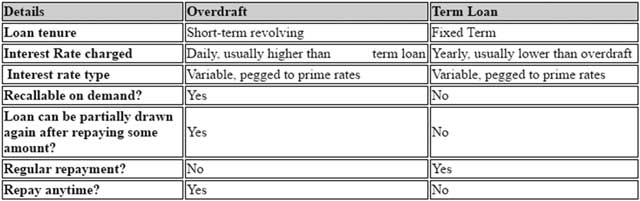

Many people in the finance and banking sector industry know that in certain circumstances, interest due may be capitalized on the banking facilities offered to the borrowers. However, there are two kinds of banking facilities, Loan and Current Account. Bank loan facilities mainly consist of Working Capital Loan, Housing Loan, Import Loan and Personal loan. On the other hand, Bank Current Account facilities consist of Bank Overdraft and Credit Cards accounts. There is a difference between a loan facility and an overdraft facility. An overdraft facility is a revolving credit and allows a borrower to write cheques, deduct loan instalment payments and withdraw cash from his current account up to the overdraft limit. It is a short-term (usually up to 12 months) standby credit facility which is usually renewable on a yearly basis. It is not subject to any repayment as long as the amount used is within the credit limit. The overdraft facility however is repayable on demand by the bank at any time. On the other hand, a term loan must be fully repaid over the period of the term loan by regular instalments. A comparison of the main characteristics of overdraft facilities and term loans is shown below:

Whether banks in Mauritius may capitalise loan interest due on a monthly basis? What is Capitalisation of interest? The balance of a loan is made up of two major components: the principal, which is the amount borrowed, and the interest, which accrues regularly on the principal. Loan capitalisation is the point at which all of the unpaid interest that has accrued on the principal is added to the principal. The significance of capitalisation of interest is that capitalising interest on a loan increases the cost of repaying the loan. This is because the new principal balance is higher, and interest charges after capitalisation are calculated based on the new principal balance. The borrower has to spend much of the monthly payment on not only paying off the higher balance after the capitalisation, but also paying the extra interest on this higher balance.

The prevalence of the Mauritian Banking Practice legitimatises stipulation as to interest on periodical rests and their capitalisation being incorporated in contract as per the Article 1134 of the Mauritius Civil Code. Such stipulations incorporated in contracts voluntarily entered into and binding on the parties shall govern the substantive rights and obligations of the parties as to recovery and payment of interest. The contract is law but it should be made in good faith and can be revoked for the reasons that the law allows. However, the Capitalisation method is founded on the principle of the provision of law made under the “Code Civil Mauricien”. In accordance with the provision of law made under Article 2202-6 of the Civil Code a bank may capitalise interest for a loan above three years but the pertinent question is – How to capitalise interest? Should it be capitalised on a daily, weekly, monthly, half-yearly or yearly basis? There are no known provisions of our law which would allow any Bank in Mauritius to capitalise interest on a daily or monthly basis. The issue of interest is very clearly governed by Article 1154 of the Civil Code which stipulates that only interest due for a year may bear interest. In order for a loan to be capitalised, the reimbursement period must exceed 3 years (article 2202-6 – Civil Code) and it must have interest that accrues during a year (article 1154 – Civil Code) when the borrower is not making any payments.

Mauritius has inherited two systems of law namely the Common Law from UK and the Civil Law from France. Common Law is the law that has evolved from UK courts going back to the Norman Conquest in 1066. Civil Law is the law that evolved from the Roman law, based on written “civil code”. The Civil Code sets out the organizing, concepts, principles, rules and ideals of law.

Il est établi en France, que nul autre qu’un compte courant n’habiliterait une banque à capitaliser les intérêts dus à des intervalles moins d’une annuité, c’est-à-dire 12 mois. Le code civil n’en admet lui-même la possibilité que dans les limites déterminées par l’article 1154 (Prof Fernand Debrida), qui stipule: “Les intérêts dus des capitaux peuvent produire des intérêts, ou (1) par une demande judiciaire, ou (2) par une convention spéciale, pourvu que, soit dans la demande, soit dans la convention, il s’agisse d’intérêts dus au moins pour une année entière”. Les intérêts échus ne peuvent produire intérêts qu’autant qu’ils sont dus pour une année entière, dans la crainte qu’une capitalisation à trop court terme n’entraine un grossissement trop rapide de la créance. (J.G. Prêt a int, 155). L’article 1154 du code civil n’est pas applicable à un compte courant (Bank Overdraft) car la capitalisation des intérêts d’un tel compte se produit en plein droit. Cette DÉROGATION ne peut pas être étendue à d’autres variétés de compte… POUR COMPTE COURANT – Les 2 conditions attachées à l’article 1154 ne s’appliquent pas. C’est-à-dire que la banque peut capitaliser les intérêts selon l’usage… In the Mauritian Case Law Rostom v Indian Ocean International Bank Ltd [1992] SCJ 332, Justice Boolell observed that “this article has been subject of a number of decisions of the French Courts. It is fairly well settled now that the article will not find its application to a ‘compte courant’.” POUR TOUS LES AUTRES COMPTES – Il faut obligatoirement observer les conditions de l’article 1154 qui sont d’ordre public de l’article 6. Les intérêts sont capitalisés à la fin d’une année entière et suivant une convention. Therefore, the 2 conditions which are of ‘Ordre Public’ are as follows: 1. Que les intérêts des intérêts soient l’objet d’une demande en justice ou que les parties aient fait une convention spéciale à cet égard. 2. Que les intérêts échus soient dus au moins pour une année entière.

The bank overdraft facilities are in relation to a “compte courant” which would benefit from the “dérogation jurisprudentielle”. On the other hand, the interest due on a loan may be capitalised on a yearly basis. The banks are not entitled to capitalise interest on loan on a monthly basis even by way of a ‘convention’. The banks in Mauritius cannot transgress ‘l’ordre public’. I am making an appeal to you to bring changes in the new Budget by introducing new Banking Law on ‘Capitalisation of Interest by banks in Mauritius’. It shall be very much appreciated if the Government and the Central Bank could intervene on the illegal interest charged by banks in Mauritius. I propose that the new banking law provides that ‘interest on loan periodically capitalised may not generate further interest, which, in subsequent capitalisation transactions, is calculated exclusively on the principal sum on a yearly basis, thus applying the legal annual capitalisation method as per article 1154 of the Mauritius Civil Code.’ Shah N Kadall, CFE, ICFA, IFC, MQA Forensic Accountant & Certified Fraud Examiner at KADALL SHAH ASSOCIATES

J'aime

J'aime