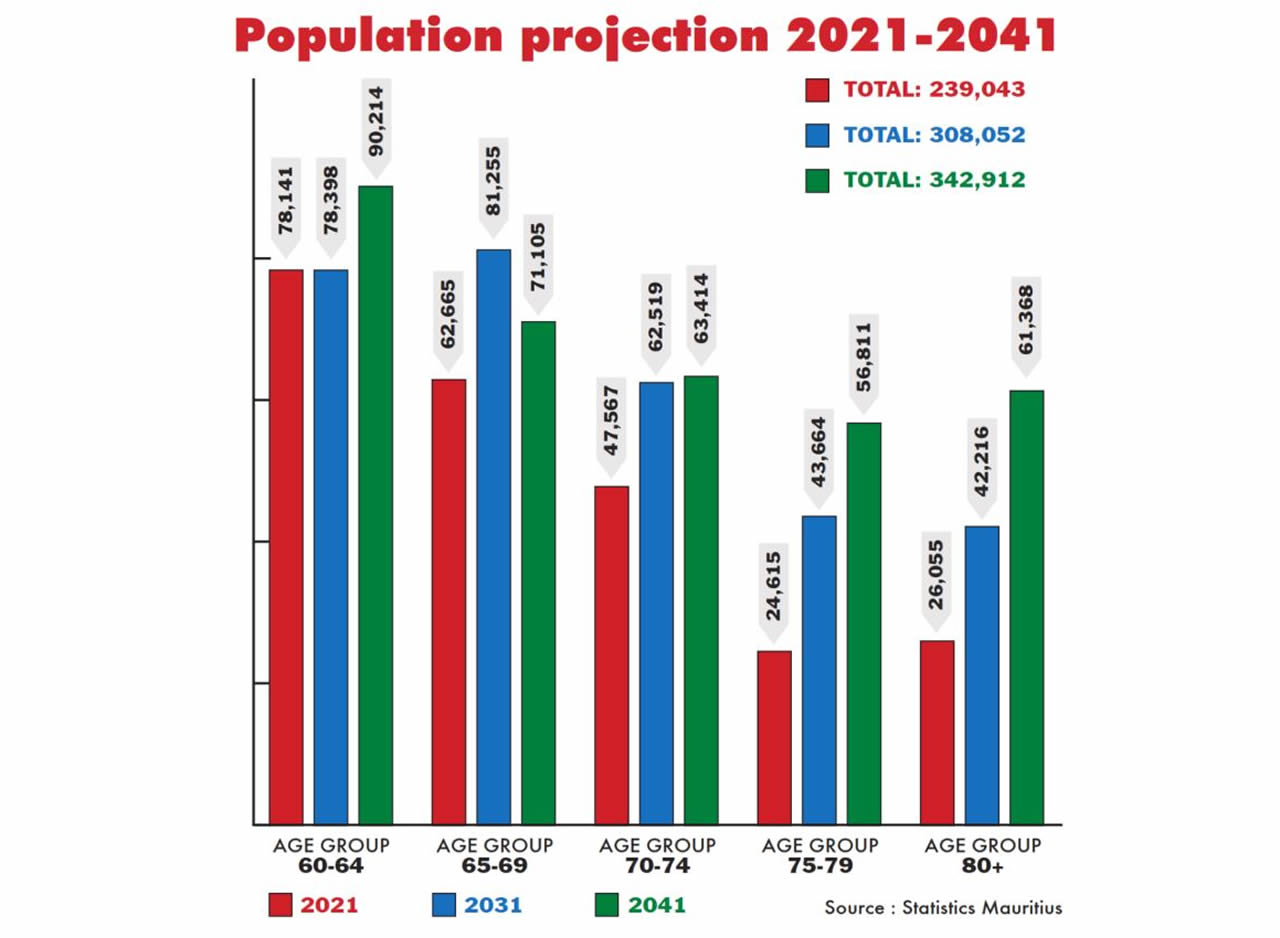

The ageing population is one of the major challenges that the country will face in the coming decades. The socio-economic implications are huge and this phenomenon is affecting many other countries as well. How do we then counter the consequences and better manage this radical demographic change?

It’s an issue that keeps coming in the news for quite some time. The demographic structure of Mauritius is changing drastically for several reasons: The fertility rate has dropped and the number of births is decreasing annually. In contrast, life expectancy is increasing. Thus, while in 2017 there were 4.3 active people to support every elderly person, this ratio will drop to 2.4 people for each retiree in 2037 and 1.7 for each older person in 2057. The figures are sending alarm bells ringing.

As part of the pre-budget consultations, Business Mauritius in its Memorandum submitted to the Government has raised the issue of our ageing population and proposed some measures to mitigate the effects. On its side, the Mauritius Commercial Bank, in its latest issue of MCB Focus, analyses the subject broadly and proposes solutions. According to this publication, the proportion of older people will be 23% of the total population in 2027 and will reach 35% in 2057 while the figure was only 16% in 2017.

The pension

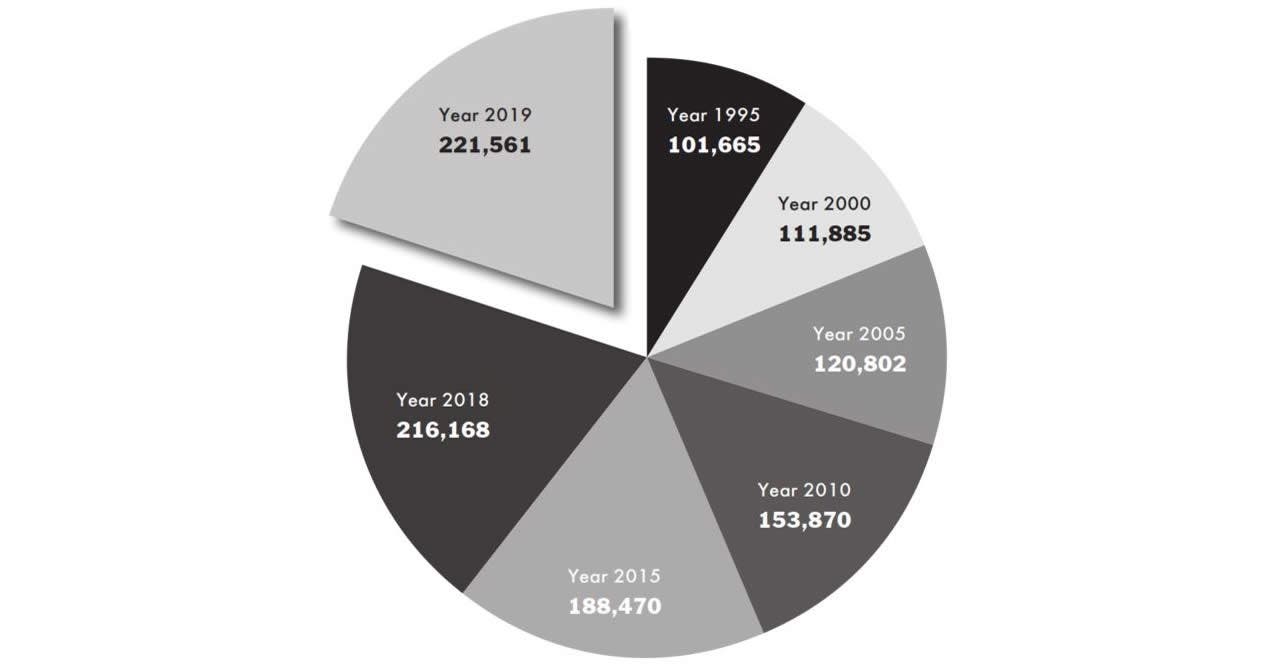

All successive governments have always had a special consideration for the old age pension. The basic amount has increased annually, from Rs 675 in 1995 to Rs 5,000 in 2015. Today, a retiree is getting Rs 6,210. The number of beneficiaries amounts to more than 221,000 while the budget for the payment of pensions is expected to reach Rs 21 billion in financial year 2020/21. It is estimated that the number of beneficiaries will be around 325,000 in 2037, while the labour force aged between 15 and 64 will drop drastically. Thus, while in 2017 there were 4.3 active people to support every older person, this rate will drop to 2.4 people for each retiree in 2037 and 1.7 for each older person in 2057.

The implications

MCB Focus explains the issue in a very technical way. In simple language, an ageing population means the Government will have to find new sources of funds to meet the rising pension bill, against a backdrop of declining revenue from both personal taxation, because of a reduced working population, and from indirect taxes such as VAT, because of lower consumption of goods and services. In addition, the Government will have to increase its budget for healthcare services to meet growing demand from the elderly community. But observers claim that the Government will also make savings on its education budget as well as on the expenditure on children’s welfare.

The measures

The authorities have been advocating couples to produce more children, but social workers claim it is costly to raise children and the Government must provide incentives. MCB Focus proposes that more child benefits be provided to financially help parents offset the cost of raising children. It suggests additional support such as helping parents throughout the early years by providing paid parental leave, access to affordable and universally accessible pre-school for young children, out-of-school-hours care for primary school children, home visits by nurses, free or subsidised day-care, like Nordic countries. If further advocates greater public awareness and encouraging private saving to create further room for increased productive capital spending. “Policies could be designed to discourage or postpone consumption, such as encouraging higher proportions of non-cash or deferred compensation, and other initiatives such as those in UK encouraging savings at a younger age. For instance, the authorities could raise awareness among the general public and in schools/universities on the importance of mobilising savings through financial literacy courses/adverts,” says the report.

Business Mauritius proposals

In its Memorandum for the 2019-2020 Budget during recent pre-budget consultations, Business Mauritius highlights that the main changes observed in our demographic composition are the shrinking of the base of the population pyramid due to falling fertility, the thickening of the upper body of the pyramid indicating an increase in life expectancy and the relatively longer bars on the female side of the pyramid around its apex indicating the predominance of females among the elderly. It states that our “Capacity to Attract and Retain International Talent (including Mauritian students) will determine the pace and degree of development.” Business Mauritius recalls that the International Monetary Fund (IMF) estimates that the National Pension Fund (NPF) will have used its reserves by 2063, and there will be increased pressure on the funding of public and private health, pension and welfare services as well as low investment by working age population in long-term insurance and pension schemes.

| Demographic trend 2027-2057 | ||||

| Age group | 2027 | 2037 | 2047 | 2057 |

| Number | Number | Number | Number | |

| Less than 15 years old | 183,012 | 162,733 | 130,295 | 107,896 |

| 15 – 59 years | 751,524 | 685,647 | 604,660 | 506,912 |

| 15 – 64 years | 835,756 | 760,996 | 678,248 | 587,244 |

| Over 60 | 280,464 | 315,131 | 333,897 | 341,697 |

| Over 65 | 196,232 | 239,782 | 260,309 | 261,365 |

| Total Population | 1,215,000 | 1,163,511 | 1,068,852 | 956,505 |

| Annual pension increase 1995-2019 | ||||||||

| Age/Amount Rs | 1995 | 2000 | 2005 | 2010 | 2015 | 2017 | 2018 | 2019 |

| 60 to 69 years | 675 | 1,500 | 2,200 | 3,048 | 5,000 | 5,450 | 5,810 | 6,210 |

| 70 to 89 years | 675 | 1,500 | 2,250 | 3,048 | 5,000 | 5,450 | 5,810 | 6,210 |

| 90 to 99 years | 3,900 | 5,725 | 6,900 | 9,067 | 15,000 | 15,450 | 15,810 | 16,210 |

| 100 years and over | 4,000 | 6,500 | 7,850 | 10,292 | 20,000 | 20,450 | 20,810 | 21,210 |

Zohra Gunglee : “The pension should not be seen as a burden”

Zohra Gunglee : “The pension should not be seen as a burden”

Zohra Gunglee, economist, is of the opinion that the pension will see a substantial rise soon because of political considerations. However, she says any hike should be welcomed as this will benefit our elders, who will be able to live better. “Pensioners deserve a significant increase, because those who have worked all their lives and contributed to the economy must be able to reap the benefits,” says the economist. To the question whether a rise in the pension would be a burden on the economy, she retorts that all public spending has an economic weight, but we spend anyway, so why should we always term the pension as a burden when it comes to streamlining public spending. “We can reduce other public spending in order to give priority to the old age pension,” she says.

Reaz Chuttoo : “We are against selective targeting”

Reaz Chuttoo : “We are against selective targeting”

At a press conference on Tuesday, Reaz Chuttoo, spokesman for the ‘Confédération des Travailleurs du Secteur Privé’ (CTSP), stated that he is against any form of selective targeting regarding the payment of the old age pension. Sending a strong warning to the Government, the trade unionist said: “The message is clear. The Government must show on which side it is: On the side of employers or workers.” He severely criticized Business Mauritius for its stand on the pension issue, saying that Business Mauritius is distorting facts and figures on the subject.

Radhakrishna Sadien : “It’s not the worker who decided to work more”

Radhakrishna Sadien : “It’s not the worker who decided to work more”

Radhakrishna Sadien, Chairman of the Government Services Employees Association, explains that the purpose of the old age pension is to support an elderly person who stops working at the age of 60. Now, if we want to make him work beyond this age, we cannot take away his pension. “It’s not the retired worker who wants to work longer, it’s the Government who wants to push the retirement age further, so it cannot stop the payment of the pension at the age of 60 because retirement is at 65,” says the unionist.

J'aime

J'aime