La National Corporate Social Responsability (CSR) Foundation sera opérationnelle avant janvier 2017, sera placée sous la tutelle du ministère de l’Intégration sociale et gérée par un conseil comprenant les secteurs public et privé, et la société civile.

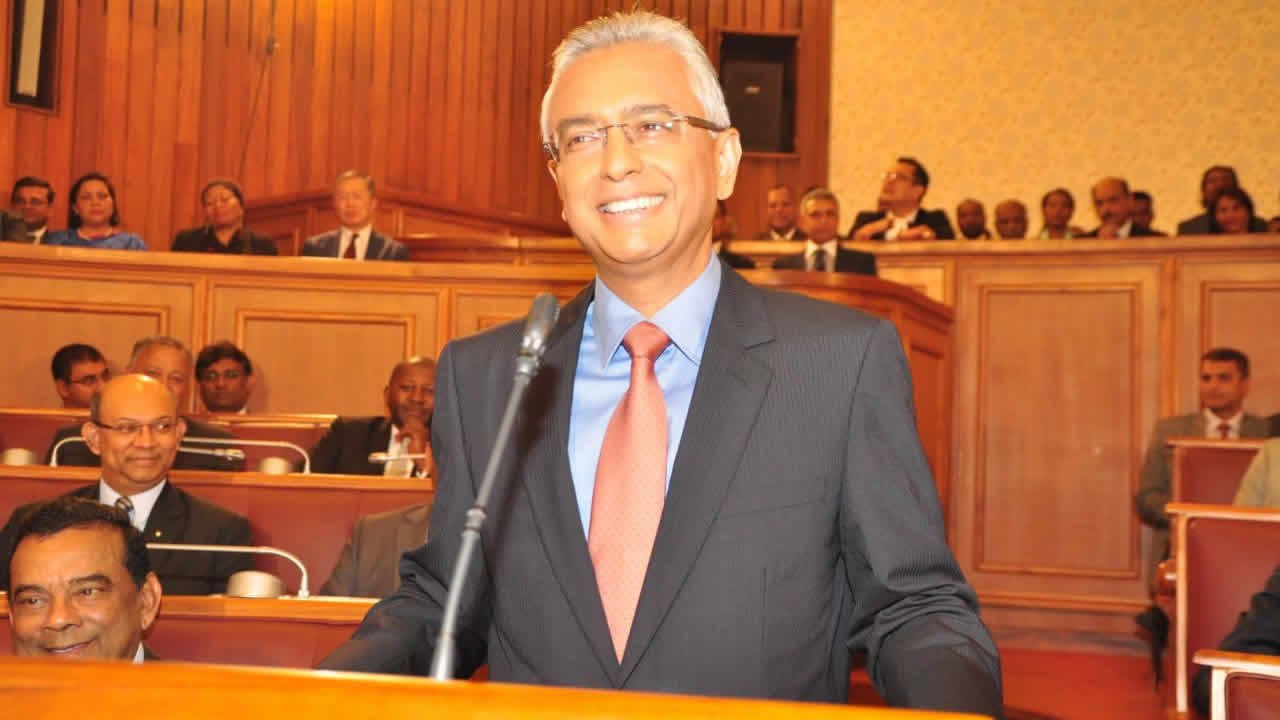

C’est ce qu’a affirmé le ministre des Finances Pravind Jugnauth en réponse à la Private Notice Question (PNQ) du leader de l’Opposition Paul Bérenger vendredi 12 août à l’Assemblée nationale.

Pravind Jugnauth a precisé : « The Corporate Social Responsibility (CSR) system was introduced in the Income Tax Act in 2009, whereby companies were required to devote 2% of their profits for carrying out CSR activities under approved programmes as per published guidelines. »

Et d’ajouter : « In July 2015 all CSR guidelines were removed and companies were allowed to use their CSR funds according to their own CSR framework. »

Une provision sera incluse à cet effet dans le Fiance Bill, qui sera voté après les débats sur le Budget 2016-17.

La National CRS Foundation opérera sur six axes prioritaires comme suit :

- Allégement de la pauvreté des familles enregistrées sous le Social Registrer of Mauritius

- Soutien à l’éducation aux familles enregistrées sous le Social Register of Mauritius

- Logements sociaux

- Soutien aux personnes souffrant de handicap sévère

- Problèmes de santé résultant de l’abus des drogues

- Protection aux victimes de violences domestiques

Ci-dessous la PNQ de Paul Bérenger et la réponse de Pravind Jugnauth :

PRIVATE NOTICE QUESTION

To ask the Honourable Minister of Finance and Economic Development –

Whether, in regard to Corporate Social Responsibility, he will state –

(a) the obligations of the companies in 2015 in respect thereof and, for the benefit of the House, obtain from the Mauritius Revenue Authority, information as to the amount unspent money thereof available thereat as at to-date, indicating if some companies are presently in arrears thereof;

(b) the total amount of money thereof granted to the Non-Governmental Organisations in the years 2014 and 2015 respectively and to the Lovebridge Company Limited as at to date; and

(c) how and when the proposed National Corporate Social Responsibility Foundation will be set up, indicating –

(i) the proposed composition of the Board thereof;

(ii) the proposed percentage of Corporate Social Responsibility money of the companies that will be remitted thereto;

(iii) if the draft guidelines thereof are available; and

(iv) what will be the role of the Mauritius Revenue Authority in relation thereto?

Reply

Madam Speaker,

The Corporate Social Responsibility (CSR) system was introduced in the Income Tax Act in 2009, whereby companies were required to devote 2% of their profits for carrying out CSR activities under approved programmes as per published guidelines.

2. In my Budget Speech of November 2010 (paragraph 333), I stated the following:

Quote ‘To this end, we are reviewing the utilisation of CSR. Our aim is to focus on the most urgent problems so as to maximise the social benefits and ensure national coverage. We will therefore use 50 percent of the CSR resources to focus on the three National Programmes. Government will add to the CSR resources to implement these three programmes which are:

- Social Housing

- Welfare of Children from Vulnerable Groups

- Eradication of Absolute Poverty.’ Unquote

3. In July 2015 all CSR guidelines were removed and companies were allowed to use their CSR funds according to their own CSR framework.

4. Madam Speaker, during the pre-budget consultations, numerous representations were received from civil society organisations concerning the operation of the CSR system. The main criticisms levelled were as follows:

- Lack of focus on poverty alleviation and assistance to vulnerable groups (diversion from the original objectives);

- Arbitrariness and lack of transparency in the allocation of CSR funds by companies;

- Difficulty in accessing funds by some deserving NGOs and other civil society organisations;

- In the absence of guidelines, there has been a proliferation of all types of organisations and clubs just to benefit from the CSR funds; and

- Lack of proper monitoring and evaluation of CSR programmes and activities.

5. There have been many instances where the CSR funds were not directed to the support of vulnerable groups.

6. After giving careful consideration of the representations received and after assessing the current system, I announced a new CSR Framework in the Budget 2016/17 with a view to ensuring greater transparency and better outcomes in the implementation of CSR programmes.

7. Madam Speaker, concerning part (a) of the question, according to provisions in the law, the CSR obligations of companies in 2015 were as follows:

- Every company shall in every year set up a CSR Fund equivalent to 2 per cent of its chargeable income of the preceding year to implement a CSR Programme in accordance with its own CSR framework.

- ‘CSR programme’ means a programme having as its objects the alleviation of poverty, the relief of sickness or disability, the advancement of education of vulnerable persons or the promotion of any other public object beneficial to the Mauritian community.

- A company shall submit to the Mauritius Revenue Authority (MRA) as an annex to its return of income a statement showing the amount of CSR spent and the details of CSR projects implemented by the company during the income year.

- The unspent balance has to be remitted to MRA.

8. The unspent Corporate Social Responsibility money collected by MRA is transferred to the Consolidated Fund within one week of collection. Thus, MRA does not hold any such funds at its level. The unspent CSR money collected by MRA and remitted to the Consolidated Fund to-date is as follows:

- Fiscal Year 2010 : Rs 149.5 Million

- Fiscal Year 2011 : Rs 116.4 Million

- Fiscal Year 2012 – Rs 130 Million

- Fiscal Year 2013 – Rs 124.7 Million

- Fiscal Year 2014 – Rs 166.5 Million

- January 2015 – June 2015 (6 months period) – Rs 55.8 Million

- Fiscal year 2015/16 – Rs 147.5 Million

9. Regarding the question of whether there are some companies which are in arrears, I am informed by the MRA that there are some companies which are in arrears and the detailed figures are being compiled.

10. Anyway, MRA has all the statutory powers for enforcement and recovery of unpaid tax including CSR money.

11. With regard to part (b) of the question, for the year 2014 under the previous CSR guidelines, companies and Foundations with a CSR Fund of Rs 500,000 and above, must seek prior approval of their Corporate Programme/projects from the CSR Committee, including the NGOs involved.

12. I am informed that in 2014, out of a total amount of Rs 336 Million of approved CSR programmes, an amount of Rs 124 Million was meant for NGOs. It must be stressed that these relate only to big companies with a CSR Fund above Rs 500,000. However, there is no information available as regards to projects and grants to NGOs by companies with CSR Fund of less than Rs 500,000.

13. Concerning 2015, since removal of the guidelines, the CSR Committee has no information with regard to funds made available to NGOs. However, the Income Tax Act was amended to provide for companies to submit as an annex to its return of income tax a statement showing the amount of CSR spent and the details of CSR projects implemented by the company during the income year. The information for the income year 2015/16 will be available only after all companies would have submitted their returns by 31st December this year.

14. As has been explained in reply to PQ B/522 of 7th June 2016, a one-off amount of Rs 100 Million has been paid as seed capital to Lovebridge Ltd in January 2016 from the Consolidated Fund.

15. In addition, Government is providing direct financial support to NGOs yearly from the Consolidated Fund as follows:

- Fiscal Year 2014 – Rs 235 Million

- 6 months budget (January – June 2015) – Rs 106.5 Million

- Fiscal Year 2015/16 – Rs 245 Million

- Fiscal Year 2016/17 – Rs 293 Million

16. With regard to part (c) (i) of the question, the new National CSR Foundation will be under the aegis of the Ministry of Social Integration and Economic Empowerment. It will be managed by a Board of Directors, comprising a Chairperson, members from the private sector, public sector and civil society. It will be set up after the Finance Bill has been passed and it will be fully operational before January 2017.

17. With regard to part (c) (ii) of the question, businesses will be required to contribute through MRA at least 50% of their CSR money to the new National CSR Foundation at the start of their next accounting year – for example for companies with accounting period ending 31 December 2016, the new CSR framework will be applicable as from 1st January 2017. The rate of contribution will be changed to at least 75% in the following year.

18. With regard to part (c) (iii) of the question, the guidelines will include the 6 priority areas of intervention as stated in the Budget Speech and are as follows:

- Poverty Alleviation– targeting families in the Social Register of Mauritius (SRM);

- Educational Support – targeting families in the SRM;

- Social Housing – targeting families in the SRM;

- Supporting persons with severe disabilities;

- Dealing with health problems resulting from substance abuse and poor sanitation; and

- Family protection, that is protection to victims of domestic violence.

19. The detailed guidelines will be finalised by the National CSR Foundation after undertaking consultations with stakeholders concerned.

20. With regard to part (c) (iv) of the question, the MRA will act as an agent for collection of the CSR money and its recovery on behalf of the National CSR Foundation.

21. Any unspent balance of CSR money should be remitted at the time of submission of annual income tax return to MRA as per the current practice. The money collected by the MRA will be channeled to the National CSR Foundation and no longer to the Consolidated Fund.

22. There will be a possibility for a company or its foundation to continue using its CSR money on an existing or a new CSR Programme, provided it fits within the six priority areas, and is approved by the National CSR Foundation.