On 11 May 2018 the Joint Technical Committee (JTC) of the sugar barons sent a sugar coated bill to the Government asking for a subsidy of Rs 1.3bn annually for the five years 2018-2022 in the name of the small planters.

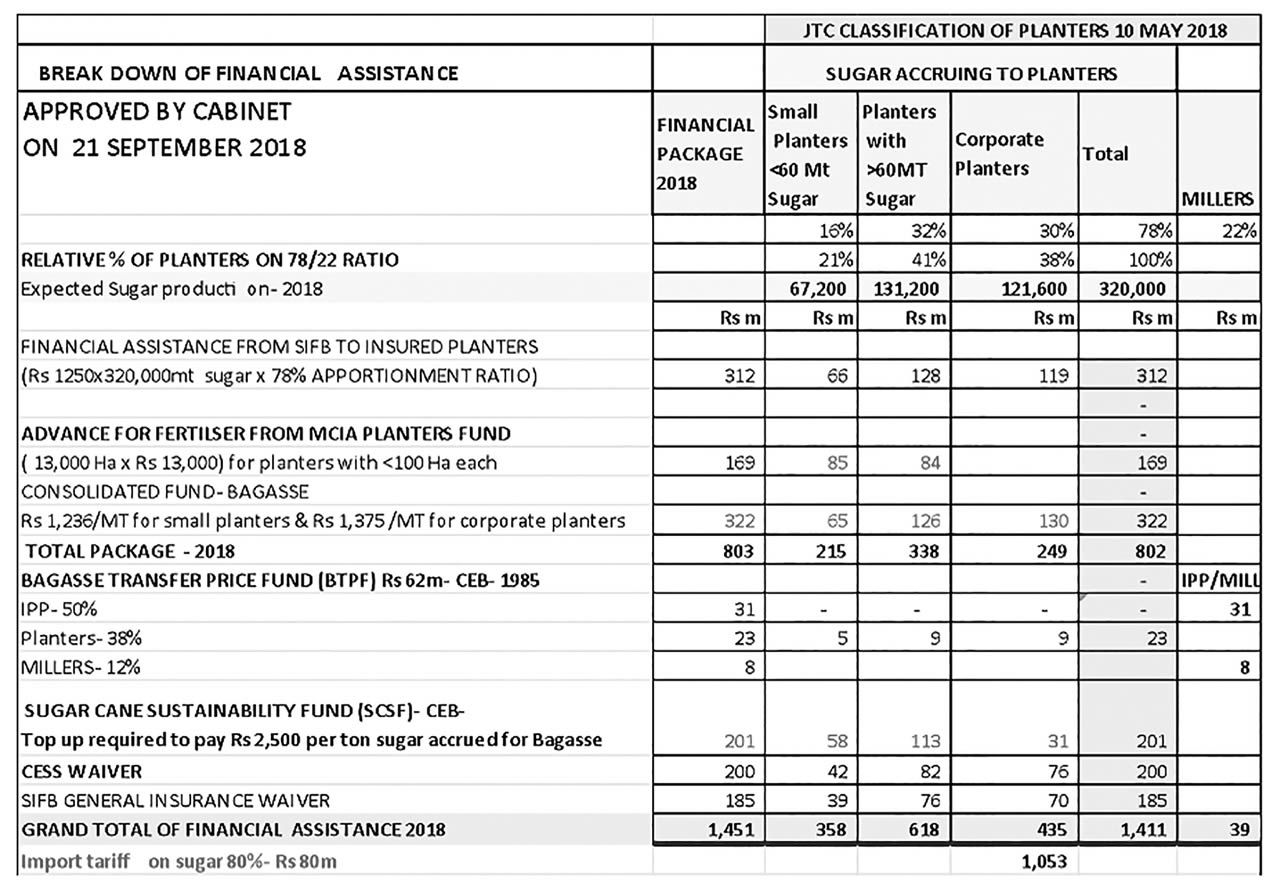

They also intimated that workers compensation is the main cause of the fall in their profitability and they urged government to approve a labour force retrenchment of 40%. On 21 September 2018 their wish was more than fulfilled. Government granted them Rs 1.4bn as depicted in the table below. Shortly after, the Minister of Agriculture went on air to boast that this package was in favour of the small planters without disclosing the full details of the package. The spin doctors of the sugar barons and the Government want us to believe that these handouts will benefit the small planters only. But the truth is that Government has bled Sugar Insurance Fund Board (SIFB) the tax payers, the small planters and electricity consumers once again to play Robin Hood to the fat cows of the sugar sector. The sugar barons have in fact received a jackpot of more than Rs 1.0 bn instantly. The ultimate beneficial owners of the corporate sugar sector have pocketed at least Rs 250m each. How much will they ask for the 2019 crop?

FLEECING THE SMALL CANE PLANTER

The sugar barons are guzzling themselves with all the other incomes derived from the gamut of by-products originating from the cane. They pocket a discounted income of at least Rs 14bn annually from the cane cluster- or RS 4,500 per ton cane compared to the meagre Rs 1,000./ ton cane receivable by the small planter with the newly announced package.

The sugar barons claim that they are doing everything within the set legal parameters? The obvious culprits for this rot are the Regulators (MCIA), the pay agent (MSS), the Executive (Government) and the Legislature. Who has enabled them to split their sugar estates into plantation companies, milling companies, refineries, distilleries and power plants? Successive Governments have denied the planters a fairer distribution of income from Bagasse and Molasses. It is not too late though. It does not take too much to bell this cat.The existing laws have been crafted by the new “Sirdars “-generation 4.0” of the sugar barons, sitting on the board on the MCIA/ SIFB and pushed through cabinet and thereafter forced down the throat of MPs in Parliament .

THE MAURITIUS CANE INDUSTRY AUTHORITY (MCIA).

The Mauritius Sugar Authority was replaced by the MCIA in 2011 to regulate the cane industry in the wake of liberalisation of the EU sugar market. It has utterly failed to meet 12 out of the 16 objectives for which it was set up and it has not delivered at all on 8 of its statutory duties. Had it played its role as a strong regulator today every planter should have been receiving a CANE INCOME instead of a SUGAR INCOME. The small planter should have been proudly earning Rs 2,500 per ton cane since 2012 itself and not a single acre of land would have been left to abandonment. There is no more money in sugar but there are billions of rupees in cane and in its by-products. The MCIA is responsible for fixing prices of molasses and is also responsible to ensure planters get a fair share of all income arising from any goods produced out of Bagasse (including electricity). But it has failed to deliver on these counts too. To illustrate these arguments let’s consider the followings:

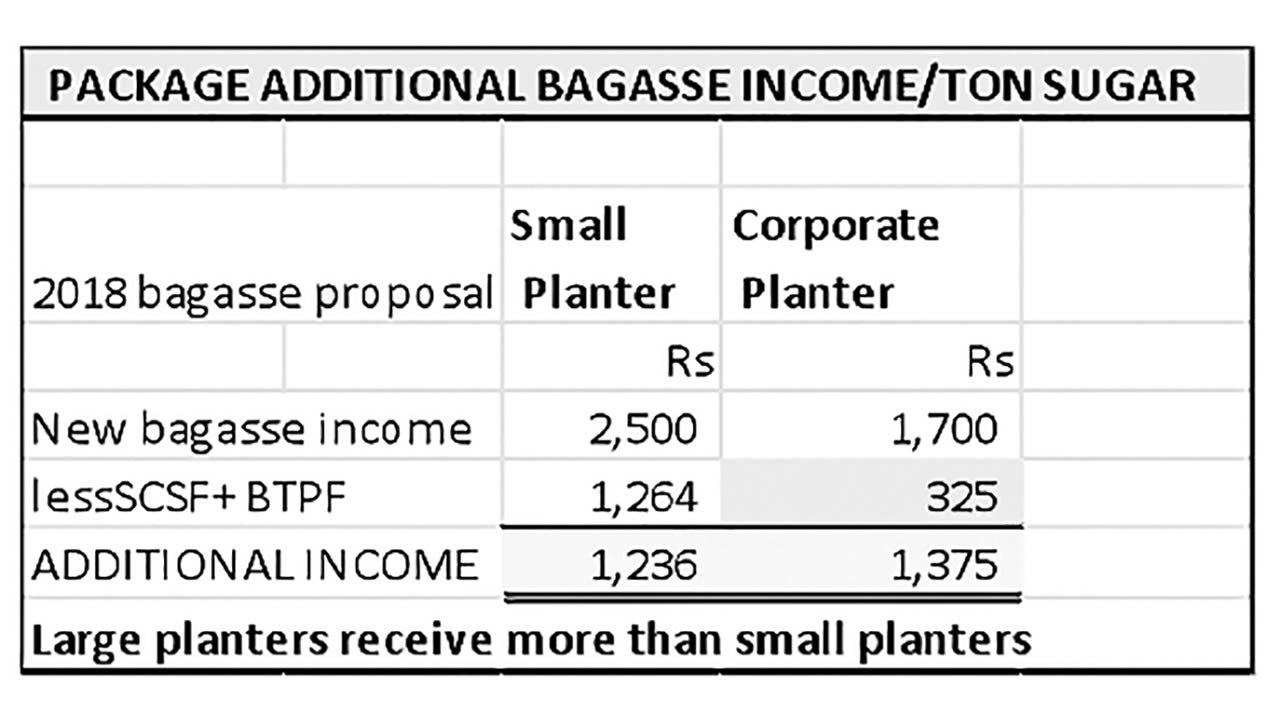

1. BAGASSE INCOME : For more than 30 years planters have received a mere RS 11.40 per ton Bagasse (2017 figures). The same Bagasse converted into electricity has a commercial value of Rs 1.6bn or Rs1,452 per ton. The topping up announced by Government to remunerate Bagasse at Rs2,500 per ton sugar accrued effectively benefits the sugar barons (Rs400m) instead of the small planters( Rs123m).

2. MOLASSES INCOME : The MCIA is the sole Authority to fix the revenue of planters arising from Molasses. Planters receive a blended price of Rs 2,147 (year 2017) per ton pure molasses and a bottlers’ contribution for rum destined for local consumption. The total works out to Rs 3,543 per ton or Rs 3.54 per litre of Molasses (100% Acohol). The same litre of Molasses produces 2.7 litres of Goodwill Rum (37% alcohol) with a commercial of value of at least Rs 1,350./=.in our shops. The income from sugar distributed to producers for the 2017 crop amounted to Rs 3.8bn but the sugar barons have pocketed Rs 4.2 bn from the sale of Molasses converted into rum and ethanol during the same year. The planter receives Rs 3,543 per ton of Molasses but the sugar baron earns nearly Rs 25,000 for the same ton of Molasses. And some still want us to believe that this is an equitable distribution of income!

Regarding the determination of the price of Molasses, this government just like the 1985 Government has committed a big statutory blunder. The 1985 Government had introduced the BAGASSE TRANSFER PRICE FUND (BPTF) with RS 60m set aside from CEB funds annually to pay for electricity produced from 600,000 tons of Bagasse. It worked out to RS 100./ per ton of sugar accrued 62% of which went the IPP & the Miller. Thirty years later the small planters are still stuck with the same price of Rs 11.40 per ton from the BPTF.

Under the SIE Act 2016 the actual Government not having learnt the lessons from the past and under the “diktat” of Omnicane and its stooges at the MCIA , has created a colourable device by which the distillers will now pay only Rs 2,000 per ton of Molasses. The same Omnicane some time back imported molasses at a cost of Rs 8,000 per ton to produce ethanol, but with the complicity of the MCIA the price of locally originating Molasses is being artificially kept low. Before the advent of Omnicane Molasses was being sold at Rs 3,500 per ton. The price of Rs 2,000 per ton given to Omnicane in 2014 was a temporary incentive meant to last for the years 2014, 2015 and 2016 only. In December 2016 the actual government has converted a temporary measure into a permanent one. As a result not only Omnicane but all the other distillers are now buying Molasses at Rs 2,000 per ton. By implication small planters have lost Rs 1,500 per ton Molasses or Rs 135 m annually. Shall we take another 30 years to rectify these two blunders? Is there someone out there to fight for the interest of the planters rather than that of the sugar barons?

3. Refining fee and sugar apportionment ratio 78/22 : The sugar apportionment ratio has been worked to compensate the miller for his effort to receive the cane, analyse its sugar content, produce sugar, package it, store and deliver it to the quays. This ratio which works out to Rs 2,375./= per ton sugar has not been reviewed after centralisation which was supposed to reduce costs. The MCIA has again failed in its duty to review this apportionment ratio. Over and above planters are now being forced to bear a refining fee of at least Rs 5,600 per ton of White Refined Sugar (WRS). Sugar refining consists of converting raw sugar (Sucre roux) into WRS by removing the excess molasses from the raw sugar. How on earth can a simple refining process cost more than the whole cost of producing that sugar? The MCIA Act 2011 allows the MCIA to open the books of the miller/refiner to ascertain the validity and integrity of these claims deducted at source by the MSS.

When adding the refining cost to the initial processing cost (78/22 ratio) the small planter is taxed with Rs 8,622 per ton WRS even before receiving his income from sugar which amounts to Rs 10,717 only per ton for the 2017 crop . So the effective apportionment ratio of the sugar barons works out to 75 % instead of 22%.If taken as an average of the total sugar produced it works out to 40% instead of 22%. The sugar barons have pocketed Rs 2.3 bn in 2017 just to produce and refine the cane into WRS.

SURPLUS MOLASSES

The MCIA has also allowed the sugar barons to pocket the additional income from the surplus Molasses arising from the refining process. In his reply PQ/B693 of 24th July 2018 the Minister for agriculture stated that 7,829 tons of surplus Molasses were produced from imported sugar in 2017. The MSS annual reports shows that effectively 64,876 Mt sugar were imported for refining purposes that year. One can easily calculate how many tons of surplus Molasses have been produced from refining 355,213 Mt locally produced sugar in 2017 and one can also question the MCIA as to the reasons for which this additional income has not been shared given that the planter is legally entitled to 100% of molasses originating from his cane?

DEPLETING THE SUGAR INSURANCE FUND BOARD (SIFB)

This insurance fund was created to provide compensation to planters in rainy days. It is one of the best managed insurance company in the country and a model in the world. It is sad to note that more than Rs 5.2 bn of the accumulated reserves of the SIFB have been depleted during the period 2009-2018. A sum of Rs 2,7bn has been forgone as insurance premium waivers and another Rs 2.2bn has been given away as financial support. The SIFB was even made to give a loan of Rs 304m to the MSS in 2017 as additional financial support to the planters. This loan will presumably not be repaid. A closer look at the recent annual report of the SIFB forecasts a gloomy future for the SIFB. If Government keeps on plundering this Fund to please the sugar barons there is a very high risk of this insurance fund becoming insolvent and going bust over the next two years. It should not be forgotten that contribution to an insurance fund is a form of savings that must be refunded to the deposit maker one day. How many years did it take to build up the fund? What was the initial planter profile (1988-2014) and what is it now (2014-2018)? These are questions that need serious and immediate attention in order to help the small planters who have contributed graciously over the years. The fund is also made up of surplus premiums contributed by small planters who have abandoned their fields. Their number fell from 30,000 in 2000 to 13,000 in 2018. What has happened to their accumulated savings? Will somebody care to explain why they should not be refunded their savings? It’s too easy to say that small planters are abandoning their lands. But what has happened to their surplus premiums? On what basis did Government pressurize the SIFB to redistribute the planters’ savings to the sugar barons? It seems that there is a lunatic running an asylum somewhere at the Ministry of Finance.

CONCLUSION

Based on the foregoing it is time for the small planters to wake up and take their destiny into their own hands. Nobody owes us a free lunch but nobody is also allowed to snatch our rightful income from us. Unless and until small planters realise their true worth nobody will really care for them. So it’s time to stand up, to fight and to put an end to this economic genocide. The fight is not against a person or an institution but it is rather against an oppressive system that does no longer have its place in a civilised society. All the self-proclaimed champions of meritocracy, equal opportunities, affirmative actions, positive discrimination and equitable distribution of national income have chosen to remain quiet on the issue and for too long. It is high time for them also to stand up and get counted?

J'aime

J'aime