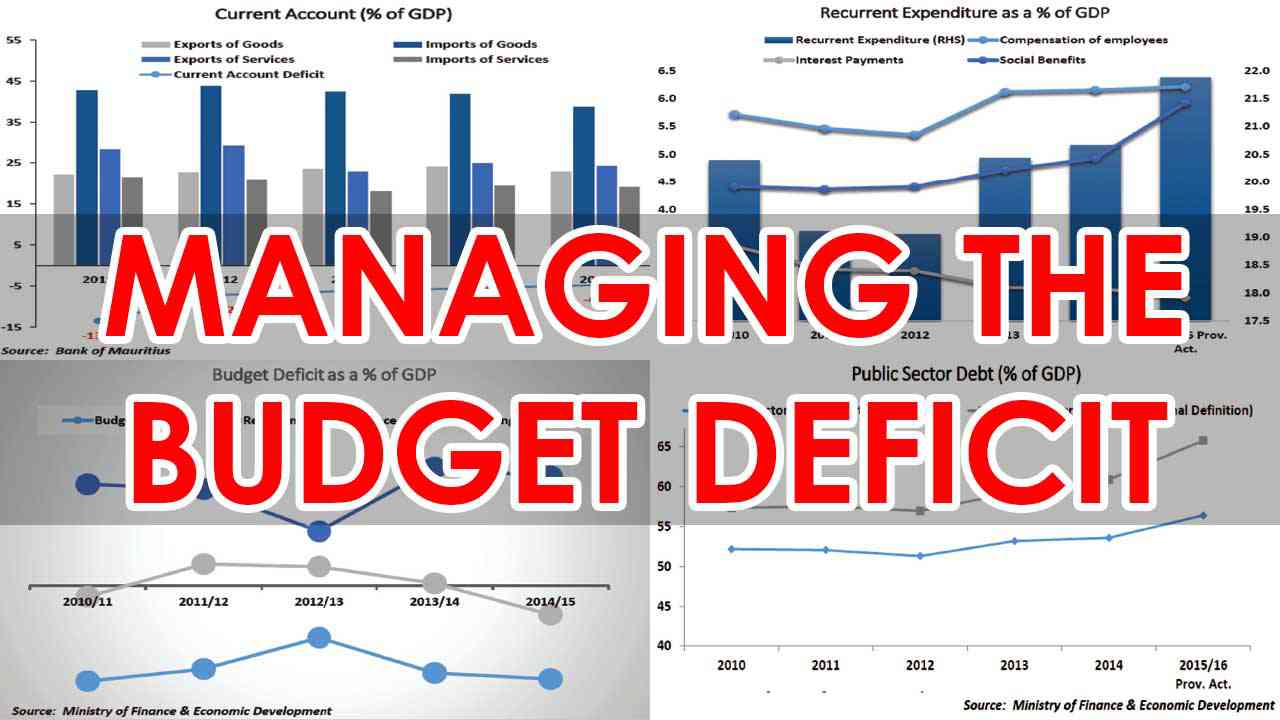

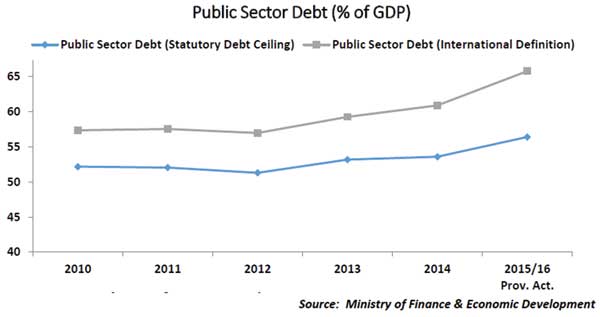

Lower than expected growth in Europe could adversely affect tourism, trade and FDI. On the domestic side, while risks from the public debt profile should be manageable, given the low external debt with long maturities and favourable terms, vulnerabilities could arise if public debt is not reduced from its relatively high level of about 64 per cent of GDP. The current account deficit narrowed from 8.8% of GDP in 2014 to 7% of GDP in 2015, driven by a smaller trade deficit and lower net income outflows.

“The bulk of the current account deficit is structural, reflecting weaker private saving and reliance on capital goods imports, compounded by the slow recent growth of Mauritius’ main trading partners. The current account deficit continues to be financed largely by FDI (especially property, and hospitality services), and financial flows from the offshore corporate sector,” says Dr Bhavish Jugurnath.

Given the importance of the UK and the EU for Mauritius exports, the implications of Brexit on these markets could be significant for the domestic economy. These risks and issues are all the more worrying in the context of an already weak investment environment and imbalances on the external and fiscal fronts, and emphasize the need for reigniting the growth engine through a revamp of the economic strategy.

Most important, external balance and domestic financial stability conditions are crucially dependent on continued funding from non-residents and the GBC sector, which could be affected by a revision of the DTAA with India, and on the absence of adverse spillovers on domestic banks from their large exposure to credit risks on cross-border lending operations.

There is also a risk that domestic credit growth may be lower than projected should bank balance sheet strains worsen. These risks and issues are all the more worrying in the context of an already weak investment environment and imbalances on the external and fiscal fronts, and emphasize the need for reigniting the growth engine through a revamp of the economic strategy.

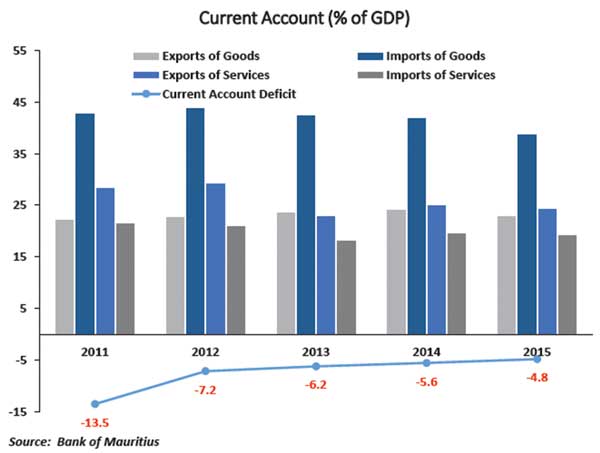

The budget deficit has exceeded 3% in recent years and is expected to continue to do so except for a brief dip to 2% in 2012. Government expects to also bring down its debt levels to 50% in coming years.

J'aime

J'aime