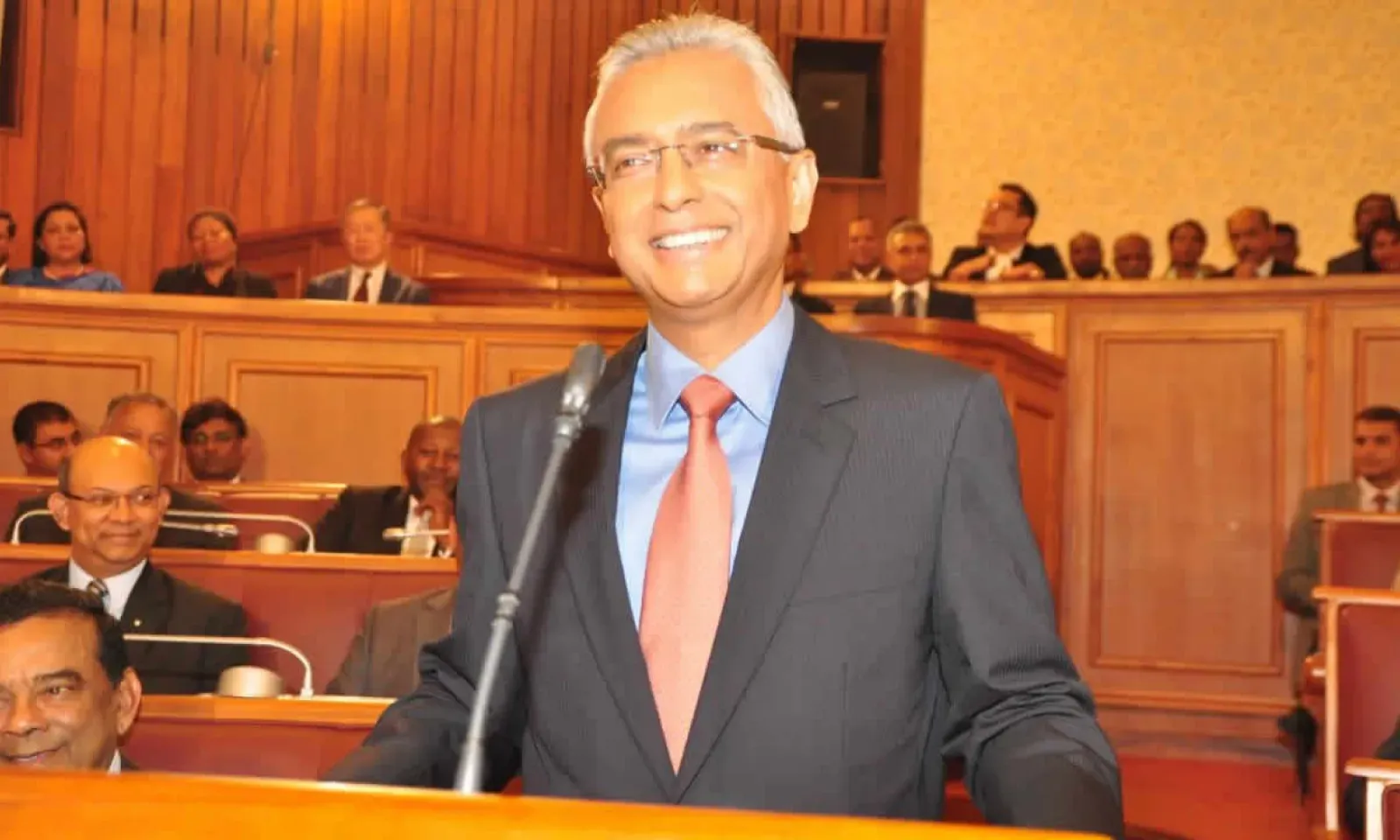

Fin des débats sur le Budget 2016-17 à l’Assemblée nationale mardi 16 août.

Le ministre des Finances Pravind Jugnauth, lors de son « summing-up », a annoncé que l’argent alloué initialement au projet Heritage City, mis au frigo par le Conseil des ministres le 5 août, sera « reallocated » au projet Metro Express.

Pravind Jugnauth annonce qu’une requête a déjà été faite au gouvernement indien pour « reallocate » les Rs 2,7 milliards du « grant » de Rs 12,7 milliards au projet Metro Express, connu auparavant comme le projet métro léger.

Le gouvernement indien avait accordé un « grant » de Rs 12 ,7 milliards à l’île Maurice. Et c’est de ce « grant » qu’aurait été puisé les Rs 2,7 milliards allouées au projet Heritage City dans le Budget 2016-17.

Pravind Jugnauth affirme que le gouvernement indien a accédé à la requête du gouvernement mauricien.

Commentant le Budget 2016-17 qu’il a présenté le 29 juillet, le ministre des Finances se réjouit que son grand oral ait été « bien reçu par la population ».

« In fact, few budgets in the past have been so well received. […] These are probably the reasons that have led the Honourable Leader of Opposition to say, just after the Budget Speech was delivered, “c’est un budget intéressant”. I could not agree more », a déclaré Pravind Jugnauth.

Mais il dit ne pas être d’accord avec le leader de l’Opposition lorsque celui-ci dit « qu’il n’y aura pas de relance économique ».

Pravind Jugnauth se dit confiant que les mesures budgétaires permettront au pays de connaître une croissance économique de 4,1 %, et « d’assurer la relance économique ».

Le ministre des Finances affirme que les mesures prises pour relancer la consommation et augmenter l’investissement « should give the economy a significant spur on the demand side ».

Pravind Jugnauth ajoute que seules les dépenses [Government capital expenditure] injecteront Rs 14, 5 milliards dans l’économie en 2016-17, contre Rs 10,8 milliards en 2015-16, soit une hausse de Rs 34 %.

Il indique que le « overall public sector investment would amount to Rs 34.5 billion in 2016/17 and to some Rs 97.6 billion for the next three years ».

Et d’ajouter que le « Government recurrent expenditure for 2016/17 has been increased by Rs 10.5 billion. Thus, Madam Speaker, Government alone will be injecting an extra Rs 24.8 billion in the economy ».

L’intégralité du « summing-up » du ministre des Finances Pravind Jugnauth:

Madam Speaker,

Let me at the very outset thank all the members on both sides of the House who have participated in the debate on the Budget.

The debate has been very constructive and there have been valuable suggestions that will no doubt help us to strengthen our policies and aim at even better outcomes.

LEGACY FROM THE PAST GOVERNMENT

Madam Speaker, before elaborating on the impact of the Budget I would like to speak briefly about the kind of legacy that was left behind by the previous Government.

On the macroeconomic front all major indicators were pointing to an economy that was dangerously moving towards stagnation at a very low growth rate, with rising unemployment, private investment on a free fall, unsustainable levels of deficits and debt and deteriorating current account of the Balance of Payments.

The business as well as consumer confidence in the economy was at its lowest.

There was rampant mismanagement of our public institutions, with most of them accumulating huge losses and debts; such as MPCB with non-performing loans of Rs 3.2 billion, the DBM, Mauritius Post, Casinos, the MBC and many more Madam Speaker, like the Rose Belle Sugar Estate. Even in the private sector there were companies, such as the BAI Group that were in deep financial mess, that were absorbing public funds in the billions. We have all witnessed the unfolding of those saga during the first year of our mandate which we had to deal with and to carry out a major cleansing operation.

On top of all these, there was huge wastage on the implementation of major infrastructure projects, such as the Bagatelle Dam with an initial project value of Rs 3.1 billion that has ended up costing Rs 6.2 billion; the Terre Rouge Verdun project with an initial cost of Rs 2 billion which finally cost Rs 4 billion. And we are still having to spend huge sum of money to repair the structural defects in that road.

Taken together all these events would have rocked any economy and created a financial turmoil. But we dealt with them and we can say that we have succeeded to save the country from a major crisis and at the same time protect thousands of families from financial distress.

It was indeed a heavy legacy.

The entire development model was cracking at the core.

It had to be rebuilt.

This was our primary mission Madam Speaker and Budget 2016/17 is anchored to that endeavour while ushering in a new era of development.

OVERALL IMPACT ON THE BUDGET

Overall, Budget 2016/17 has been well received by the population. In fact, few budgets in the past have been so well received.

The feedback has been very favourable. The Business leaders have expressed their satisfaction. A vast majority of SMEs and new entrepreneurs are encouraged and seeing a brighter future ahead.

Consumers are now able to stretch their rupee further. Our unemployed youths, men and women have found renewed hope for getting the right skills and a job that fits their aspirations.

The list is long Madam Speaker, and I will mention just one more – families who have been living in conditions of absolute poverty for generations are now finding new hope for escaping the poverty trap. In fact, what the Budget does for these families is historic and unprecedented.

These are probably the reasons that have led the Honourable Leader of Opposition to say, just after the Budget Speech was delivered, ‘ c’est un budget interessant’. I could not agree more.

Madame la Présidente, devant les grands défis auxquels nous avions à faire face, on ne pouvait pas se permettre de rester les bras croisés et subir le lourd héritage qu’on nous a légué. On ne peut certainement pas résoudre les problèmes avec les modes de pensée qui les ont engendrés, comme l’a si bien dit Albert Einstein.

Il fallait absolument tout mettre en place pour bâtir un nouvel avenir – un meilleur avenir auquel notre peuple aspire en toute légitimité.

C’est justement la ligne directrice du Budget 2016/17 – une nouvelle ère de développement.

LA RELANCE ECONOMIQUE

The Honourable Leader of Opposition has also said that: ‘ il n’y aura pas de relance économique’. Of course, on this one – I could not disagree more.

But first let me clear out a misunderstanding on the part of some critics of the Budget who have said that the Bank of Mauritius is forecasting a lower growth rate than the 4.1 percent we are predicting for 2016/17.

I would like to make two points clear on this issue:

First, the BoM made its forecast weeks before the Budget was delivered, which means that it was not aware of the new policies announced in the Budget to reboot the economy. The BoM’s forecast was in fact on a no-policy change basis.

On the other hand, the MCB Focus, after taking the policy impact of the Budget into account, is predicting a growth rate of 4.1 percent for 2017.

This is more in line with our own forecast.

Let me now explain how the budget measures will deliver a 4.1 percent growth in 2016/17 and ensure ‘la relance economique’.

The measures we have taken to increase consumption and investment should give the economy a significant spur on the demand side.

The budget also announces a series of measures on the supply side and at the sectoral level.

On the demand side,

Government capital expenditure alone will inject some Rs 14.5 billion into the economy in 2016/17 as opposed to Rs 10.8 billion in 2015/16. This is an increase of 34 percent.

Overall public sector investment would amount to Rs 34.5 billion in 2016/17 and to some Rs 97.6 billion for the next three years.

Moreover, Government recurrent expenditure for 2016/17 has been increased by Rs 10.5 billion. Thus, Madam Speaker, Government alone will be injecting an extra Rs 24.8 billion in the economy.

Madam Speaker, this substantial increase in Government expenditure is clearly expansionary. And its impact will be reinforced by the recovery of the construction industry which has been shrinking over the past 5 years but which is getting a considerable boost in the budget.

Our measures to increase demand for residential property includes:

Full exemption from registration duty to a Mauritian citizen acquiring a new house or a new apartment during the period 1st September 2016 to 30th June 2020 for an amount not exceeding Rs 6 million.

A first time buyer will now be allowed to buy bare residential land, free of registration duty, on the first Rs 2 million, provided the acreage does not exceed 20 perches.

An increase in the refund of VAT from Rs 300,000 to Rs 500,000, on submission of relevant receipts, regarding the construction of a new dwelling or acquisition of a newly built apartment. This is applicable to only households with aggregate income not exceeding Rs 2 million per annum.

Allowing promoters, to build and sell residential units of up to Rs 6 million, free of land transfer tax.

Removing registration duty on a secured housing loan not exceeding Rs 2 million.

And allowing non-citizens, registered with the BOI, subject to security clearances, to acquire apartments and business spaces in buildings.

Madam Speaker, the Budget is also significantly increasing the purchasing power of the population with a series of measures, such as by cutting the price of cooking gas by 20 percent for gas cylinders of 5, 6 and 12 kilos and abolishing customs duty on a number of items which at the same time is taking us closer to the duty free island goal.

VAT will be removed on several items. These include:

- Breakfast cereals

- Photovoltaic inverters/batteries

- CCTV camera systems

- And Burglar alarm systems and sensors

13. Moreover, we are giving direct income support to families living in absolute poverty; we have raised the income tax threshold for all categories of tax payers by Rs 10,000 so that families can have more disposable income; and thousands of families who make a living by running their own micro and small businesses will benefit from the suspension of the payment of trade fees, from tax holidays and from a wide spectrum of measures.

On the supply side:

We are putting some 21,400 people out of unemployment. This should raise national productivity while at the same time increase demand as these people will have more purchasing power.

Significant investments are being made in education and training to resolve the mismatch problem.

And the budget gives an unprecedented spur to the development of the digital economy and society. Besides embracing modernity, this strategy will reinforce the economy’s drive to innovate and bring about a much needed technology-driven increase in productivity.

At the sectoral level, the budget is putting a prominent focus on diversification.

It promotes new niches such as an oil refinery, gold refining and trading of precious metals and bunkering. It gives a spur to bio-farming, sheltered agriculture, renewable energy and film industry.

Moreover, we are providing a stimulus package to the SME sector; giving a boost to the manufacturing sector with an air-freight subsidy on exports of textiles and apparels; fostering new activities in the financial services sector; and diversifying the tourism industry.

Our strategy also includes an emphasis on economic diplomacy to open new markets for our products in Australia, China, India, Russia and other parts of the world.

Madam Speaker, with these policies, supported by significant improvement in the ease of doing business, and easier and cheaper financing, we have no doubt that we have a powerful recipe ‘pour la relance économique’.

In fact, Madam Speaker, we are expecting most sectors of our economy, including construction to perform better in 2016/17. Indeed, we do not expect negative growth in any major sector of the economy.

Thus, Madam Speaker, barring any headwinds on the international front, the measures taken in the Budget should be able to deliver the 4.1 percent growth rate.

Equally important Madam Speaker, is that with this growth rate, per capita GDP will rise by around 4 percent. Very few countries in the world can boast of such a per capita GDP growth.

The average per capita GDP growth rate for the world economy in 2015 was a mere 1.27 percent. It was 2.2 percent for upper middle income economies, 1.3 percent for high income countries, and 0.2 percent for sub-saharan Africa.

And it is also manifestly clear that the unemployment rate should go down.

Inflation has been subdued and should remain at a low level in the current fiscal year as well.

And we are hoping that as the economy grows at a faster pace, national savings will also go up, that the savings-investment gap will narrow down and that there will be improvement in the current account deficit of the Balance of Payments.

As regards the Budget deficit, our plan is to put in on a downward path.

For 2016/17 we are estimating a budget deficit of 3.3 percent. Some critics (UTEEM) have mentioned that special funds should be included in the calculation of the budget deficit and even stated that this would raise the deficit to 4 percent instead of 3.3 percent.

Madam Speaker, this is not the case at all. In fact, the Special Funds have a surplus which if integrated in the Consolidated Fund would bring the deficit down to 2.8 percent.

We are also putting public sector debt as a percentage of GDP on a downward trend.

With higher GDP growth and lower deficit, public sector debt should become more sustainable.

I should here emphasise that we are measuring the total stock of debt according to international definition, as well as for the purpose of the statutory public sector debt ceiling. Neither definition includes contingent liabilities as part of the debt stock. This is in line with the IMF definition that contingent liabilities should not be counted as part of the public debt stock.

Madam Speaker, with the strategies in the Budget, there cannot be any doubt that our country is definitely heading towards stronger macroeconomic fundamentals.

SOCIAL DEVELOPMENT

Let me now come to social development.

Topmost on our minds while preparing Budget 2016/17 was the importance of weaving together the economic, social and environmental threads of development.

Economic growth cannot and will not be the only metric by which we will judge the success of this Budget. Overall there must be more prosperity, wider opportunities, and our citizens must be healthier, better educated and able to enjoy a better quality of life.

Yet, while preparing the Budget, we were faced with some harsh realities when looking at the facts and after analysing the views and concerns of those who have participated in pre-budget consultations.

One troublesome truth was that about 6,400 families are living in conditions of absolute poverty as measured against the World Bank’s threshold of PPP USD 3.10 a day, that is Rs 1,938 per person per month.

Another worrying trend was that income inequality, as measured by the Gini Coefficient, was rising.

Many middle-income families were moving down, rather than up the ladder.

I found these trends to be seriously incoherent and inconsistent with our status of an upper middle income country.

Moreover these trends confirmed our worries before the elections in December 2014 about the social decay, increasing poverty, the law and order situation, unsafe roads, the water problem, an education system that needed to adapt, failed housing policies for the poor families as well as for middle-income families, and declining purchasing power, amongst others.

These realities compelled us to take a new approach to social development starting with two historic decisions:

First, to concretely implement the Marshall Plan Against Poverty for which Government is mobilising an amount of Rs 2.2 billion for the next three years.

Let me here make the point that Government has in just two budgets increased the allocation to the Ministry of Social Security, National Solidarity and Reform Institutions by around 45 percent from Rs 14.7 billion to Rs 21.1 billion.

And the second decision is to empower the families currently living in conditions of absolute poverty with an unprecedented income support combined with actions to take them out of poverty in a sustainable way.

Obviously, Government cannot do it alone. Social problems are quite complex.

A NEW CSR FRAMEWORK

That is why I have come up with a new CSR framework with a focused approach.

Madam Speaker, my decision was driven by the need to make more judicious use of CSR money and to get maximum impact in terms of lifting people out of poverty, empowering families, and giving greater protection to vulnerable families.

During pre-budget consultations it became clear to us that there was significant room for improving the performance of the CSR.

To maintain the status quo was certainly not an option. We had to act. And we did.

We have no doubt that the new CSR framework will give better outcomes.

Let me here reassure the ‘ bona fide’ and genuine NGOs who are achieving effective results and outcomes in alleviating the plight of the poor and the vulnerable families with a lot of dedication, that they will get the necessary support from the National CSR Foundation.

Madam Speaker, in our electoral manifesto and in the Government Programme, we have made a pledge to eradicate absolute poverty and so we will.

Yet another electoral promise that we are fulfilling.

SUPPORTING MIDDLE INCOME FAMILIES

I should here also stress that with equal determination and resolve, we are supporting middle-income families as they strive for a better life. This is especially obvious in the support we are giving them in this budget regarding housing.

In fact, Madam Speaker, I have announced more than 15 measures to provide low income families with a decent shelter and to support middle-income families as they construct or purchase their own residence.

IMPLEMENTATION

Madam Speaker, while the Budget has been widely well received, there have been nonetheless questions on whether the measures of the Budget will be implemented.

I should here stress that many measures have already taken effect or will be in force with the passing of the Appropriation Bill this week and the Finance Bill in a fortnight.

For example, the measures that are already in effect include the price reduction on cooking gas, and the elimination of customs duty on various items of consumption.

Measures that will take effect with the passing of the Finance Bill, include the removal of VAT, tax reduction on property and other fiscal incentives for the purchase and construction of a residence, raising the income tax threshold for all categories of taxpayers, increased deductions for education, and most measures announced to support the vulnerable persons and the disabled.

In fact, some 58 legislations will be amended in the Finance Bill.

And of course, we are conscious that the success of this Budget hinges mainly on timely and effective implementation of the major projects and programmes that require complex planning, investment and time to be completed.

It is precisely for this reason that we rolled out strategy number nine in the Budget which is about major public sector reforms.

I said in the Budget Speech: … the success of the new era of development hinges on effective and expeditious implementation of numerous reforms, new policies, vital national projects and modern ways of doing things. To make them happen requires a public sector that is more efficient and that is nimble enough to adapt fast to change.

In fact, the Public Sector Reform Programme that we have announced will concern several public sector organisations and bodies and will be carried out after consultations with stakeholders.

These reforms are a sine-qua-non condition for providing better services to the population, businesses as well as to Government so that it can implement its policies more speedily, efficiently and effectively. And equally important is that all these reforms will allow us to make better use of taxpayers’ money.

I must also add that the purpose of this reform programme goes well beyond this Budget.

Let me here, also add that every ministry concerned with the reform programme will be required to submit regular reports on progress made.

I will personally chair a high level committee to oversee the monitoring and implementation of all the strategies of the Budget.

I will thus personally see to it that the ten strategies of the Budget are implemented on time, to deliver the desired impact on our economy and society.

Madam Speaker, I should like to stress that Budget 2016/17 also shows the commitment of this Government to bring Rodrigues and other outer islands on higher development paths.

Madam Speaker, I will now clarify some measures that were announce in the budget Speech.

First, as the House is aware, Government has decided not to implement the Heritage City project. Consequently, the amount initially earmarked for that project will be reallocated to the Metro Express Project. To that effect, we have already made a request to Indian Government to reallocate the Rs 2.7 billion, from the grant of Rs 12.7 billion to the Metro Express Project.

The Indian Government has agreed to our request I will therefore be circulating, at Committee Stage, an amendment to the Estimates 2016/17 to that effect.

However, we have the flexibility in the future to use that amount to finance other projects should there be a need. Obviously, we will do so with the concurrence of the Indian Authorities.

Regarding the setting up of the slavery museum project in Port-Louis, a new site has been identified instead of the ex-Labourdonnais Military Hospital.

I would like also to take the opportunity to clarify that private banking is not included in the definition of investment banking and as such will continue to be licensed and regulated by the Bank of Mauritius. Thus the Banking Act will be amended accordingly.

Madam Speaker during the debates some issues were raised which need clarification.

ADDRESSING MAIN ISSUES RAISED

I will now address the main ones:

First (UTEEM) on our measure to remove the age discrimination regarding the Basic Invalidity Pension so that children below the age of 15 years also can benefit. Let me point out here that this discrimination has been there for 39 years.

Madam Speaker, it will be remembered that it is this Government that has put an end to this discrimination.

And I would like to clarify that persons above 60 years of age and with severe disability do receive their Basic Retirement Pension together with a carer’s allowance of Rs 2,500 per month, therefore making a total of Rs 7,750 per month.

Second, (RAMANO) in order to correct an anomaly , the division of assets between ex-spouses following a divorce, assets which have been acquired during the legal community of goods will be exempted from registration duty and land transfer tax.

Third,

Leader of the opposition

Conclusion

Madam Speaker, I would like now to conclude.

Budget 2016/17 focusses squarely on the aspirations of our youth, men and women, on micro and small businesses, on new entrepreneurs and start-ups, on lifting families out of poverty, and on strengthening the middle class.

We have prepared the Budget with the conviction that every Mauritian deserves a real and fair chance at moving up the social ladder – that every Mauritian must regain the sense of optimism in the future.

Thus Budget 2016/17 will be remembered as the Budget that:

- Reversed the unemployment trend

- Restored a higher growth path

- Created a new class of entrepreneurs

- Shaped the digital economy and society

- Took a historic action to lead families out of absolute poverty

- And, a budget that rolled out one of the boldest public sector reform programmes ever.

Indeed, Madam Speaker, the Budget sees the future in a new light.

Madam Speaker, I am confident that our goals will be attained.