Afsar Ebrahim, Deputy Group Managing Partner at BDO, tries to decipher what constitutes the middle-class. To his view, household earnings need to be stable and sustainable but at the same time, expenditure needs to be well planned.

How do you define the middle-class in terms of earnings?

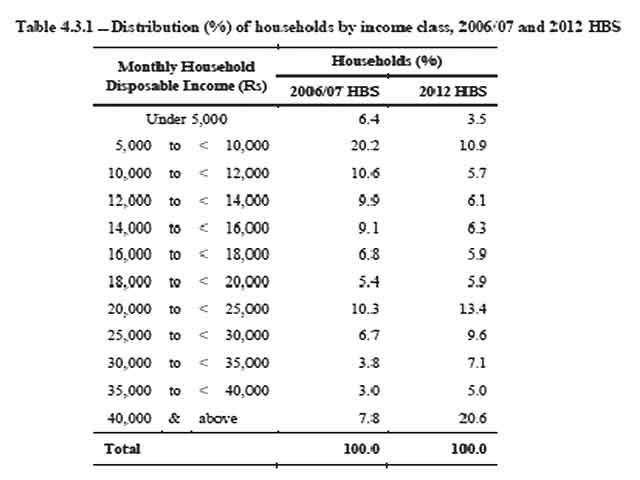

Income wise, we are speaking of households living well above the poverty line, having a disposable income that allows savings and investments into property and other assets as well as in education for the whole family. We can certainly refer to the 2012 Household Budget Survey carried out by Statistics Mauritius. This could be equivalent to households earning an average monthly income of Rs 32,000 or a per capita income of Rs 9,271. But this threshold is not a fixed one over time as prices and wages increase.

What are the main expenses of the upper middle income class?

The main expenses of the upper middle class include education, food, entertainment, household equipment, housing (especially loan/ mortgage repayment). Depending on the age of the family members, some items would weigh more in the basket. The upper middle class tends to invest in private education at either primary, secondary or tertiary levels. Fuel and transport expenses are particularly high with two or more private cars per household. Membership fees for sports and other leisure activities also represent a significant share of the monthly budget. Similarly, dining out is becoming more and more trendy, especially during week-ends.

[[{"type":"media","view_mode":"media_large","fid":"10545","attributes":{"class":"media-image aligncenter size-full wp-image-19748","typeof":"foaf:Image","style":"","width":"640","height":"480","alt":"table1"}}]]

What about the lower middle income class?

The lower middle income class will display a different expenditure pattern, attempting to maximise savings but yet, remaining trendy and not hesitating to invest in latest smart phones and other technological equipment.

Why is the income gap widening between the upper and lower middle classes?

The middle class is very far from being homogeneous. Wages and salaries for the two groups have been increasing at different rates. Large establishments and smaller ones do not have the same capacity to remunerate their work force. Those who fall into unemployment tend to stay longer in this status. Shrinking opportunities in the labour market may have caused wages to stagnate in the low-skilled job categories. On the other hand, individuals with post secondary education have witnessed an improvement in their wages and salaries. The correlation between education investment and wage levels is a clear and strong one, as depicted in the World Bank Report.

[[{"type":"media","view_mode":"media_large","fid":"10546","attributes":{"class":"media-image aligncenter size-full wp-image-19749","typeof":"foaf:Image","style":"","width":"640","height":"306","alt":"table2"}}]]

The lower middle income class is shrinking. What are the factors explaining this?

You mean more people being trapped in poverty and staying vulnerable? This is particularly true for large households (with six persons and more). There are so many expenses in today’s society. Food, housing, education, transport expenses are rising. Home appliances and many other gadgets need to be replaced regularly. It is not easy to stay on track. Stagnation in job creation, leading to a mismatch between demand and supply, is also an issue – especially for the young. Quite obviously, with two or more adults working, households are able to fare much better. It is also not a surprise that the category of employment is also a powerful determinant. Some professions such as trading and agricultural tend to be more seasonal and fluctuating compared to clerical or technical professions. The bottom line is, we need to create more jobs, more value addition jobs. The more value we create, the more we earn. The multiplier effect of job creation is what will make Mauritius a high income country.

What can be done to reverse this trend?

There is an income factor here. Social aid and transfers will not resolve the problem, although they can temporarily alleviate the hardships. A higher and better managed income may hence be decisive. Household earnings need to be stable and sustainable but at the same time, expenditure needs to be well planned. Impulsive purchases can lead to serious indebtedness. Households need to save whenever and wherever possible and also invest in an informed way. A good investment in education will undoubtedly provide a good return in the medium and long term, widening the opportunities on the job market. Multi-skilling should be considered, thereby enhancing the flexibility and resilience over time.

How can the middle class grow their money?

Ambitious people can reach very far. You grow your money generally for a purpose, and all investments do create a return. Continuous investment in learning and education is one option. We have to improve flexibility, resilience, develop inner skills to take more responsibility in the work place or even becoming entrepreneurs in sectors with a bright future. You can watch for opportunities but you can also create these opportunities. Growing your money serves no purpose if you intend to spend it all in a futile manner (that is throwing the investment away). Saving and investing is what matters. However, the bottom line is to earn more by working harder and be more productive.

Par

Eshan Dinally, Defimedia.info

Par

Eshan Dinally, Defimedia.info

Par

Eshan Dinally, Defimedia.info

Par

Eshan Dinally, Defimedia.info

J'aime

J'aime