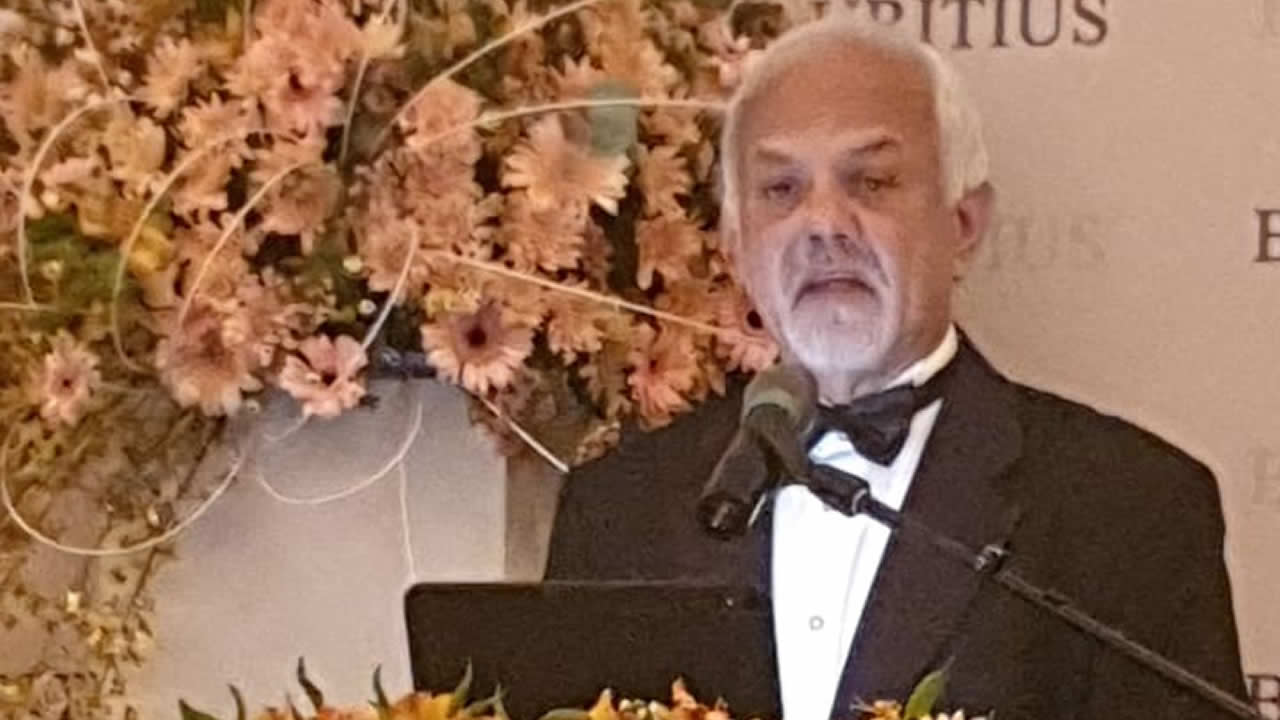

Ci-dessous le discours intégral du Gouverneur de la Banque de Maurice [BoM], Yandraduth Googoolye. C'était lors du dîner annuel de la BoM à Hilton Resort Spa à Flic-en-Flac vendredi soir.

Speech of Mr Yandraduth Googoolye,

Governor, Bank of Mauritius at the Annual Dinner for Major Economic Stakeholders hosted by the Bank of Mauritius

SHAPING THE NEW BANKING LANDSCAPE

Defining the priorities and leveraging new technology

to propel the Mauritian financial system forward

Hilton Resort and Spa,

Wolmar, Flic en Flac

Friday 29th of November 2019

Your Excellencies

Former Governor D. Maraye

Chairman of the Mauritius Bankers Association Limited

Chairmen and Chief Executives

Distinguished Guests

Members of the Press

Ladies and Gentlemen

It is an honour for me to welcome you tonight to this customary annual event of the Bank of Mauritius.

This year, I will depart from the way I made my speech last year. I will not go over the Bank’s achievements, as these have been amply reported in the media. For those who want to refresh their minds, they may wish to visit the website of the Bank. Our accomplishments will also feature prominently in the Bank’s Annual Report which will be released shortly. We shall send you an electronic copy of the Report once it is released.

I am pretty sure you are looking forward to hear my message tonight. Please feel free to share with me directly your comments and criticisms later. This space is too often filled by the media. It would be good, for a change, to hear about what stakeholders think.

Ladies and gentlemen,

Let me start with a statement that will be the weft of my discourse: ‘Much IS happening and much WILL happen!’

A look at what is happening in the world reminds me of Charles Dickens, whom I quote from his book ‘A Tale of Two Cities’:

I quote: ‘It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity’. End of quote.

You will agree with me that it befits our times, especially in the light of conflicting messages that we get all the time from all sides…

High Inflation is worrying; too low an inflation is upsetting!•

Excess liquidity is dangerous, but lack of liquidity is as troubling;•

The exchange rate is never favourable, whether for exporters or for importers;•

The policy rate, when it is high, is not helping businesses and borrowers and, when it is low, it goes against those who want to save…•

I could go on and on with the never-ending dichotomy of views and criticisms.

Indeed, it is a tale of two cities!

Ladies and gentlemen,

Let me draw your attention to some facts which are true cause for concern for us as policymakers. The global economic uncertainty has worsened. The IMF and the World Bank have revised down their global growth forecasts for 2019 and 2020. The economic environment is becoming more challenging.

Monetary policy is becoming more and more accommodative, as many central banks—both from advanced and emerging market economies—have been cutting policy rates aggressively to nearly all-time lows while others have embarked on quantitative easing to support their economies. To complicate matters, debt levels in many countries are constraining fiscal manoeuvres. The fact is that there is lesser and lesser room for dodging the bullet in case of a global recession. Some are concerned that our policy rate, currently at 3.35 per cent, is at its all-time low. We are not alone in this low policy rate environment.

This being said, there IS hope, ladies and gentlemen! Amid the global uncertainty and the materiality of downside risks, the Mauritian economy has remained resilient. Mauritius stands as a buoyant jurisdiction and is progressively growing into a leading international financial centre.

In today’s unforgiving competitive environment, success is achievable only if the highest standards are maintained. On that front, I am blunt: There is NO compromise from our side!

At the outset, let me reiterate that the Bank is pursuing its mission of preserving monetary and financial stability, whilst supporting Mauritius’ transition towards becoming a digital economy.

Ladies and gentlemen, as a prelude to the second part of my speech, allow me to set a few elements in perspective…

First, inflation. It reached a low of 0.7 per cent in October 2019 and is expected to remain below 1 per cent in the coming months, before rising to an estimated 1.5 per cent in 2020.

Second, the excess rupee liquidity has dropped to tolerable levels thanks to the Bank’s costly open market operations.

Third, monetary policy is currently highly accommodative and is expected to support the economy going forward. It will help the economy sail through the choppy waters of global economic slowdown.

In 2018, I announced a shift in the monetary policy operational target from the overnight interbank interest rate to the yield on 91-Day Bill. I am pleased to underline that, what was a long-overdue shift, has borne positive results in terms of steering short-term interest rates close to the policy rate. The Bank introduced the 28-Day Bank of Mauritius Bills in September 2019. Presently, a net amount of Rs2.8 billion has been issued to banks. This instrument has contributed significantly to improve liquidity management and ensure a smooth yield curve.

There is a fourth element that I wish to highlight. I am speaking of climate change, which is fast emerging as a priority for many countries. The 2019 edition of the annual World Economic Forum publication lists extreme weather events, natural disasters, and failure of climate-change mitigation and adaptation among the top five threats most likely to occur in the next 10 years.

Some 42 central banks and other regulatory authorities have set up the Network on Greening the Financial System. This forum focuses on climate risk management in the financial sector and fosters the transition toward a sustainable economy.

There is a clear economic case for building resilience to climate change as it may directly affect financial institutions’ balance sheets. The Bank has included climate change on its agenda and I will encourage all of you to do the same. I intend to engage with banks on this issue in the near future and request them to consider to what extent climate change is, or can be, factored in their decision-making process.

Last but not least, we are constantly improving our regulatory framework to better align it with international standards and reinforce the soundness as well as the attractiveness of our financial industry. The Bank is sparing no effort to support the country’s strategy to become a leading regional financial hub. In line with the country’s Africa Strategy, the development of regional payment facilities will be accelerated to transform Mauritius into a gateway for cross-border payments.

Before proceeding to the second part of my speech, let me spend a few minutes on two specific issues.

The quality of macroeconomic statistics is of utmost importance in policymaking. As the official compiler of external sector statistics, the Bank has to measure cross-border transactions and reflect them in the balance of payments and international investment position for Mauritius. The Bank has been conducting an annual Foreign Assets and Liabilities Survey (FALS) with entities from various sectors, which calls for specific information on our country’s foreign assets and liabilities. I strongly encourage all those entities to provide their responses accurately and in a timely manner.

Let me now dwell on recent exchange rate developments, a topic on which I have been frequently solicited from various quarters. As I said at the post-MPC press briefing last Wednesday, the rupee has depreciated against the US dollar both in nominal and real terms since the beginning of 2019. This depreciation was mostly driven by the appreciation of the US dollar on the international market and partly by domestic economic conditions.

Concerns regarding an overvaluation of the rupee at the beginning of the year have receded substantially. You will recall that the IMF has mentioned in several of its Article IV Consultation Staff Reports that the rupee was overvalued. This seems to have been corrected. I wish to also highlight that the Bank has not intervened at all on the FX market since mid-August 2019.

This brings me to the second part of my speech which is about what WILL happen.

I will now dwell on the core elements of the roadmap that the Bank has drawn to pave the way for a jurisdiction that fully embraces technology.

The successful shift in the operational target of monetary policy has enabled us to lay down a solid foundation for a thorough revamp of the monetary policy operational framework. We propose to roll out a new framework next year, which is being reviewed to infuse greater dynamism into the money market and set the basis for a more reliable benchmark yield curve.

As part of its new strategy, the Bank will strengthen its forward-looking monetary policy framework. The overall communication on monetary policy will be upgraded, complemented by more regular dialogue with stakeholders. These improvements will help anchor inflation expectations and enhance clarity on policy formulation and objective.

Financial players, especially banks given their prominence in the sector, have an important role to play in the transmission mechanism of monetary policy signals to the economy. At my last meeting of the Banking Committee in October 2019, I had urged bankers to ensure that market interest rates are adjusted in a timely manner to changes in the policy rate in order to ensure the effectiveness of monetary policy.

To boost the development of the FX market, the Bank is considering various measures, such as improving transparency on exchange rates, heightening efficiency on the FX market, and the adoption by the industry of the Global FX Code.

These measures would enhance dynamism in the FX market and offer greater opportunities to market operators to manage net open positions and hedge exchange rate risks. A more dynamic money market, a likely consequence of the new monetary policy operational framework, will provide considerable support to the FX market and stimulate its development.

Macroeconomic policies in the past few years have attracted FX inflows. There is, however, a need to address the numerous challenges facing the export sector given the weakening economic prospects in major exports markets. Structural reforms and measures to attract foreign direct investment in productive sectors are prerequisites to the strategy to rekindle the export sector.

Ladies and gentlemen, the country’s foreign exchange reserves have attained an all-time high of USD7.3 billion. Though the current account remains in deficit, the capital and financial accounts of the balance of payments have steadily generated positive FX inflows which have helped to finance this deficit. The one-year level of import cover is a solid insulation against adverse external shocks.

As you all know, the management of the central bank’s balance sheet has wide-ranging macro-economic implications. The balance sheet comprises mainly FX reserves and monetary policy instruments. A strong and sustainable balance sheet position ensures that the Bank can fulfil its policy goals effectively.

In the light of the low yield global environment and the high costs inherent to conducting monetary operations, the Bank has recently received technical advice for an optimisation of its balance sheet management. Further, the Bank intends to increase transparency in the conduct of its operations through additional disclosures in its financial statements.

Ladies and gentlemen, the protection and consolidation of our financial industry’s ecosystem is a priority. We have strengthened the legal and regulatory frameworks through the issuance of new guidelines and enhancement of existing ones and the enactment of several key pieces of legislation. These pave the way for innovations in payment systems and the protection of consumers of financial products and services. [ The main ones are the National Payment Systems Act 2018, the Ombudsperson for Financial Services Act 2018, and the Mauritius Deposit Insurance Scheme Act 2019.]

The Bank is also finalising the revision of the Bank of Mauritius Act 2004 and the Banking Act 2004. These revised enactments will modernise the central banking legal framework in sync with international as well as domestic developments. The upgrading of the banking laws and revisions of the regulations will help keep pace with the progress in this industry and fast evolving financial ecosystem. Cloud technology, artificial intelligence, cyber-security, Fintech, RegTech and SupTech are intricately linked to banking and cannot be overlooked.

The crisis management and resolution framework, also embedded in the revised legislation, will ensure a reliable safety net for customers in the event of a banking crisis. The deposit insurance scheme and the centralised KYC will be rolled out in the near future.

In the pursuit of financial stability, the Bank regularly assesses the soundness of the financial system and publishes a Financial Stability Report twice a year. Regular stress tests are carried out to gauge whether it can safely withstand a variety of extreme but plausible macroeconomic shocks.

The Bank is moving to a full-fledged risk-based supervisory framework. Concurrently, the Bank has completed the enhancement of its risk-based supervisory framework for Anti Money Laundering and Combatting the Financing of Terrorism (AML/CFT). Alongside this process, the Bank is working on an outreach programme for the banking sector jointly with the Mauritius Bankers Association Limited and has also enhanced its interactions with other licensees.

Work is ongoing with the OECD with a view to making Mauritius a stronger IFC. All stakeholders have to work closely for the benefit of the financial sector of Mauritius, especially within the parameters of the National Strategy for Combatting Money Laundering and the Financing of Terrorism and Proliferation 2019-2022. This strategy sets out the approach to tackle money laundering, terrorist financing and proliferation threats over the next three years. We are also closely engaging with banks and our licensees on compliance with AML/CFT requirements to ensure that all the risk mitigating systems are well in place.

Speaking of the payment systems infrastructure, a notable achievement this year was the implementation of the Mauritius Central Automated Switch which combines the Card Payment System and the Instant Payment System. MauCAS provides an innovative digital platform that significantly broadens the range of financial services offered to customers. It also makes banking, e-commerce and mobile payments inter-operable, and promotes a ‘cash-lite’ society.

We expect to on-board all banks on the platform over the next six months. I also invite non-bank stakeholders to leverage this new platform for channelling local payments. MauCAS will foster the emergence of Fintech start-ups and e-government initiatives. There are unprecedented opportunities to tap in this industry and its development will help shape digital Mauritius.

To keep pace with international developments in the digital currency space, I have engaged discussions with some international institutions for the introduction of a central bank digital currency for retail and wholesale payments in Mauritius.

We are determined to make our country a leader in the region, where a well-regulated central bank-issued digital currency becomes a reality.

I am pleased to announce that, as part of its financial literacy strategy, and to contribute to the emergence of a new breed of Mauritian tech entrepreneurs, the Bank will launch early next year a Fintech competition. This competition will target college and university students and will serve as an incubator hub to develop apps that will benefit consumers of financial products and services.

Cybersecurity remains paramount for the Bank. We are living in a world where cyberattacks on the banking industry are increasing and are being committed with more sophisticated tools. The Bank is already monitoring the SWIFT Customer Security Programme. It is conscious that additional tools and precautions must be taken by the industry as a whole. The Bank wishes to have an industry approach to this problem and proposes to come up with an enhanced cybersecurity framework for the banking industry. This framework will be based on the latest Bank for International Settlements and the Financial Stability Institute standards and principles.

My vision is a banking landscape where technology will redefine bank-customer interaction. I want a dynamic banking landscape without impediments for mobility, flexibility, accessibility, and security.

Let the future of the banking industry show the truth in the statement uttered by the great Charles Darwin. I quote: “It is not the strongest of the species that survives, nor the most intelligent that survives. It is the one that is the most adaptable to change!” End of quote.

Ladies and gentlemen, we need to own the change process of our country. Whether you are from the business community or from the media, you all have a determining role to play in sketching this new economic and financial landscape.

I hope that you are as eager as I am to dive into the future!

On that note, I take this opportunity to convey to you, on behalf of the Board of Directors, staff members of the Bank and in my own name, our warmest regards and best wishes for the upcoming festive period.

I thank you for your attention.

J'aime

J'aime