In the previous Budget, the government clearly spelled out its ambition of turning the SME sector into an economic pillar. A strategy was proposed to cover all stages of business development to achieve this goal, namely: financing, choice of production methods and technology, and marketing.

One year later and in line with the forthcoming Budget Speech, we have sought the views of various stakeholders regarding their expectations. The current situation is precarious, according to our report, one of the reasons being the economic situation.

The prevailing economic conditions are not conducive to the business environment. Small and Medium Enterprises (SME) are facing various difficulties. According to the President of the Federation of SMEs, Amar Deerpalsingh, the conditions in which those businesses operate are getting worse day by day. “All the measures announced by the government have never seen the day. No promises have been fulfilled. The government is not supporting SMEs who are still facing tough times,” he says.

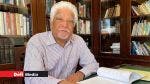

The Managing Director of the Small and Medium Enterprises Development Authority (SMEDA), Phalraj Servansingh, explains that Mauritius has around 127,000 SMEs. Among those, 80,000 are micro enterprises which have an annual turnover less than Rs 2 million. “Most of them are sole traders. Then, we have small businesses which have a turnover between Rs 2 million and Rs 10 million.”

SMEs are facing difficulties in different operational aspects such as financing, marketing, labour, infrastructure and equipments, among others.

Financing

According to Phalraj Servansingh, small businesses experience difficulties in accessing finance. “Financing is accessible, but the problem comes down to management. Unfortunately, micro enterprises, which form the biggest chunk of this sector, know how to produce but they do not have management skills. At a point when they start getting more orders and produce more, this lack of management skills starts to weigh down upon them. It is at this point, when the business is growing, that they start to take on excessive amounts of debt. They have a perception that they need financial help when it is rarely the case. In fact, it is more a management problem,” he reveals.

On the other hand, the chairman of business linker MATRADE, Saheed Thupsee, claims that working capital is one of the biggest difficulties small businesses face. “SMEs face considerable financial problems. They have overdrafts, and tend to be indebted. There are no facilities for them when it comes to financing and interest rates. It is just a myth that SMEs can easily access bank loans but this not true. If SMEs do not provide collaterals, they cannot benefit from any loan.”

Marketing

Marketing is another serious issue facing this sector, says Mr Thupsee. “SMEs are unable to increase their visibility on the market. They cannot showcase their products or services properly. Even if they get a chance to do it, they are unable to market themselves due to lack of proper packaging and branding.”

No proper infrastructure

Another issue he reveals is that many SMEs do not have a proper place to operate in and others have such a small and inconvenient place that they are unable to expand their businesses.

Labour scarcity

The Director General of Neel Industries, Yusuf Jeeva, states that scarcity of labour is a major problem for these small operators. “Many SMEs enrol foreign workers for a period of four years. The government renews this contract for two more years and asks the company to look for Mauritian employees. Companies have to look for new workers after having trained the previous batch. The government has to look into the specificities before taking a decision and not treat all cases the same way.”

[[{"type":"media","view_mode":"media_large","fid":"21463","attributes":{"class":"media-image alignleft wp-image-35734","typeof":"foaf:Image","style":"","width":"350","height":"463","alt":"Phalraj Servansingh"}}]]

Tax on imported shoes

Local manufacturers hope that the upcoming budget will re introduce tax on important shoes as the local market is suffering. Two years ago, Young Bros Ltd was producing around 1,000 pairs of shoes per day. However, today the factory is unable to manufacture due to fierce competition against imported shoes from China.Clifford Young stated that previously 20% of the production was directed towards Reunion Island and Seychelles. Banker Shoes faces the same fate. Today the company is manufacturing 100 pairs instead of 500. The Director of the firm Rajoo Permal Sinnapan explains that previously there was a Specific Tax of Rs 125 for every imported shoe but the government had reduced it to Rs 80 and finally it was abolished.

[[{"type":"media","view_mode":"media_large","fid":"21463","attributes":{"class":"media-image alignleft wp-image-35734","typeof":"foaf:Image","style":"","width":"350","height":"463","alt":"Phalraj Servansingh"}}]]

Overcoming the difficulties

SMEDA and MyBIZ Phalraj Servansingh explains that SMEDA and MyBiz are doing their best for small enterprises. “With the SME development certificate, companies incorporated after June 2015, businesses can benefit from a tax holiday of up to eight years and preferential interest rates. Sectors eligible include start-ups, agribusiness, bio farming and oceanic. The government wants to attract a new breed of young entrepreneurs.” SME Forums and Integration of SMEs on boards Yusuf Jeeva claims that major organisations like that of SMEDA should try to consider integrating people who have knowledge and are on the fields to work for the welfare of all SMEs voluntarily. On the other hand, Saheed Thupsee says that there should be an SME forum whereby these businesses can receive assistance and help in making a business plan and manage their business. New Incubators The Managing Director of SMEDA recalls that recently, they have launched an incubator in Mahébourg and intend to launch other such facilities across the country. “Operation of hand holding is where officers from SMEDA and MyBiz will meet entrepreneurs to take stock of their problems. The officers will then accompany them. Specialist consultants will be called in to address the issues they are facing in terms of finance, marketing and production. We will then monitor those beneficiary SMEs.” International fairs As highlighted by the Managing director of SMEDA, the SMEs should be encouraged to participate in international fairs for more visibility. “The SMEs should take advantage of international exposure. There are already such schemes to improve themselves.”Testimonies

Prakash Aubeeluck: “A low tax rate would be favourable”

Prakash Aubeeluck is an entrepreneur in the IT field. Being an entrepreneur is not an easy task with so many difficulties. “Firstly, the administrative procedures are too lengthy. We have to wait for long to get an item approved by the Mauritius Standards Bureau. Whenever there are any changes in the laws, we remain unaware of it. 15% of tax on electronics is quite hefty and this impacts on our sales. If the tax would have been reasonable, it could have boosted sales.” He believes that the government should implement a fast track for imports. “If the steps for importation were easier, SMEs in this field would not face difficulties. The government should try to accelerate procedures for existing SMEs. A low tax rate would be favourable.”[[{"type":"media","view_mode":"media_large","fid":"21514","attributes":{"class":"media-image wp-image-35735 alignleft","typeof":"foaf:Image","style":"","width":"179","height":"164","alt":"Tetimony-Beekeeper"}}]]Devika Ramgoolam: “A better place for production”

Devika, a beekeeper, faces financial, marketing and infrastructural issues for her business operations. “I am unable to expand my business as I do not have any proper place. As a beekeeper, I need a better place for production. If I do not produce how will I expand my business? I receive orders but I am unable to complete them.” She makes an appeal to the government to help SMEs by making provision for spaces.What to expect from the Budget?

The forthcoming Budget 2016-2017 is expected to bring a lifeline to this struggling but promising sector. Small businesses and other economic stakeholders are impatiently waiting for the first Budget of the new finance minister Pravind Jugnauth which is believed to bring a new dimension to economic development. Amar Deerpalsingh says he was not satisfied with the previous Budget but he has some expectations for this one. “Administrative procedures should be reviewed. Regulations governing imports and recruitment of foreign labour also need to be reviewed. Assistance should be provided to SMEs in terms of sales and marketing. The number of licenses required for a business should be reduced. Small businesses should be encouraged to take advantage of regional preferential trade agreements with COMESA, SADC and IOC.” Phalraj Servansingh confides that there has been an element of frustration among existing SMEs when the government came up with the SME development certificate in the previous Budget. Existing SMEs felt that the government had in a sense neglected them. “So, we expect existing businesses to get some help from the Budget to overcome their difficulties as well,” he says. Flat interest rates Saheed Thupsee argues that the government should introduce a flat interest rate of 3% for loan granted to small businesses. “As far as possible, the government should make financing even more accessible to SMEs.” Review of employment laws Yusuf Jeeva put forward that the relevant authorities should review regulations governing the employment of foreigners. “A general law concerning the employment of foreign workers is not applicable in reality. The government should consider matters on a case to case basis before taking any decision.” Factoring Scheme Phalraj Servansingh says that a factoring scheme is very important. Factoring allows businesses to get part-payment of an invoice before the payment is made by the debtor. “Many entrepreneurs have cash flow problems when clients buy on credit. With the help of the government, these businesses can improve their cash flow.” Modernisation of equipments According to Phalraj Servansingh, more facilities should be given to small businesses to buy modern equipments. SME park As stated by the managing director of SMEDA, many SMEs are looking for space at subsidised rates to grow and expand their business. On the other hand, Saheed Thupsee argues that the government should launch incubators across the country just like India and Malaysia have been doing to promote start-ups. Moreover, the Director General of Neel Industries maintains that it is high time to develop an industrial zone for SMEs. “For many small businesses, more control should be effected in those zones so that they do not merely use the allocated space as a store.”

Notre service WhatsApp. Vous êtes témoins d`un événement d`actualité ou d`une scène insolite? Envoyez-nous vos photos ou vidéos sur le 5 259 82 00 !

![[Blog] Coup de gueule - 1 er-Mai politique : entre illusions de foule et réalités électorales](https://defimedia.info/sites/default/files/styles/square_thumbnail/public/crowd.jpg?itok=O1Ag_jui)