Published by Cleveland Elementary School on June 24, 2025, the article discusses the UK’s state pension age increase, driven by longer life expectancy and financial pressures. Currently 66, it will rise to 67 by 2028 and possibly 68 by the mid-2030s. Younger generations, especially those born post-1970, and low-income workers will be most affected. The article advises early saving, tracking pensions, and seeking financial guidance to adapt. We are reproducing the full article below.

The retirement landscape in the United Kingdom is undergoing a major shift. With increasing life expectancy and pressure on public finances, the government is pushing forward changes to the state pension age. For millions of UK citizens, the dream of retiring at 67 may soon be a thing of the past. Here’s what these changes mean, who will be affected, and how it could impact your retirement planning.

The New State Pension Age: What’s Changing?

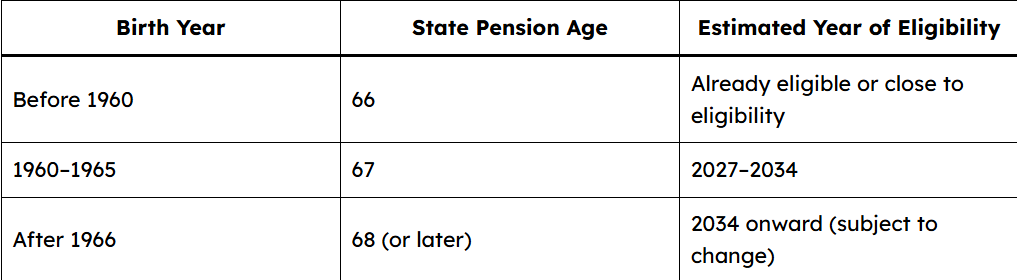

Currently, the state pension age in the UK is 66 for both men and women. It is already scheduled to rise to 67 by 2028 and 68 by 2046, but recent government reviews suggest that this timeline could be accelerated due to demographic and economic pressures.

The most recent state pension age review, published in 2023, recommended reassessing the move to age 68 between 2041 and 2043—but future changes could bring this even earlier, possibly as soon as the mid-2030s.

Planned State Pension Age Timeline (As of June 2025)

Why Is the State Pension Age Increasing?

Several key factors are driving the rise in pension age:

Longer life expectancy: People are living longer, meaning pensions must stretch over more years.

Public spending concerns: The state pension is one of the largest components of government spending.

Changing demographics: A shrinking working-age population means fewer people are contributing to the National Insurance system.

The government aims to keep the proportion of adult life spent in retirement relatively stable. With that in mind, raising the pension age helps maintain financial sustainability in the long term.

Who Will Be Affected the Most?

If you were born after April 1970, there’s a strong chance you won’t be able to collect the state pension until age 68 or later, depending on future legislation.

Younger generations—especially those born in the 1980s and 1990s—will likely feel the most impact, as they may need to work several extra years before qualifying for pension benefits.

Workers in physically demanding jobs or with lower incomes may find this change particularly challenging, as they often rely more heavily on the state pension for retirement income.

What Can You Do to Prepare?

As the retirement age shifts upward, it becomes more important than ever to take control of your financial future. Here are some strategies to consider:

Start saving early: Maximize workplace pensions, ISAs, and personal retirement savings.

Track your state pension: Use the government’s online service to check your forecast and contribution history.

Consider phased retirement: Gradually reduce working hours instead of retiring abruptly.

Get professional guidance: A financial adviser can help tailor a plan that fits your needs and changing retirement rules.

Impact on Retirement Planning in the UK

The extension of the retirement age has ripple effects across personal finance, employment, and lifestyle planning. It may influence:

Mortgage timelines

Savings goals

Health and insurance planning

Career longevity and job transitions

Employers and workers alike will need to adapt to an older workforce, which could involve reskilling, flexible working arrangements, and long-term health planning.

As the pension system evolves, early and informed preparation will be essential for maintaining financial security in retirement.

Fact-Check

Current State Pension Age is 66 and rising to 67 by 2028

True

The UK government has legislated that the state pension age will increase from 66 to 67 between 2026 and 2028.

This is based on the Pensions Act 2014.

Source:

UK Government – State Pension age timetable

J'aime

J'aime