The Budget 2016-17 has brought many changes to the country’s tax ecosystem with increase in Income Exemption Thresholds and new exemptions, among others. So what would these changes entail for your income tax returns? We ask Mr Roopesh Dabeesingh, Tax Director at Deloitte, to provide us with some explanations.

What is your analysis of the new measures taken in the budget concerning income tax?

The 2016/2017 Budget can be considered as a no-tax budget, with no change to the income tax, corporate tax and VAT rates and minimal changes to fiscal measures either in terms of new taxes & levies or increase of the tax base. The Finance Minister has come forward with a series of tax incentives to revive growth which has been slowing to 3.4% amidst the difficult domestic and international economic context.

With regards to personal income tax, a relaxation of the regime will enable a greater number of people to benefit from deductions and reliefs, to which they were not previously entitled due to restrictive conditions.

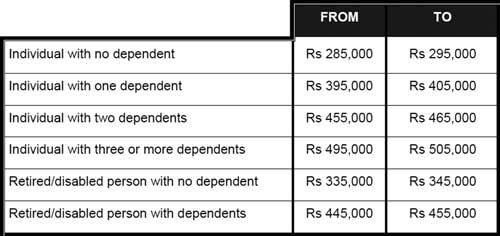

The Income Exemption Thresholds (IET), which is the main deduction available to individual taxpayers has been increased by Rs10,000 across the board for all categories. Henceforth an individual with no dependant and annual income of Rs295,000 (i.e. equivalent to a monthly salary of around Rs 22,700) will be scoped out of income tax altogether.

Changes to filing tax returns: What kind of change will it bring on the filing of tax returns? What are different kinds of exemption people will be benefiting with the new budget?

The increase in IET along with a series of other measures, including the relaxation of eligibility criteria for deductions and reliefs, will reduce the income tax bill for a considerable number of middle-income earners whose representations made over the last few years seemed to have finally been heard by the current Finance Minister.

In addition to the increase in IET, this year’s budget contains several measures that are likely to benefit individual taxpayers at large and the more interesting ones are:

- With no restriction on the date loan is taken as well as the increase of annual income limit from Rs 2 million to Rs 4 million to benefit from interest relief on secure housing loan, a significant number of people will henceforth be able to claim interest relief. This can be a major deduction for individuals or couples, especially with the removal of cap of Rs120,000 on the amount of relief claimable in last year’s budget

- The decrease of minimum tuition fees qualifying for additional exemption in respect of dependent child pursuing tertiary education from Rs 44,500 to Rs 34,800

Impacts of the new measures on the country

The budget contains various fiscal measures to boost different sectors of the economy while maintaining a safety net for those at the lower rung of the ladder. The more meaningful tax proposals are as follows:

l Introduction of a 5-year tax holiday for entities engaged in provision of: treasury management centre services, international law firms providing legal advisory and international arbitration services to global business clients, investment banking and corporate advisory services as well as for foreign ultra high net-worth individuals and asset and fund managers. These measures are interesting for the global business operators which are being provided with a framework and opportunity to broaden their service offerings as well as to target the niche market of Asset and Wealth management.

l Tax holiday of 8 years for industrial fishing aiming at providing a boost to the ocean economy is a good initiative but we should look forward for more substantial measures and initiatives if we really want to develop this into an important pillar of the Mauritian economy.

l Extension of 8-year tax holiday to new enterprises set up by individuals or co-operative societies registered with SMEDA as well as the introduction of a 4-year tax holiday to existing SME’s with annual turnover of less than Rs10 million.

The new measures to open the economy to international operators as well as the numerous incentives to provide an impetus to the SME sector are designed to stimulate economic growth whilst at the same time ensuring that adequate provisions have been made for the less fortunate section of the population. Overall the initiatives contained in the budget reflect a good balance between economic, fiscal and social responsibilities and have been well thought out to address the many challenges facing the economy and hopefully pave the way for a “new era of development”.

Changes to VAT and Registration Duty

A combination of other amendments to the VAT and Registration Duty legislation will be welcomed by the middle and low income earners who are contemplating the acquisition of their first house or apartment, such as:

- Registration duty exemption on secured housing loan for first time buyers now applicable for loan amount up to Rs2 million compared to previously Rs1 million

- Registration duty exemption threshold for first time buyer of a residential bare land are being increased from Rs1.5 million to Rs 2 million (provided the acreage does not exceed 20 perches)

- The ceiling of VAT refund limit to a Mauritian regarding the construction of a new dwelling or acquisition of a newly built apartment from property developers are being increased from Rs 300,000 to Rs 500,000 accompanied by removal of the maximum floor area eligibility criteria.

- Registration duty exemption for Mauritians acquiring a newly built house or apartment not exceeding Rs 6 million during the period 1 September 2016 to 30 June 2020.

J'aime

J'aime