After the presentation of the 2016/2017 budget, now comes the implementation phase, which will start after the voting of the Finance Act 2016 following debates at the National Assembly. In the meantime, socioeconomic stakeholders are dissecting the Budget and measuring the impact of the decisions on different sectors of the economy.

The Budget is behind us. The main concern is now the implementation of the announced measures. In the interim, stakeholders and analysts are busy assessing the measures, while other groups, such as second hand vehicle importers want to meet the Finance Minister for their counter proposals. On his side, Trade Unionist Radhakrishna Sadien says he is against the distribution of PC Tablets to primary school children of Grade 1 and 2.

Overall, most economists are more or less satisfied with the Budget: Erig Ng, Vishal Ragoobur, Arvind Nilmadhub and Frankie Tang, among others, state that the Budget this year has a major social component. Pradeep Dursun is of the view that the measures announced will bring economic reform, while Pierre Dinan told the press that he agrees we should assist those who are in need. Gerard Sanspeur, the special economic adviser at the Ministry of Finance, termed the Budget as a one that cuts off from the past. Raj Makoond, the CEO of Business Mauritius talks of a ‘reform budget’. Frankie Tang says the most important part is the implementation phase, as this is where many previous ministers of finance have failed.

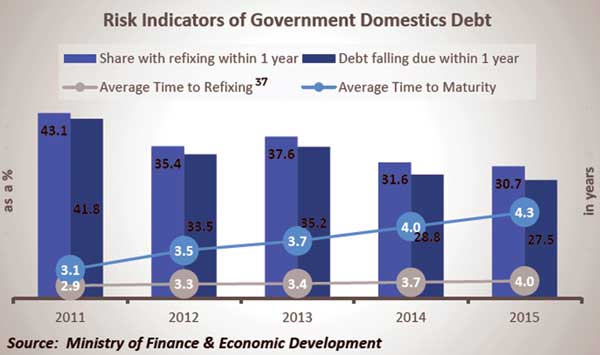

Interest rates

About 2 % of our debt is interest-free. 38% of public debt carries a fixed rate of interest while almost 60% of our debt has variable interest rate.

Loans in foreign currency

Nearly 50% of our external debt is in US Dollars while 28% is in Euros. The rest (21%) is in other currencies. Thus, major fluctuations in the exchange rate have a direct impact on the level of national debt. For example, a rising dollar will increase the value of our loans borrowed in USD, making us repaying more.

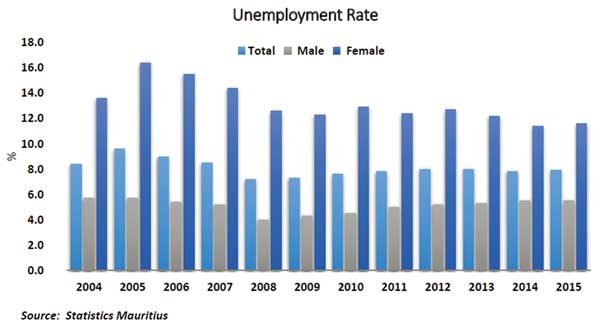

Unemployment

The unemployment rate hovered around 8%, although it was higher among women at 11% and the youth at 23%. With low inflation of 0.4% in January 2016 reflecting in part declining oil prices and shipping costs. The Bank of Mauritius reduced its key policy rate by 25 basis points in recently to support domestic demand.

Trade Licence: The misses

Trade Licence: The misses

Entrepreneurs and businessmen have for quite a long time complained about the irrationalities surrounding the Trade Licence. The Trade Licence was itself abolished in 2006, but the Trade Fee remained payable to local authorities. However, the basis of determining the trade fee is unreasonable, as there are huge variations from one activity to another. The Finance Minister has, in his Budget announced that businesses will be exempted from Trade Fee for all trade fees up to Rs 5,000. While the measure is welcomed as it will relieve entrepreneurs, the fact remains that most activities carried out by SMEs carry a trade fee higher than Rs 5,000 and will therefore be excluded from this exemption. Only traditional SME activities, such as manufacturing or handicraft, are taxed less than Rs 5,000. Today, SMEs are more and more engaged in ICT activities, business consultancy, outsourcing, design and advisory but the trade fee can reach up to Rs 20,000. Furthermore, a self employed who chooses to open a one person company sees his Trade Fee double, which is unfair, as trading under a company brings more advantages than as a self employed. In addition, the Trade Fee does not take into account regional variation in customer base, and it is unfair that SMEs as well as large organisations with higher turnovers pay the same rate. Another issue is the road tax of certain category of vehicles, such as Double Cab pickups, used mainly by SMEs but which carry a high rate.

J'aime

J'aime