The Government’s budget has considerable effects on society as well as on the political health of a country. The recent Budget of this current Government is described as being a sweetener to the population. How far can this sweetener leave a bitter taste to the economy is a debatable issue! With the Budget deficit setting to reach nearly Rs 17 billion in the next financial year, what could be its impact on our economy?

The last Budget of this Government has surely conquered the hearts of many people with the various measures announced. From the health sector to infrastructure, amounts allocated to various sectors have seen a considerable increase. For instance, for the health sector, the amount has increased from Rs 12.2 billion to Rs 13.1 billion. For free education, an amount of Rs 600 million is being earmarked. Major infrastructural projects are also at the heart of economic development in Mauritius. The Government has embarked on a major infrastructural make over by investing in the Metro Express, the Cote D’Or Sports Complex, Jumbo Phoenix roundabout, the bus modernisation programmes, just to name a few.

Furthermore, statistics show that the Budget deficit is likely to reach Rs 16.9 billion during the next fiscal year, and the Minister of Finance intends to borrow an amount of Rs 19.2 billion, mainly on the local financial market. In an unprecedented move, the accumulated surplus of the Bank of Mauritius will be partly used to repay the public debt. Public Sector Debt is essential for the economic development of the country, however, excessive debt carries serious risks. This is because large amounts of funds, earmarked to service debts, implies reduced amounts being allocated to other classes of activities.

Various stakeholders are referring to this Budget as being a populist one. Can a populist Budget have serious consequences on our economic health? Experts in the field provide their arguments on this debate.

Shaktee Ramtohul : “There are indicators which are cause for concern”

Shaktee Ramtohul, referring to the World Bank, states that the global economy has slowed to its lowest pace in three years, amidst heightened trade tensions between the US and China. “In fact, extracts of the World Bank Report suggest that the Global Economy is expected to grow by a mere 2.6% for the year 2019. In light of the current Global Economic Outlook, the Economic Growth Rate of 3.9% estimated for 2019 still indicates a resilience of the Mauritian Economy towards a global slow down. However, there are indicators in the current Budget which are cause for concern. We are facing a current account deficit implying that we continue to rely heavily on imports. While the unemployment rate stood at 6.9%, the Budget is not entirely clear regarding the creation of further employment.”

Shaktee Ramtohul, referring to the World Bank, states that the global economy has slowed to its lowest pace in three years, amidst heightened trade tensions between the US and China. “In fact, extracts of the World Bank Report suggest that the Global Economy is expected to grow by a mere 2.6% for the year 2019. In light of the current Global Economic Outlook, the Economic Growth Rate of 3.9% estimated for 2019 still indicates a resilience of the Mauritian Economy towards a global slow down. However, there are indicators in the current Budget which are cause for concern. We are facing a current account deficit implying that we continue to rely heavily on imports. While the unemployment rate stood at 6.9%, the Budget is not entirely clear regarding the creation of further employment.”

He points out that the short and medium term outlook appears to be positive in view of the current budgetary measures. “Mauritius continues to be viewed as a politically stable country and our recent fully compliant status with the OECD standards on transparency and exchange of information regarding tax purposes will surely attract further Foreign Direct Investments. Key economic indicators suggest that Mauritius is set to continue on its momentum of economic growth with an estimate of 4.0% by 2020. Furthermore, the historical visit of the Pope scheduled for September 2019 will undoubtedly position Mauritius on the global stage, considering that this visit will benefit from media coverage throughout the globe.”

The Ocean Economy again appears to have been left behind in the current Budget, he adds. “While Mauritius enjoys an exclusive economic zone of 2.3 million sq kilometres, little or no measures emerged from the Budget regarding how to exploit this segment. Moreover, The National Audit Office produces a report on a yearly basis and repeatedly highlighted mismanagement of public funds. Are we finally amending the law to hold Public Officials accountable for mismanagement of public funds? While an online auction market will be set up between local fishermen, fishing companies and buyers (both local and international), this measure could have been extended to other business segments, primarily SMEs.”

Vineet Jugessur : “Difficult to increase revenue in the coming years”

For Vineet Jugessur, the Minister of Finance and Economic Development presented a conservative Budget following upcoming general elections, with a lot of focus on social measures to gain people’s popular support. “This Budget sends out a strong signal on the Government’s intention to invest and explore new innovative clusters such as AI and Fintech. Unfortunately, the manufacturing sector appears to have been overlooked.” According to him, there are some positive performances as well, such as GDP growth, decrease in unemployment rate, inflation and major infrastructural project.

For Vineet Jugessur, the Minister of Finance and Economic Development presented a conservative Budget following upcoming general elections, with a lot of focus on social measures to gain people’s popular support. “This Budget sends out a strong signal on the Government’s intention to invest and explore new innovative clusters such as AI and Fintech. Unfortunately, the manufacturing sector appears to have been overlooked.” According to him, there are some positive performances as well, such as GDP growth, decrease in unemployment rate, inflation and major infrastructural project.

Commenting on the public debt, he adds, “The Government aims to limit this level to 61.6% of GDP in the next financial year by using the accumulated undistributed surplus of Rs18bn held at the Bank of Mauritius. Now, this is an area of concern, as it may have broader impacts on the country’s monetary policy.”

He explains that as per the projections, Government’s estimated revenue for 19/20 stands at Rs 121.6 billion. “More than 50% of this amount is expected to be eaten out by salary and pension expenditures. Total expenditure is estimated at Rs 138.5bn, resulting in a Budget deficit of Rs 16.9bn. With a downward trend of major sectors such as tourism, textile, agriculture and no visible prospects from new emerging economic clusters, it appears to be difficult to increase revenue in the coming years. Additionally, expenditure is expected to further increase in health sector, education sector, social security, and due to new measures, such as medical insurance scheme for civil servants. It is critical for the Government to make sure that a good governance mechanism is followed by all the different institutions which act as arteries for the country to operate efficiently, ranging from social, environmental, fiscal and legal spheres.”

Sanjay Matadeen : “It provides for short term relief”

With economic growth averaging 3.7% over the last four years and a contained inflation rate under 5%, the Government has opted for an expansionary fiscal policy largely based on a massive increase in public expenditure in the hope of a multiplier effect on the economy in terms of increased consumption, employment and growth, says Economist Sanjay Matadeen. “As stated in the annex to the Budget in the Three-Year Strategic Plan 2019/20-2021-2022, almost three quarters of the increase in the real GDP growth can be accounted by an increase in real consumption growth over the period 2015-2018. Increase in consumption will remain the main driver of economic growth over the next two years presenting two main challenges in terms of increased public debt for financing government expenditure and the risk of increasing inflation with excess demand.”

With economic growth averaging 3.7% over the last four years and a contained inflation rate under 5%, the Government has opted for an expansionary fiscal policy largely based on a massive increase in public expenditure in the hope of a multiplier effect on the economy in terms of increased consumption, employment and growth, says Economist Sanjay Matadeen. “As stated in the annex to the Budget in the Three-Year Strategic Plan 2019/20-2021-2022, almost three quarters of the increase in the real GDP growth can be accounted by an increase in real consumption growth over the period 2015-2018. Increase in consumption will remain the main driver of economic growth over the next two years presenting two main challenges in terms of increased public debt for financing government expenditure and the risk of increasing inflation with excess demand.”

He highlights that in an election year, it is difficult for the party in power to focus on serious economic issues only. “We cannot expect that one budget only will solve all the serious economic issues, it is more of a longer term planning and continuity. This is the closing Budget of this Government and we can surely expect better from the next budget of whatever government is in place in terms of reviewing the economic fundamentals of the country and launching or re-launching of sectors which have the ability to bring in higher growth and foreign currency. This Budget is being used mostly as an accounting exercise to balance expenditure with revenue rather than an economic tool. Decreasing labour productivity, decreasing exports of goods because of the declining agriculture and manufacturing sectors, the heavy concentration of FDI on the property sector, high youth and female unemployment, rising inequality between the poor and the rich and soaring public debt remains as unfinished business.”

For him, the Budget provides for short term relief to a number of targeted sectors in the economy, a compensation for the hardships they are facing. “The proposed new licencing regulations in terms of Fintech and Crowdfunding are in the positive direction; these are the first steps in an increasingly digital and connected world. However, much more is needed in terms of economic policy and to have a transformative impact on Mauritius and making it ready for Industry 4.0.”

The main weakness of Mauritius is the low labour productivity, the decrease in exports of goods and the lack of entrepreneurship, he says. “There is also the alarming international context with BREXIT, trade wars and rise in protectionism. Along with increasing the Budget for the Economic Development Board and MTPA for export and tourism promotion, it will have helped to assist ailing enterprises in manufacturing sector and the SME’s to restructure themselves and become more productive.”

He believes that more emphasis should have been put on the financial services sector, mainly the offshore sector, as it is the sector which is sustaining our Balance of Payment. “It is the sector which is bringing the much needed foreign exchange to sustain our living standards. It is imperative to move to higher value activities in the sector from the actual BPO type activities undertaken by so many of the enterprises in the financial sector. Many are just doing accounting, administrative and secretarial subcontracting activities.”

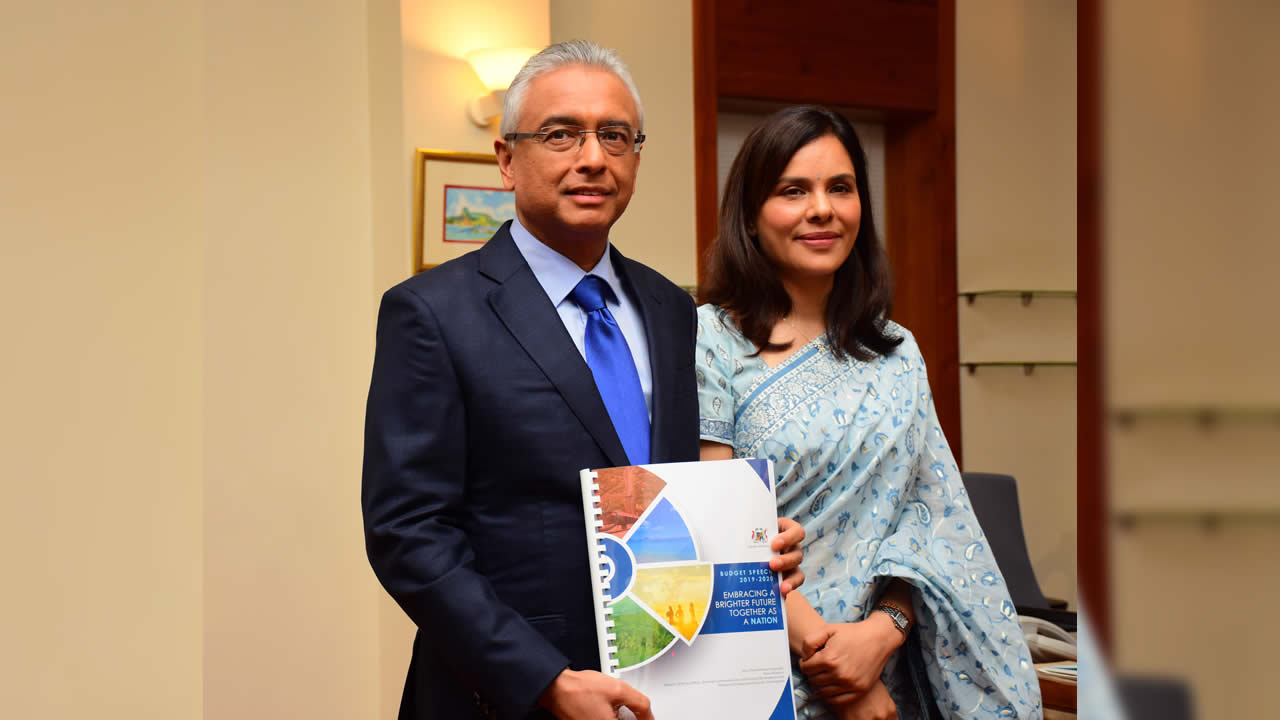

Pravind Jugnauth : “Various measures for a better future for the population”

During an interview on Wednesday on the MBC, the Prime Minister and Finance Minister Pravind Jugnauth provided his explanation on the Budget. He stated that they have not taken the various measures because of upcoming elections but rather to provide for a better future for the population. “

The Prime Minister also commented on the public debt. “We are also worried about the debt. Better we take debt rather than tax the population for financing the projects. I will do everything I can to increase these reserves, but when I look at past loans and we have to pay back billions of rupees of interest, I have to do something to bring down the debt.”

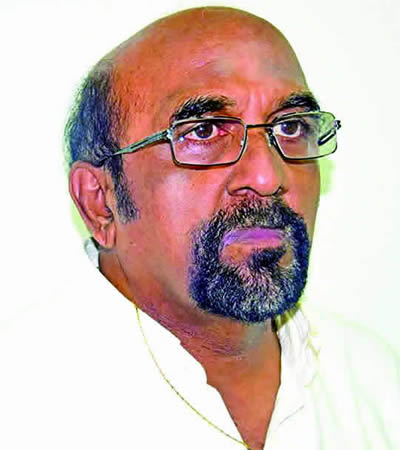

Dr Tulsidas Naraidoo: “Should react positively to the measures”

Dr Tulsidas, observer and senior economist, reveals that as a whole, it is a good Budget in favour of the working class. “If prices of various commodities such as gas cylinder or fuel would have increased or remain constant, it could have resulted in price hike and this could have a domino effect on various services.”

Dr Tulsidas, observer and senior economist, reveals that as a whole, it is a good Budget in favour of the working class. “If prices of various commodities such as gas cylinder or fuel would have increased or remain constant, it could have resulted in price hike and this could have a domino effect on various services.”

He argues that the population should react positively to the measures. “The measures are here and now it is up to the population to use it. For instance, many incentives have been listed for SMEs and now it is time for the SMEs to take advantage and react positively.”

For him, the Finance Minister should have adopted a more holistic approach. He also points out that the tourism sector has not been addressed as it should have. “The problems of stray dogs, garbage on beaches and refurbishment of beaches has remained unattended. Similarly, nothing has been done for young graduates.”

Xavier Luc Duval : “This Budget provides no analysis, no strategy and no solution”

In parliament on Thursday, the leader of Opposition, Xavier-Luc Duval, stated that Mauritius is still trapped in the middle-income economy. “This Budget provides no analysis, no strategy and no solution. The only solution has been the offering of subsidies. It was not a macroeconomic Budget but rather an action plan for the NDU. It contained no reform.”

In parliament on Thursday, the leader of Opposition, Xavier-Luc Duval, stated that Mauritius is still trapped in the middle-income economy. “This Budget provides no analysis, no strategy and no solution. The only solution has been the offering of subsidies. It was not a macroeconomic Budget but rather an action plan for the NDU. It contained no reform.”

He summarizes the Budget as such: “It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair.”

The leader of Opposition also highlighted the unemployment rate among young people who remained unattended in this Budget. “There is a serious issue of employment and under employment. Bold action should be taken.” Moreover, he lamented on the quality of education and social housing. He confided that the promise on social housing has not been made.

J'aime

J'aime