The Board of Investment has embarked on a vast promotional campaign based on the measures announced in the Budget 2016-17. Writing in the organisation’s newsletter, its managing director Ken Poonoosamy states that announced measures are “bold and implementable” in the short term.

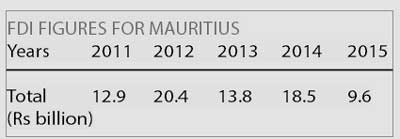

The Minister of Finance has rolled out a series of measures in the Budget 2016-17 speech in order to attract foreign investments. Foreign Direct Investment has been slowing down over the years and mainly geared towards the property sector. FDI in “Accommodation and food service activities” stood at Rs 1.8 billion in 2011 as compared to only Rs 58 million for the first quarter of 2016, according to figures from the Bank of Mauritius.

The Minister of Finance has rolled out a series of measures in the Budget 2016-17 speech in order to attract foreign investments. Foreign Direct Investment has been slowing down over the years and mainly geared towards the property sector. FDI in “Accommodation and food service activities” stood at Rs 1.8 billion in 2011 as compared to only Rs 58 million for the first quarter of 2016, according to figures from the Bank of Mauritius.

“This budget foresightedly sets the stage for the much needed convergence of ideas and strategies. It has certainly been designed for the dawning of a new era of nation-wide development and prosperity,” says Ken Poonoosamy.

New rules for property investments

Foreigners registered with the BOI, subject to security clearance, will be allowed to acquire apartments – in a Ground + 2 building – and rent them out. The Non-Citizens (Property Restriction) Act will be amended accordingly. However, this measure does not apply to apartments built on “Pas Géometriques”.

Property Development reviewed

The Property Development Scheme (PDS) has been reviewed. Henceforth, no restriction will be imposed on the maximum extent of land for development of a project (previously restricted to 50 arpents). Moreover, 100 % of residential units can be sold to non-citizens (previously, 25% had to be sold to Mauritians); and individual plot size for the construction of a villa has been extended to a maximum of 1.25 Arpent.

Commenting on the Budget, he says it lays down the foundations for an investment-driven development model. “It rests on measures aimed at stimulating both domestic and foreign direct investment with a view to achieving foremost socio-economic objectives, namely high economic growth and the creation of high-end jobs to improve the quality of life of all Mauritians, and eliminate the pain of absolute poverty.”

The main thrusts of the exercise according to him will have an immediate bearing on entrepreneurship and SMEs, business facilitation and institutional reforms. SMEs are placed at the very front of the stage since the dynamism of local entrepreneurship and its capacity to generate wealth are clearly recognized. SME parks, matching grants and improved access to capital will definitely give a boost to the sector of small and medium businesses.

Regarding the acquisition of property for business purposes, a company with foreign shareholders wanting to buy property for business purposes, will not have to seek approval from Prime Minister’s Office if non-citizens in the company are holding not more than 25% of the shareholding. It is expected this measure will boost foreign investments by expediting processes.

“Regarding business facilitation, BOI has been vested with additional powers. In the main, through the implementation of a Regulatory Sandbox Scheme (RSS), BOI will promote innovation through the prompt leveraging of latest global trends. In a world characterized by technological break-throughs and scientific advancement, the RSS will be a game changer for it will position Mauritius as a prime platform to attract and test innovative start-ups while facilitating high value-added projects,” says Mr Ken Poonoosamy.

The acceleration of the implementation of large investment projects is rendered possible due to measures that will decisively unclog administrative bottlenecks. And as a further improvement in the business environment, several licenses and permits will be done away with.

Another strong aspect of the budget is digital revolution which it is thought will pose ground works for a transition to the next phase of economic prosperity. Government will lead the charge by embracing e-practices through the development of applications to effect needed changes and clip out any crippling inefficiencies. Measures to increase connectivity and bandwidth will complement those aimed at improving the skills-sets of our workforce.

“The development of sound infrastructure has been given significant attention with the recognition of the importance of investing today in order to reap tomorrow. Accordingly, huge investments will be channelled to improve air and sea connectivity. The decongestion programme will be reinforced with the metro express and other road network developments.”

The upgrading of seaport facilities will be pursued at an increased pace. In addition, a rural and urban regeneration programme will be put in place to ensure that residents enjoy all standard amenities in modern towns and villages. A National Planning Commission will drive this project.

Economic diplomacy occupies a prominent place in the new era. Since there is an urgent need to expand our economic space, seven more economic counsellors will be posted around the world to promote our country and explore new markets for our products and services. Ties with India through the Comprehensive Economic Cooperation Partnership Agreement (CECPA) will be consolidated. E-commerce will be given a boost as well.

“It will help the sector offset uncertainties in the wake of Brexit. Local industries will also be granted reasonable preferences in a bid to further their development,” says the MD of the country’s investment promotion agency.

The attractiveness of a multiplicity of other sectors has been significantly enhanced, namely agro-industry, financial services, tourism, renewable energy and the ocean economy. Incentives to improve the environment and further attract investors in these sectors have been built in.

“The Budget 2016/2017 has made provision for the emergence of better, fairer and more equitable society. The Marshall Plan for poverty alleviation puts forward realistic measures to take people out of a grievous predicament. On the other hand, our youth who are at the threshold of their professional life will regain hope to build a bright future following the measures enunciated concerning tax reliefs and exemptions for housing,” writes Mr Ken Poonoosamy.

J'aime

J'aime