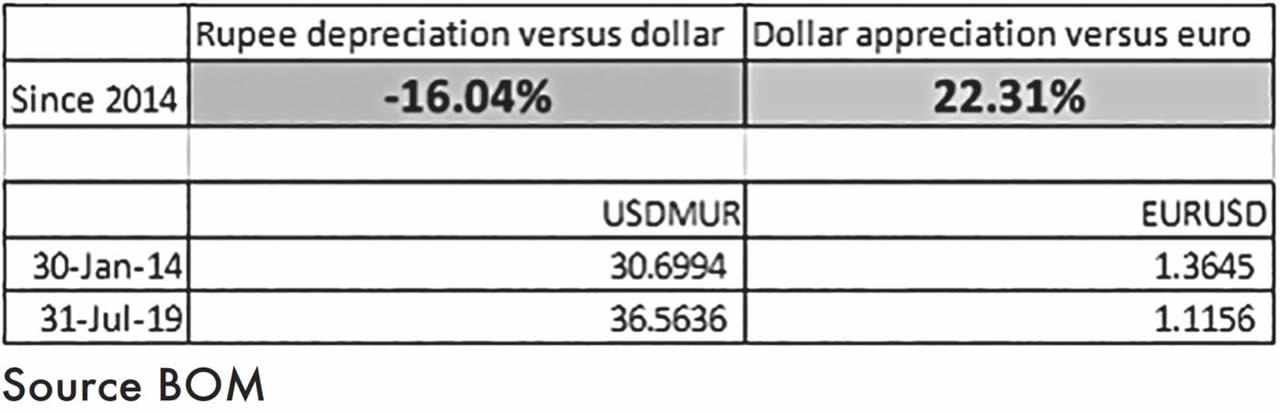

Mauritius has been trying to turn around its economy since the past years but one barometer that has shown signs of stress is the currency. According to statistics, the depreciation of the Mauritian Rupee over the last five years stands at 16. 04% with the annual average depreciation around 3.5%. It seems that the tough time for the Mauritian Rupee is never ending.

Exchange Rate of the Rupee against USD in Jan 2014 was 30.69 and July 2019 has been 36.56 The Mauritian Rupee has not been stable since 2014. As per June 2019 Monthly Statistical Bulletin of BOM, it states that “between May and June 2019, based on the weighted average dealt selling rate, the Rupee, on average, depreciated against the US dollar and the Euro but appreciated against the Pound sterling. The average Rupee exchange rates were Rs35.615/USD, Rs40.257/EUR and Rs45.354/GBP in June 2019 compared to Rs35.190/USD, Rs39.449/EUR and Rs45.403/GBP in May 2019.”

CEO of KATIC consulting and former director of Bank of Mauritius (Development and Supervision of Financial Markets and Internal Debt Management, Dr. Chiragra Chakrabarty, explains that currency appreciation and depreciation are common occurrences in countries and markets that adopt a floating exchange rate. “Factors on both the local and international level play a role in either appreciating or depreciating the value of various currencies. In FY2017-18, movements in the exchange rate of the rupee remained largely influenced by developments on international markets. The Bank of Mauritius continued to intervene on the domestic foreign exchange market to smooth out undue volatility in the rupee exchange rate and ensure that the rupee broadly reflects domestic economic fundamentals.”

He further adds that “total turnovers, two third of these transactions were denominated in US dollar and Euro. However, US dollar transactions declined from 54.6 per cent in FY2016-17 to 45.5 per cent in FY2017-18 while transactions in Euro increased from 20.7 per cent to 23.3 per cent. In nominal effective terms, as gauged by MERI1, the Rupee depreciated marginally by 0.1%, undermined by the strength of the currencies of major trading partners. In real effective terms, based on trade weights, the Rupee appreciated by 0.5 per cent as the nominal depreciation against major trading partner countries was partly offset by a higher inflation differential. The Rupee exchange rate has been fairly stable, reflecting broad movements of major currencies in international markets, in addition to domestic demand and supply conditions.”

Appreciation versus depreciation

Appreciation versus depreciation

Amit Achameesing, Founder of the New Economic Thinking Academy (Sey) and lecturer at Whitefield Business School, explains that an appreciation tends to cause lower inflation because import prices are cheaper. “The cost of imported goods and raw materials will fall after an appreciation, for example. the price of imported oil will decrease, and with an annual import bill of around Rs30 billion for petroleum products, Mauritius is likely to benefit from an appreciation of its currency in the short term. On the other hand, an appreciation means that exports are likely to become less competitive. However, the net effect depends on the responsiveness of demand over time, which economists call the price elasticity of demand for imports and exports. Mauritius manufacturing exports are more likely to be price sensitive because there is more competition. However, it is important to note that if an appreciation is a result of improved export competitiveness, then the appreciation is sustainable, and would in fact not be a problem for the Mauritian economy.”

Whereas for depreciation, he reveals that the exports become cheaper and more competitive to foreign buyers. “Therefore, this provides a boost for domestic demand and could lead to job creation in the export sector. A higher level of exports should also lead to an improvement in the current account deficit. However, with a shrinking export sector, the benefits are much lower today. Furthermore, as a strong net importer of goods and services, a currency depreciation in fact has far more adverse effects on the Mauritian economy. For instance, in 2018, the current account deficit, which mainly reflects the differences between imports and exports, widened considerably to more than 8% of GDP.”

Reasons behind depreciation

Dr. Chiragra Chakrabarty recalls that global and local factors play major roles in influencing the exchange rate. “It is technically seen that if USD appreciates against Euro, MUR depreciates against USD. Since March 2019 till May 2019, USD strengthened, which influenced the local currency to depreciate. In June 2019, the US dollar depreciated against the Euro but appreciated against the Pound sterling. In the build-up to the FOMC meeting, the US dollar appreciated but subsequently stumbled after the meeting, reflecting the more accommodative stance of the US Federal Reserve. So, there was a mixed trend in month of June 2019.”

He also avers that local factors can influence and detract the international factors influencing USD-MUR relationship. “One of the key local factors is Forex inflows. Although I don’t have the current data of Forex inflows, but theoretically it can be assumed, if the trend of inflows is declining, it can lead to depreciation of MUR against USD. Demand for a currency might fall, leading to currency traders/speculators to expect the exchange rate to depreciate causing them to sell on the market. Another factor which can depreciate local currency is a deficit on the current account of the balance of payments. This leads to a net outflow of currency, causing exchange rate weakness. As per June 2019 Monthly Statistical Bulletin of BOM, first quarter data for 2019 shows an increase in current account deficit compared to first quarter of 2018. Stating that, I must say MUR is one of the safe haven currencies with very low volatility. The current level is correct level of MUR-USD and the Bank of Mauritius is doing a great job by intervening and trying to maintain an optimum MUR-USD rate.”

Ganessen Chinnapen, economist, recalls that firstly, the import dependency which has led to a widening current account deficit of around Rs112bn representing 23% of GDP. “Secondly, by converting foreign debts into local debts where we are replacing the USD with the Mauritian Rupee, which is the predominance of debt capital in Forex reserves. The third reason is the strategic orientation of the USA in terms of increasing its trade tariffs for countries like China and India have changed the international trade environment and market fundamentals resulting in currency depreciation against the US dollar. For example, both the Chinese Yuen and the Indian Rupee have experienced significant depreciation against the USD during the last 18 months.

BOM and exchange rate

Amit Achameesing highlights that it is important to mention that the foreign exchange reserves of the Bank of Mauritius stands today at around 7.5 billion US dollars. “Therefore, a depreciation of one Rupee against the US dollar gives an unrealized profit of about 7.5 billion Rupees to the BOM.

However, the crucial question to ask is where do those 7.5 billion US dollars come from in the first place? The answer is simple. During the past two years, the BOM has constantly intervened in the foreign exchange market by accumulating US dollars while at the same time selling Mauritian rupees in the belief that the Rupee is overvalued. Therefore, those unrealized profits only exist because of exchange rate interventions and fluctuations which are temporary and costly. The depreciation of the Rupee would have truly benefited the BOM if those US dollar reserves were accumulated through solid economic growth driven by a buoyant export sector.”

Ganessen Chinnapen argues that the BOM, just like any other central banks in the world, has a mandate to ensure a smooth and sound financial system, wipes out excess liquidity and pumps in funds in time of shortage of liquidity. “At the same time, the delicate task of monetary fine tuning is essential and this is where sometimes the wrong policy mix is implemented. Normally the Central Bank will buy or sell a currency in the foreign exchange market in order to increase or decrease the value its nation’s currency possesses against an alternative currency. This Central Bank intervention in the foreign exchange market should be the last resort. For example, a decline in value of our Rupee is likely to result in inflation from imported goods and services, subsequently, and the Central Bank will have no choice to raise the interest rate which will unfortunately affect the economic growth and asset markets. It is not advisable for the Central Bank to intervene frequently in the Forex Market.”

Pierre Dinan states that if the Rupee is depreciated, it will be in the BOM reserves but this does not picture a bright advantage. “The balance sheet will show the positive sign. But behind, there is another picture. What is important is to keep the balance of payment stable. The BOM plays a crucial role and it helps in boosting the economy. So, we cannot say that the BOM will be at complete advantage.”

The Bank of Mauritius : Mauritius has a floating exchange rate regime

The Bank of Mauritius (BOM), on its part, highlights that Mauritius has a floating exchange rate regime. “The exchange rate of the Rupee is determined by market participants on the basis of fluctuations of major currencies on the international market as well as the forces of demand and supply in the domestic foreign exchange market. Between 30th January 2014 and 31st July 2019, on a point-to-point basis, the Rupee consolidated indicative selling exchange rate of banks depreciated by 16 per cent against the US dollar. Similarly, on a point-to-point, the US dollar appreciated by 22 per cent against the Euro on the international market.”

For the BOM, it is expected that the exchange rate of the Rupee will continue to be driven by domestic demand and supply conditions, and by developments on international currency markets. The latter will be influenced by global macro-economic conditions and interest rate policies of major central banks.

Economic consequences

There are serious implications related to depreciation. It impacts on various sectors as well. Experts elaborates more on this. Dr. Chiragra Chakrabarty opines that adopting a local perspective, currency depreciation is almost never welcomed with open arms. “A downward trend usually causes the cost of living to rise and impacts international trade and exchange, among a range of other factors. But the story may be little different for Mauritian economy. A depreciation of the exchange rate will make exports more competitive and appear cheaper to foreigners. This will increase demand for exports. Also, depreciation will lead Mauritian assets to become more attractive; for example, a depreciation in the MUR can make Mauritian property appear cheaper to foreigners. Another upside of downward progression, is the upswing in local tourism.”

There are serious implications related to depreciation. It impacts on various sectors as well. Experts elaborates more on this. Dr. Chiragra Chakrabarty opines that adopting a local perspective, currency depreciation is almost never welcomed with open arms. “A downward trend usually causes the cost of living to rise and impacts international trade and exchange, among a range of other factors. But the story may be little different for Mauritian economy. A depreciation of the exchange rate will make exports more competitive and appear cheaper to foreigners. This will increase demand for exports. Also, depreciation will lead Mauritian assets to become more attractive; for example, a depreciation in the MUR can make Mauritian property appear cheaper to foreigners. Another upside of downward progression, is the upswing in local tourism.”

The economist Ganessen Chinnapen articulates that this is beneficial to our tourism sector which naturally attracts travelers and tourists and will find Mauritius to be an affordable destination, but in grounded reality, currency depreciation, which is organically a pricing phenomenon, is no more beneficial in export competitiveness. “It has been shifted from price to value addition. Many countries are importing value added products and services irrespective of their prices. Thus price is no more a competitive dimension, quality and sustainability is the new yardstick towards export competitiveness.”

Tourism

A local currency that’s depreciating means that travel, accommodation, and a range of related expenses become more affordable for international tourists, a fact which compensates, in some way, for the ill-effects of a downward trend, says Dr. Chiragra Chakrabarty. “The real estate and tourism are the two major industries of Mauritian economy and that may get a boost from MUR depreciation. Assuming the demand for such industry is relatively elastic, may lead to enhancement of economy’s aggregate demand.”

Imports

The negative side of depreciation is imports, such as petrol, food and raw materials will become more expensive, adds Dr. Chiragra Chakrabarty. “Due to inelastic demand for such goods, the demand for such products will not go down and it will lead to cost push inflation. Another negative impact, Mauritius will be less attractive for foreign workers. If the impact of export, increase in tourism and increase investment in real estate nullify the expensive import, then it will have positive impact of current account, leading to reduction in current account deficit.”

Consumers

Amit Achameesing avers that as Mauritius imports about 80% of the products it consumes, the effects of currency depreciation adversely affect the Mauritian consumer. “Economists use a concept called exchange rate pass through to assess the percentage change in local currency import prices resulting from a per cent change in the exchange rate between trading countries. As Mauritius pays about 67% of its import bills in US dollar, a stronger dollar makes it more expensive for Mauritius to import oil and foodstuffs. And with a high exchange rate pass through, a currency depreciation against the US dollar means that there is a significant rise in the level of local currency import prices which feed into higher consumer prices.”

Ganessen Chinnapen also states that a depreciating Rupee will affect the purchasing power of our citizens, mainly outside the country. “For example, education and holidays in foreign countries will be costlier as a result of the depreciating rupee. On the other hand, imported products like computers, smartphones and cars will also get more expensive. Furthermore, the external borrowing costs for Mauritian firms are likely to go up, which will dampen firm’s external borrowing. Both the household sector and the business sector are likely to be affected as currency depreciation triggered by excessive imports are expected to result in imported inflation along with the volatility of oil prices.”

Foreign Direct Investment

Economist Pierre Dinan opines that depreciation of the Rupee can boost the FDI in Mauritius. “With the value of Rupee being low, it attracts more foreigners to invest in the country. It will facilitate investment in the country at a time where FDI is quite low.”

Public debt

The impact of exchange rate changes in small open economies has been a widely researched topic for decades, says Dr. Chiragra Chakrabarty. “According to economic theory and relevant research, depreciation can have a positive impact on the economy through an increase in exports, and a negative effect through decrease in an individual consumption. The question of the impact of exchange rate fluctuations on overall economy has been the subject of much debate among academic researchers and economic policy makers for decades.”

He states that the exchange rate depreciation leads to an increase of liabilities denominated in foreign currency. “In case of accumulated foreign currency debt, currency depreciation might have overall negative effect on the economy. The composition of currencies of external debt also plays an important role. For example, if any country’s external debt is diversified in various currencies and not much concentrated in one major currency, then impact of local currency depreciation against the major currency will not have much effect on external debt negatively. So before concluding the impact of depreciation on external debt, we should take into consideration the level of depreciation. And as I said earlier, the Central Bank will never allow a run down on the value of local currency, it will always keep a proper balance of exchange rate keeping in mind macro-economic factors of the economy. So, to conclude the depreciation of exchange rate is not a good friend of external debt.”

J'aime

J'aime