One of the budgetary measures that caught the attention of the population is the introduction of the Negative Income Tax system to provide financial support to some 150,000 employees in full-time employment and earning emoluments of less than Rs 10,000 per month. This measure will provide financial support of up to Rs 1,000 per month to low-income earners. This policy will take effect as from 1st January 2018. How far will this measure reduce the gap between the poor and the rich? Young blood of the country debate on the issue.

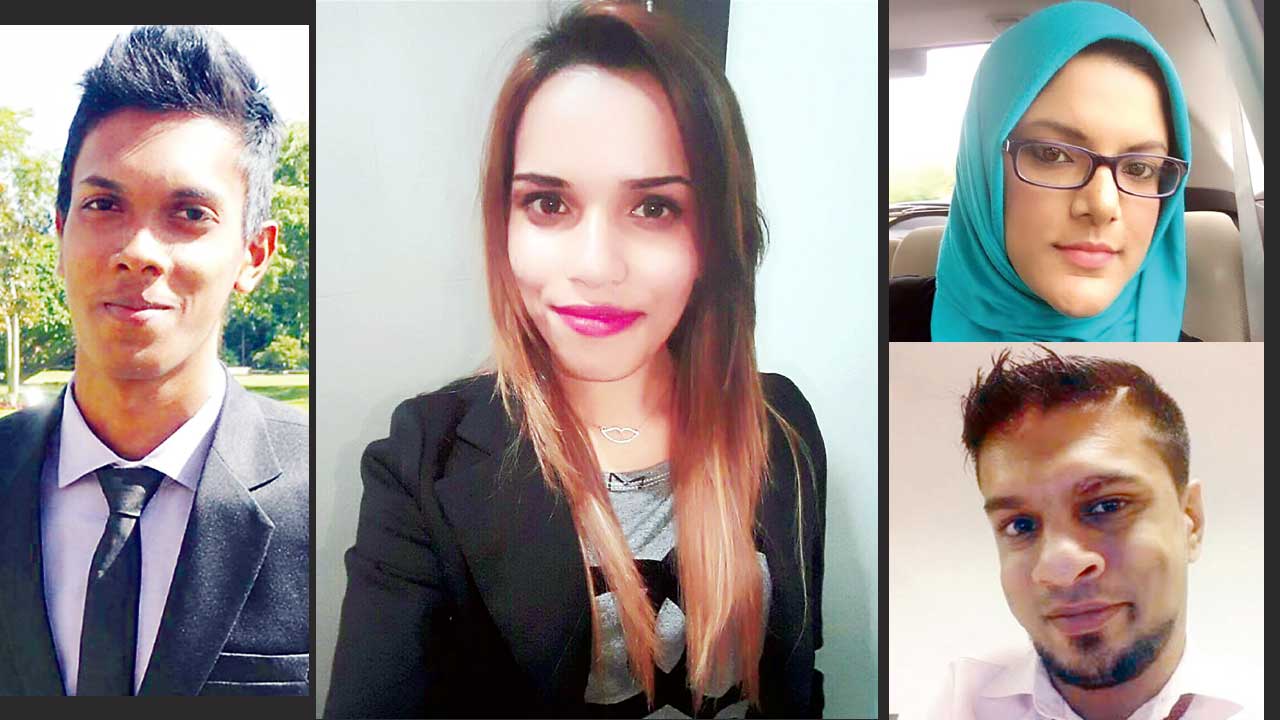

Sooraj Dhunoo: “It is a laudable measure”

Sooraj Dhunoo: “It is a laudable measure”

Sooraj states that in recent years, we have seen the rich becoming richer while the poor becoming poorer. “The figures provided by Statistics Mauritius are nothing short of alarming. The recent government budget has proposed certain measures to address these issues, one of which is the concept of the Negative Income Tax (NIT) system which aims at providing financial support to low income earners, particularly to those earning less than Rs 10,000 a month. Such a laudable measure has since long been implemented in many countries, including the US, and has shown much success. More money to the poor will enable them to raise their living standards; higher income means greater purchasing power and thus more benefits to the poor.” However, he maintains that such a system encourages what social scientists call “poverty traps”, tempting the poor not to improve their situations. “As income rises, the benefits given to the poor will disappear. Hence, there is no incentive for hard work and this can merely exacerbate poverty. This policy may prove burdensome to the Mauritius Revenue Authority owing to the administrative procedures. And it is estimated to cost around Rs 1.3 Billion. Will this not worsen the problem of indebtedness which Mauritius is currently facing? Undeniably, the idea of implementing NIT is a wise move by the government. However, ending poverty is much more than simply giving money. The NIT needs to be supported by other policies to empower the poor and to lift them out of poverty. Today, more than ever, we have the momentum to make this happen. Efforts should be focused towards improving our quality of education for education is reckoned to be one of the greatest forces to alleviate poverty.”

Ruksaar Hulkury: “It would have been better to introduce the minimum wage rate”

Ruksaar Hulkury: “It would have been better to introduce the minimum wage rate”

Under this system, people earning a salary under Rs 10,000 would receive a supplementary pay from the government through the Mauritius Revenue Authority (MRA) instead of paying taxes to the government, says Ruksaar. “This measure would only be a relief for the lower income workers instead of helping them directly. In fact, it would help to employer directly, as the Organisation does not have to spend any additional expenditure to subsidise any amount to that programme. Only the Government would invest in it. Consequently, the Company could recruit more staff and increase its productivity and profitability without incurring any additional expenses. However, the introduction of the Negative Income Tax (NIT) would cost the government an additional amount. For example, in Mauritius, this measure would concern around 150,000 citizens and cost around Rs 1.3 Billion to the Government as new and additional expenditures. Hence, this amount of Rs 1.3 Billion could be invested in different basic needs projects such as construction of housing for lower income people, or improving any infrastructures or any additional social aids could be implemented to those needy citizens.”

According to her, in the context of the actual economical situation, it would better to introduce the minimum wage rate for all sectors instead of a Negative Income Tax (NIT) system as the minimum wage rate for all sectors would be money raised from the organisation directly and not from public fund. “Consequently, public funds could be used for alternative projects or social aids and the public debt would not increase, as it is becoming alarming nowadays and corrective measures are not being taken. Our future generations would be accountable for our actions being committed now.”

Zahire Ahmad Joghee:“The complexities will not be eliminated”

Zahire Ahmad Joghee:“The complexities will not be eliminated”

Negative income tax (NIT) would allow claimants to receive income through the simple filing of tax returns rather than through the claiming of welfare benefits, ideally eliminating the need for a complex welfare bureaucracy, states Zahire. “The introduction of the Negative Income Tax (NIT) system is intended to create a single system that would not only be beneficial for the Government in terms of handling different administrative tasks but on the other hand, it would fulfil the social aims of making sure that there is a minimum level of income for all citizens. It is theorised that with a Negative Income Tax (NIT) the need for minimum wage, social security programs or other government assistance programs could be eliminated.”

He further adds that “in Mauritius, the introduction of the Negative Income Tax would benefit some 46,000 lower income employees whose incomes are Rs 5,000 only per month. Thus, they will guarantee an additional amount of Rs 1,000 maximum monthly but payable on each semester of a tax year. Consequently, with only Rs 1,000, we cannot make significant changes in one’s life, it will be only a relief, not assistance. In addition, Government would have to maintain different systems (NIT) and its entire social aids as well. The complexities associated with the welfare system would not be eliminated.”

He argues that instead of taking public contribution to subsidise lower income ones, it would be better to create more jobs in order to increase the active population. “Consequently, the Government could used the amount of Rs 1.3 billion to empower lower income ones and this would be a better way to eradicate extreme poverty. In other words, the Government would make the lower income ones independent and in future, the budget of social aids could be decrease gradually.”

Zohra Gunglee: “The official unemployment rate will decline”

Zohra Gunglee: “The official unemployment rate will decline”

Zohra Gunglee, a young economist, believes that this is not only a good initiative for low income earners but also a method of bringing the informal sector under the tax bracket. “The negative income tax will apply to those earning under Rs 10,000. Yet, those who fall in this category but who are not officially registered will not be eligible. There are many workers who work for SMEs and individuals and get paid in cash. They will, therefore, have to ask their employers to register them and pay social security contributions in order to be eligible for the negative income tax. Similarly, many persons who are officially registered as unemployed but who work in the informal sector will be encouraged to become formal. Hence, the official unemployment rate will decline. Furthermore, the informal sector being gradually registered implies that the incomes by these workers will be accounted for in the GDP figures, thus contributing to official growth rate. However, the negative tax may upset certain thresholds for other benefits. Plus, the MRA’s administrative processes will become onerous. Also, there is the possibility that many low income earners will simply ignore the negative income tax as they would prefer to remain in the informal economy.”

Abhishek Fowdur: “Demotivate workers to work more”

Abhishek Fowdur: “Demotivate workers to work more”

The negative income tax from Rs 100 to Rs 1,000 will not have an impact on the household expenses of such recipients, avers Abhishek. “This is applicable for those who contribute to NPF and NSF, but persons who do not form part of such criteria are left unattended. Now the question that arises is what will a family gain from Rs 100 to Rs 1,000 in their monthly consumption? If the bread earner of eligible negative tax income does a part time job, he will earn approximately double facilities grant. Gas cylinder subsidies are not the only way to improve the purchasing power of low income families, in addition of such tax. Theoretically, such system would somehow demotivate a worker to earn more than his or her wage rate where his or her skills would not justify the ability to earn more because the clause is that income should not exceed Rs 30,000 if couples’ earnings are added together.”

As highlighted by the young man, the definition of poverty in Mauritius is not clear. “Is poverty defined as a person who doesn’t have a minimum pay or an individual who doesn’t have a concrete house? Low income earners are being exempted from tax, but I guess an individual who is earning above Rs 50,000 monthly for instance should have an absolute tax theory compared to specific criteria of those who meet an annual income of Rs 3,500,000 as specified in the budget. Before drafting or implementing strategies for poverty, the better solution is to find out why there is poverty.”

Kovalen Beemadoo: “It is a positive fiscal measure”

Kovalen Beemadoo: “It is a positive fiscal measure”

The introduction of a system of Negative Income Tax for people at the lower rank of the social ladder can be viewed as a positive fiscal measure to bridge the gap between the rich and the poor, says Kovalen. “It is a good measure for about 150,000 people who earn less than Rs 10,000 and whose employers are currently contributing to the national savings fund and the national pensions fund. On the flip side of the coin, attention should have also been provided to workers that do not contribute to these pension plans and who are working in the informal sector. The best solution could have been the implementation of the national minimum wage as proposed by the national wage consultative council, which aims at providing a decent salary to workers both in the formal and informal sector.”

Avinash Dhondoo: “It can be a springboard to help the poor”

Avinash Dhondoo: “It can be a springboard to help the poor”

A Negative Income Tax is the best way to eliminate the pitfalls of both the minimum wage and the failed bureaucratic welfare state, says Avinash. “It’s a public policy solution that is very pragmatic, as we consider overhauling the welfare state for the 21st century. The Negative Income tax would function as a basic minimum income that would get cash to the people who need it without the red tape of bureaucracy and benefit rules. The NIT, especially when combined with tax reform that sets a decent-sized gap between the income ceiling to qualify for NIT payments and the income level where income and payroll taxes would apply, can eliminate the perverse incentives in the welfare state against work, education and marriage.” He further explains that “an NIT can serve both as a safety net and as a springboard to help poor people improve their lives. Since an NIT only covers the gap between what someone makes and a certain basic income, there is no penalty for getting a raise that puts you over the income threshold. One further advantage is that we could structure its benefits not just on only the poor but it could be also used to provide some help to those higher up on the income distribution as well. However, many things promised in the last budget have not been implemented.”

J'aime

J'aime