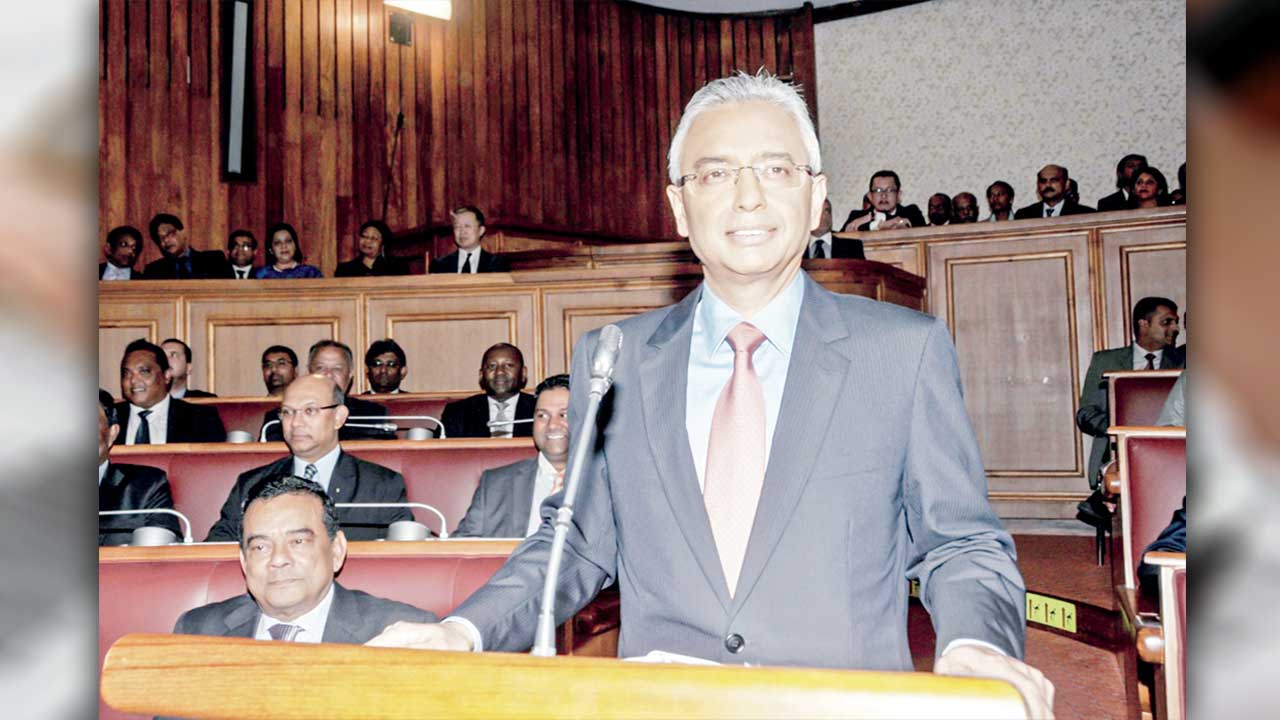

The countdown begins. Just one week to go till Prime Minister and Minister of Finance, Mr Pravind Jugnauth presents his first Budget since taking over the reins of government from his father, Mentor Minister Sir Anerood Jugnauth. Given the international and domestic contexts, great expectations are vested upon him. Economic operators from different sectors are looking for a lifeline through Budget 2017-18 which they expect to be a library of everything positive. Now, operators say, is time for action and not hot air.

Economist Bhavish Jugurnath claims that Mauritius is economically at the crossroads of some serious choices – either to continue with the present model of economic development based on neoliberal policies tried elsewhere in given circumstances or we choose a different destiny, a path of serious discovery and inventiveness, by directing our energies to more imaginative forms of planning and policies that produce altogether different outcomes that are more sustainable and inclusive.

“Mauritius would find it challenging to become a high-income economy in an opportune manner if the reform agenda remains in its current mode and the prevailing sub-par growth trend persists. The finance minister should realise our potential for sustainable and inclusive growth with a long-term horizon and vision.”

“Mauritius would find it challenging to become a high-income economy in an opportune manner if the reform agenda remains in its current mode and the prevailing sub-par growth trend persists. The finance minister should realise our potential for sustainable and inclusive growth with a long-term horizon and vision.”

The main emphasis, he says, should be on creation of greater national wealth with better sharing. Bhavish Jugurnath underlines three key measures to that end:

Addressing Near-Term Concerns

In view of the current economic conditions, the government should provide measures to address cyclical headwinds while supporting firms to seize opportunities and press on with restructuring. It is very crucial in the current economic context to launch an Industry Transformation Programme to help Mauritian firms and industries create new value and drive growth. The three key thrusts under the Industry Transformation Programme are:

- Transforming Enterprises

- Transforming Industries

- Transforming through Innovation

As we seek to transform enterprises and industries through the Industry Transformation Programme, the government should support the population in adjusting to change and seizing new opportunities. An ‘Adapt and Grow’ initiative is also important to help people adapt to evolving job demands and grow their skills.

Deepening Innovation Capabilities

To promote start-ups in new and existing industries, the government can set up a new entity called “Mauritius-Innovate”. This programme can match budding entrepreneurs with mentors, introduce them to venture capital firms, help them to access talent in research institutes, and open new markets. To help firms access the many grants from various agencies more easily, the government could consider launching a Business Grants Portal. These grants should be organised along core business needs of i) capability building, ii) training and, iii) international expansion.

Digitisation of the economy

Access to ICT services is no longer the primary issue facing policymakers. Instead, the critical question is how to maximize the adoption, utilisation, and impact of these services. Digitisation has emerged as a key driver and enabler of socioeconomic benefits. The digital economy is developing rapidly across the globe. It is the single most important driver of innovation, competitiveness and growth, and it holds immense potential for entrepreneurs and small and medium-sized enterprises (SMEs).

Unfortunately, only few enterprises are currently taking full advantage of new digital opportunities. How businesses adopt digital technologies will be a key determinant of their future growth. Government can harness the varying effects of digitization through three main measures, which go beyond their current roles of setting policy and regulations. For this, it should:

- Create digitization plans for targeted sectors in which they wish to maximize the impact of digitization.

- Encourage the development of the necessary capabilities and enablers to achieve these digitization plans.

- Work in concert with industry, consumers, and government agencies to establish an inclusive information and communication technologies (ICT) ecosystem that encourages greater uptake and usage of digital services.

Tourism Sector

Regarding the tourism sector, Sen Ramsamy, Managing Director of Tourism Business Intelligence, there are plenty of areas that require priority consideration. These are, namely, improving on average tourist expenditure, which is relatively low compared to that of our competitors.

“We should aim at attracting tourists having a higher pattern of expenditure than looking merely at number of arrivals. Tourists are spending much less and this is a serious alarm bell. The forecast for 2017 in terms of tourist expenditure is still more alarming. Whereas, with a slight twist in the tourism policy framework, would allow more money to be generated in tourism, perhaps double the actual amount, plus a drastic increase in direct jobs in tourism. It is a question of policy and strategies. The all-inclusive packages in hotels are also stifling our destination to a slow suffocation until we are knocked out of the competitive game. Remember that in terms of arrivals and average expenditure, we have already been knocked out as leader among destinations in the region to third and fourth positions respectively. The government should be able to discourage this practice, as it is detrimental to other economic sectors. It is just a question of our ability to tackle the problem with more dexterity and intelligence. And yet, it is quite feasible,” says Sen Ramsamy.

“We should aim at attracting tourists having a higher pattern of expenditure than looking merely at number of arrivals. Tourists are spending much less and this is a serious alarm bell. The forecast for 2017 in terms of tourist expenditure is still more alarming. Whereas, with a slight twist in the tourism policy framework, would allow more money to be generated in tourism, perhaps double the actual amount, plus a drastic increase in direct jobs in tourism. It is a question of policy and strategies. The all-inclusive packages in hotels are also stifling our destination to a slow suffocation until we are knocked out of the competitive game. Remember that in terms of arrivals and average expenditure, we have already been knocked out as leader among destinations in the region to third and fourth positions respectively. The government should be able to discourage this practice, as it is detrimental to other economic sectors. It is just a question of our ability to tackle the problem with more dexterity and intelligence. And yet, it is quite feasible,” says Sen Ramsamy.

He also says that “the level of tourist safety and security, the standard of services and staff training, should be considered more seriously and this, beyond the confines of hotel establishments. Staff working in restaurants, in local shops, guides, taxi drivers, airport staff, and so many more, need to be adequately trained to service a more sophisticated and demanding clientele.”

What are the expectations from the Budget? “The tourism sector is heavily indebted despite the arrival figures for which we are so excited. Other than looking in awe at arrival figures every month, not much is being done to advance the industry. We are paying lip service to innovation; the hard work of many operators (especially the DMCs) is not duly sustained nor encouraged to allow for more efforts and renewed initiatives.” For Sen Ramsamy, “tourism seems to be on auto-pilot mode with no bold actions in marketing and product improvement in relation to the expectations of the new generation of world travellers.”

Sen Ramsamy explains that tourism is one of the main economic pillars and is sustaining our economy despite the odds. “It has far more potential in terms of direct, indirect and induced employment, wealth creation, investment opportunities, contribution to GDP and multiplier effects/linkages. In terms of regional tourism development, Mauritius is now pitifully trailing behind Seychelles, Reunion Island and even Madagascar whose International Tourism Fair to be held this week at the venue of its recent Francophone Summit, has soared after just a few years. Seychelles is riding high in world reputation, and Sri Lanka is advancing rapidly.” He strongly believes that the forthcoming Budget can “unlock a huge avenue of opportunities for our people, especially our youth. Whilst the private sector does what it knows best in terms of operations, government should be able to move out of its comfort zone to demonstrate more dexterity in development strategies and a good dose of audacity in its policy orientation and vision for tourism.”

Manufacturing Sector

According to Ahmed Parkar, from textile firm Star Knitwear, the next budget should focus on specific areas of the manufacturing sector. Among those: cost of sea freight. If this is lowered, it will bring a major boost. The training scheme should also be upgraded, he adds.

“However, the main issue is the work permit for foreign workers who have stayed for eight years. Once they reach that limit, they must go back for one year before being eligible for a new work permit. This should be reduced to three months only. If the expatriate has received high level training and returns to his country where he/she might get a job placement for over one year, we will lose in terms of value added.”

“However, the main issue is the work permit for foreign workers who have stayed for eight years. Once they reach that limit, they must go back for one year before being eligible for a new work permit. This should be reduced to three months only. If the expatriate has received high level training and returns to his country where he/she might get a job placement for over one year, we will lose in terms of value added.”

Ahmed Parkar also calls for more emphasis on connectivity with Africa. “If we do not have an export promotion strategy, then how will we revamp the port to get more connectivity? Moreover, another issue is the exchange rate. The dollar and the rand among others have gone down. How will we maintain the local costs and support increase of salary if we do not get a helping hand in terms of exchange rate. This is the ideal period to make adjustments.” He adds that visibility plays a vital role for the manufacturing sector and that it should be increased on the markets around the world.

On the other hand, the Mauritius Export Association (MEXA) has underlined issues that the budget should focus on the manufacturing sector. In its Budget Memorandum 2017, MEXA states that it expects the manufacturing sector to receive due consideration. “It is a fact that the export manufacturing base is shrinking. However, today many manufacturing companies, of varied sizes, are exporting in an incoherent manner,” it states. The MEXA has identified six types of manufacturing companies, which if brought together, would constitute a stronger and larger export base. These are namely the “Domestic Oriented Enterprises (DOEs), Export-Ready Small & Medium Enterprises (SMEs), New Entrants through Industrial FDI, Freeport sector, Offshore sector and the Export Oriented Enterprises (EOEs).”

MEXA says a level playing field should be created between the Export Oriented Enterprises, Domestic Oriented Enterprises, Small & Medium Enterprises, Freeport companies, and the offshore sector to generate synergies and create scale.” It is proposing the government to provide export-driven fiscal incentives to all manufacturing companies.

Property Development

Property Development

The President of the Association of Estate Agents, Mr Laval Savreemootoo, highlights that if the government rolls out favourable new measures, the sector will get a much-needed boost. Some of his main demands are:

Review price of materials

The government could eliminate taxes on certain materials like cement and iron bars which will in turn reduce the cost of construction. If this becomes a reality, there will be more employment for masons, plumbers and electricians.

Control in the price of land

There are certain areas where plots of land are too expensive and locals cannot buy. Mauritians have the dream to buy a plot of land but with ever-higher land prices, it is impossible for them to buy. If the government is willing to give a boost to the construction and real estate sector, there should be some control over land prices.

Small and medium enterprises

The president of the Association of Small and Medium Enterprises, Mr Amar Deerpalsingh, says that the SME sector employs 54% of the workforce and contributes 40% of the country’s Gross Domestic Product. Yet, he says, small businesses still are lagging and face numerous difficulties. He hopes measures announced in the previous Budget will finally be implemented.

“Despite being voted by Parliament, many projects have still not seen daylight. It is time for the government to find real solutions to difficulties faced by SMEs. One of the main issues today is red-tape. We have around 400 trade licenses. Some businesses need various licenses to operate and then must run errands through different authorities. Many times, when you go to one department, they will pass the buck. This has discouraged many people from launching their businesses. Even foreigners have complained of the procedures. Unsurprisingly, we have dropped down on the Ease of Doing Business global ranking. Why not set up a fast track committee like for other projects?”

“Despite being voted by Parliament, many projects have still not seen daylight. It is time for the government to find real solutions to difficulties faced by SMEs. One of the main issues today is red-tape. We have around 400 trade licenses. Some businesses need various licenses to operate and then must run errands through different authorities. Many times, when you go to one department, they will pass the buck. This has discouraged many people from launching their businesses. Even foreigners have complained of the procedures. Unsurprisingly, we have dropped down on the Ease of Doing Business global ranking. Why not set up a fast track committee like for other projects?”

Work permits for foreign labour is a pressing issue, he says. “SMEs face tremendous difficulties in having recourse to foreign labour. It takes time. This is one of the major reasons many entrepreneurs prefer to import products at the detriment of local manufacturing. Regarding competition between local products and imported products, there are some norms which only apply to locally-made products and these do not favour local manufacturing. So, the government needs to address this issue to boost domestic manufacturing.”

Mr Deerpalsingh recalls that national investment has taken a downward trend and now stands at 16 per cent. Without investment, there is no economic growth. “SMEs will continue to suffer if the economy does not pick up. We are losing competitively and productivity keeps on decreasing. It is time for action.”

Global Business

President of the Association of the Trust Management, Kamal Hawabhay reveals that they have sent their correspondence to the Ministry of Finance, explaining their situation and what needs to be done to boost up the sector. “With the change in the DTAA (with India), we have faced various issues. The global business sector is facing headwinds.

To compensate this, the government must make provision for a new type of service. For instance, the government can implement the Tax-Exempt Fund. Many other jurisdictions have come with this game changer. Besides, we are also expecting some policy decisions to be implemented in regard to the Income Tax section 79 and 81.”

To compensate this, the government must make provision for a new type of service. For instance, the government can implement the Tax-Exempt Fund. Many other jurisdictions have come with this game changer. Besides, we are also expecting some policy decisions to be implemented in regard to the Income Tax section 79 and 81.”

He further explains that another issue that needs to be addressed is reviewing the tax regime for investors. “If investing through Mauritius becomes difficult, investors will hesitate to come here.” He argues that the European Union is introducing various policies such as Foreign Tax Credit. “We really hope the government will not be in a hurry to sign other treaties that will be detrimental to the sector. We should not accept everything that is being announced to us. We need to be vigilant and take our time to decide. We need to analyse all new policies and its impact in our sector.”

Over the past months, the global business sector has been subjected to criticism, highlights Kamal Hawabhay. “Recent cases of money laundering had a negative impact. It would be essential that the Ministry of Finance gives a clear statement about the sector so that the employees are reassured and foreign investors gain confidence in us.”

According to him, two years ago, the government came with African Strategy whereby the Board of Investment has set up offices in South African and New Delhi. “We expect the government to come forward and enlighten us about the African Strategy. How can this help us more? We are unaware of what it promotes really and how we could use it.”

Finance Sector

Swadicq Nuthay, CEO of ABC Capital Partners, is a well-known figure in the financial services sector. Last year’s Budget, he says, announced a plethora of measures to transform the sector into one with higher value-added segments. However, he argues, some of these measures are yet to be implemented, for example the setting up of the Mauritius International Derivatives & Commodities Exchange (MINDEX) and the promotion of Mauritius as an International Arbitration Centre.

“The government should aim at building up the necessary ecosystem to make Mauritius an IFA. Several licenses such as Investment Banking, Corporate Advisory, Global Legal Advisory, Family Corporation License, etc. have been introduced. However, the number of licence holders is still relatively low. Similarly, tax holidays for a number of entities have been introduced to encourage business in the sector. Structural changes and reforms are important for the economy to shift into such sectors as technology and financial services where growth potential exists. It is also important to improve our Ease of Doing Business ranking,” he says.

“The government should aim at building up the necessary ecosystem to make Mauritius an IFA. Several licenses such as Investment Banking, Corporate Advisory, Global Legal Advisory, Family Corporation License, etc. have been introduced. However, the number of licence holders is still relatively low. Similarly, tax holidays for a number of entities have been introduced to encourage business in the sector. Structural changes and reforms are important for the economy to shift into such sectors as technology and financial services where growth potential exists. It is also important to improve our Ease of Doing Business ranking,” he says.

What are the expectations in the finance sector? “Bold measures from the government to reignite the engines of growth, diversify, modernise and transform the economy through structural and sectoral reforms, better collaboration between the public and private sector, more employment opportunities for the young people, mega projects announced in the Budget which were expected to generate jobs and contribute to the growth have not even started.”

How much leeway does the finance minister have? Swadicq Nuthay explains that “the public-sector debt is on the rise (65.6% in Mar-17 from 62.9% in June-15 and 65.1% in June-16), which is above the 60% threshold, recurrent deficit is currently 2% of GDP. Over the last two years, recurrent expenditure has grown by 28% while recurrent revenue has gone up by 19%.” Hence, he underlines, this calls for fiscal discipline. The government must also “ensure that proper control mechanisms are put in place to run the different infrastructure projects.”

J'aime

J'aime