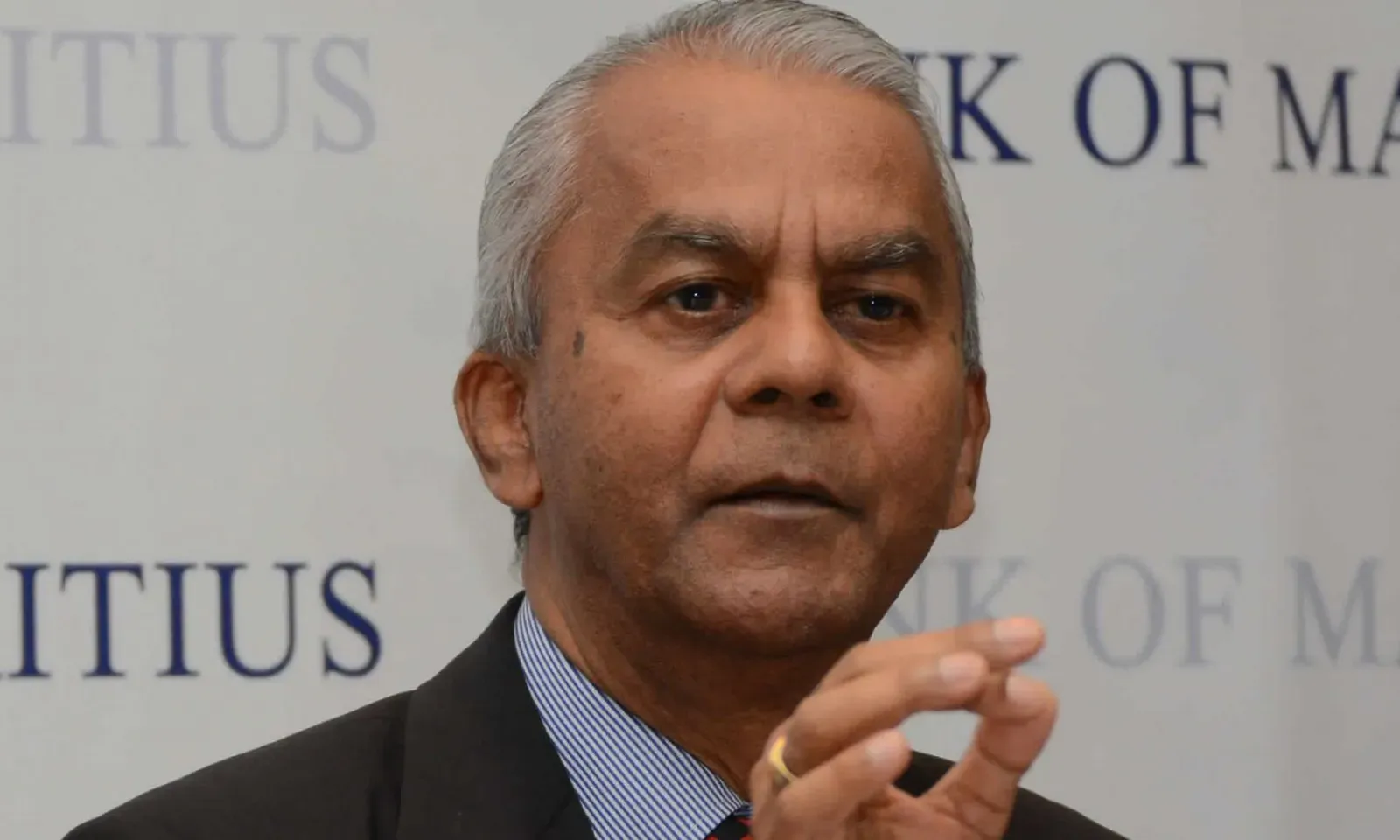

Mauritius Central Bank Governor Ramesh Basant Roi delivered a speech Friday night, 25 November, at the Bank of Mauritius annual diner.

Below is the full text of his speech:

Bank of Mauritius Annual Dinner with Major Economic Stakeholders – Address by Mr R. Basant Roi G.C.S.K., Governor of the Bank of Mauritius, 25 November 2016

ANNUAL DINNER FOR MAJOR ECONOMIC STAKEHOLDERS

Address by Mr R Basant Roi, G.C.S.K., Governor of the Bank of Mauritius

Le Méridien, Point Aux Piments

November 25, 2016

Distinguished Guests

Ladies and gentlemen

Good evening

This is the 19th Annual Dinner being hosted by the Bank of Mauritius for major economic stakeholders and it’s my 11th address to this august gathering of decision makers in the private sector. This evening I will dwell briefly on the state of the external environment the Mauritian economy has to interact with and on an area of risk in the Mauritian economy that makes it highly vulnerable to a conceivable development that could throw our financial industry out of balance with consequences deleterious to the economy.

We have all been seeing in recent times that even those who are exceptionally gifted with horizon-scanning capacity are left flabbergasted and totally disarmed by unexpected twists and turns of events. Unexpected outcomes have hit hard the business community at home and abroad. Every one of us, whether we are in the business of manufacturing for exports, trading, fund management or macro-economic policy making, faces heightened risks of going utterly wrong, not because of recklessness or incompetence but because of developments beyond our cerebral capacity to foresee. Volatility is a phenomenon we have to reckon with. Surprises are unusually aplenty. It’s a complex external environment - taxing to the brain - that we have to cope with. The convolutions of happenings abroad are characterized by a phenomenon known as “Knightian uncertainty”: “There are known knowns; there are things we know we do know. We also know that there are known unknowns; that is to say, we know that there are some things we do not know. But there are also unknown unknowns – the ones we don’t know that we don’t know.” If there is one thing investors and the market do not like, it is uncertainty.

We are in a world fraught with surprises the outcomes of which defy conventional thinking. Utterances that sound prophetic are a risky business to get into. It’s a fool’s game to predict that everything is going to be fine. Either it’s going to be fine, in which case none of you will ever remember who made the prediction or something painfully unacceptable happens in which case all of you will remember - without fail. I will try not to make any forecast, projection or prediction. The optimist says, “The glass is half full.” The pessimist says, “The glass is half empty.” The rationalist says, “This glass is twice as big as it needs to be.” I will stick to facts and lay bare the disruptive forces underlying the emerging external economic environment for your appreciation.

Models from the Ricardian comparative advantage to the Heckscher-Ohlin factor endowment theory tell us that free trade is a win-win game for trading partners. Free trade is widely believed to make countries better off. Gross Domestic Product goes up and the standards of living of the trading countries improve as a result. As we know it, free trade is the core constituent of globalisation. In the past three decades, as the pace of globalisation accelerated to a sustainable gait, all over the world, people were made to believe that globalisation will keep on lifting human conditions to heights never seen before. In fact, it did lift hundreds of millions of people out of poverty in developing countries. What proponents of globalisation did not openly admit is that free trade also creates victims. Poor people have been elevated at the expense of wealthier nations, thus creating a good deal of resentment. The wealthier nations’ coloured perceptions of the benefits resulting from globalization have ultimately cracked. Built into the trade models is the conclusion that free trade will have potentially adverse distributional consequences. In other words, it will have winners and losers. It punishes those who do not have the required skills or do not have appropriate training or are victims of poor macro-economic management that prices them out of the market by the forces of competition stemming from low wage economies. Those of us familiar with Paul Samuelson’s factor price equalization theorem in trade theory will better appreciate this point. As is aptly said, “Free markets are not pain-free markets.”

The standard response to this problem is to argue that the gains from free trade are sufficient to more than adequately compensate the losers by way of training that will equip them with new skills. But it has never been clear what kind of training can transform a 50-year old factory worker into a computer programmer or a web designer. As though factory workers in our export sectors would retool, re-equip and make a giant leap forward, within a short timespan, to become knowledge workers in a flexible new economy wherein their new skills would get them higher wages. Jobs are being lost to automation at a rate faster than we had imagined in the early years of the 21st century and 50 per cent of the jobs we have today will be gone by the year 2030 according to certain credible estimates. How then do we prepare young people for a world that does not yet exist and cannot be foreseen? Occasionally, there have been serious re-tooling agendas in various parts of the world as the centrepiece of a much needed adjustment process. In practice, the adjustment has often failed to materialize. Economists and public intellectuals portrayed the shift from a manufacturing economy to a post-industrial service-based economy as not only inevitable but also desirable. The state of things at the global level bear out ominous turns of events. Good politics has the capacity to clear up the mess left by bad economics. But will it?

Two seminal events took place this year. One of them is Brexit. Since 1971, there have been seven times when the pound sterling fell 15 per cent or more against the US dollar in the space of 6 months. Brexit hit hard a few exporting firms. The euro has been having a rough ride ever since it was introduced. The US dollar, itself being challenged from time to time in the last fifteen years as a star currency, has been sailing on choppy waters. The behavior of these three major currencies and the almost sudden rise of the renminbi reflect the underlying disruptive forces at work and the tectonic shifts occurring at the global level. The second seminal event is known to you as much as it is to me. It’s best left of this address.

The world order that business communities and policy makers across the world are accustomed to has been going through a noticeable process of de-construction for quite some years. Lately, the process has accelerated. We witnessed, in recent years, competitive devaluation of currencies, mostly among advanced countries. The dangers of a global retreat into protectionism are all too real. De-globalization appears to be afoot. It’s sort of a poetic justice that the fervent supporters of free trade are the very ones who are its biggest victims. This sounds like a really good lawyer’s brief, for the wrong side. The intellectual challenge is to find out if it is at all possible to unwind globalization without seriously affecting national economies and the global economy, the objective being some trade-off between a little GDP for greater income equality. The "big ideas" might be out there, but they're buried in a blizzard of abstractions, qualifiers, pros-and-cons, excuses and rationalizations, the truly annoying and pathetic deflections, even counter and counter-counter arguments.

The clash between economics and politics is assuming a dimension that does not augur well for the world economy. The ratios of world trade to world output have been flat since 2008, making it the longest period of stagnation since World War II. Does it suggest that globalization is no longer driving world growth? Has globalization reached its limit? If the process is coming to an end, or even going in reverse, it would not be the first time since the industrial revolution, in the early 19th century.

Two phenomena might threaten democracy: continuing weak productivity and what has come to be known as secular stagnation, a terminology coined by Larry Summers. We commonly understand democracy as a system that takes scores of voters to say ‘yes’ before reforms are implemented. Democracies also have loud voices. Those are voices that wait for a fight to break out and take a swing at the guy they have always wanted to hit. Whether or not the guy had anything to do with starting the fight is beside the point. It takes only a few loud voices that cherish democracy to say ‘no’ to stop the reforms. Press the ‘no’ button for reforms, the path to economic recovery becomes unnavigable. No wonder it takes long for democracies to come out of recession.

A blistering cocktail of unsettling forces is militating in most societies. The vast majority of people finds the word ‘austerity’ abhorrent. We are not exempt. Voices, particularly the louder ones, suffused with vice and folly with some form of addictive delirium, are more about ‘taking’ than about ‘making’. It leaves one rather uninspired when it comes to the ‘mental tone’ underlying people’s actions. Unlike in the distant past, more precisely in what used to be called a peasant society, a man is no longer sized up by the number of children he has. He is today sized up by the number of Rolex watches and number of tweeter followers he has. Remember the famous lines from William Yeats that many of us must have come across in our schooldays: “Things fell apart. The centre did not hold. Mere anarchy was loosed upon the world…”

We are left to guess what happens next. I believe none of us has the oracular capacity to precisely say what’s next. One can only state that world economic outlook is what it is, given the political developments in recent months. A couple of days ago, the UK slashed it growth rate for 2016 drastically. Singapore published a significant contraction of its third quarter GDP for 2016.

Many of us here must be aware that the world economy is growing below its potential. In the very early years of the 21st century, the world economy used to grow, on average, by about 4 per cent. In the years after the 2008 international financial crisis, the world economy has been growing by roughly half the rate. Similarly, the medium to long term growth rate of our economy used to be somewhere between 5 and 6 per cent. In the post-international financial crisis years, the growth performance of the Mauritian economy also has been roughly half the rate it used to be. If anyone of us wonders why we are stuck with a growth rate of around 3 per cent for the past several years, I would ask him to cast his mind back to the 1980s.

The Government had successfully created a congenial business climate – a business climate conducive to growth. By this I mean, Government had positively demonstrated a strong commitment to a battery of measures. The measures were coherent and comprehensive. Abolition of import licenses and import quotas, removal of cash deposit scheme for imports, dismantling of high tariff walls, Government’s greater reliance on indirect taxes rather than on income tax, gradual scaling down of income tax rates, gradual liberalization of the financial sector, including exchange control liberalization are some of the key ingredients that had inspired business confidence in the economy. At the highest level of the civil service we had a class of disinterested, well-groomed and exemplary movers and shakers, with an elevated sense of purpose and with a strong sense of commitment to the precisely defined development agenda. Importantly, a pragmatic approach to exchange rate policy along with a very prudent wage policy had set the economy into a high growth path. The benefits of the broad based policy efforts had reached out to all segments of the Mauritian society.

This is history. If history is not a language in which the dead speak to the deaf, we have to learn the lesson that the recipe for growth does not rest on a single monetary policy tool, but on a comprehensive set of bold reforms and other associated policy initiatives. Society has to own them. Is there progress without sacrifice where everyone is a winner? There is no such thing. Truths need to be told bluntly, without prevaricating and without obfuscation, as otherwise people tend to delude themselves into believing that nothing fundamental needs to change if the future economic performance is to match the past. We need to re-create the kind of business climate I just outlined. We need coherence. We need stronger commitment. We need to fully comprehend the dynamics of a digitally-driven world of technology – a phenomenon that we cannot at all afford to take lightly. It’s not a world of cows and cattle; it’s a world of cybernetics and robotics. We need to drop 20th century instincts and develop 21st century instincts. The context is riddled with complexities. In a world that is out of order, a world that is pulling apart, the scale and scope of challenges are far wider, deeper and tougher than they were in the 1980s. Absent a strong dash of commonsense, society as a whole is bound to bear the brunt of painful adjustments in the future.

Most of the economic policies that support robust economic growth in the long run fall outside the province of the central bank. If we really want to have sustained good growth back, we can only do it through exports of goods and services. In a very resource scarce country like ours, aggregate income levels can meaningfully rise only if exports of goods and services go up. This is a story that has only one simple conclusion: we have to be, first and foremost, competitive. It’s a conclusion that, despite overwhelming evidence, many of us conveniently put a lid on, perhaps because human beings cannot digest too much of reality in a single shot. When everybody in a society ends up believing that everybody can live at the expense of everybody else, something terrible happens to the national character. Free riders multiply; they off-load individual responsibilities. The gradual shift from a belief in individual responsibility to a belief in which the emphasis is more on social responsibility, whatever that means, is deplorable. There always comes a time when the Government will not be able to produce the proverbial rabbits out of its fiscal hat.

Our only resource is human capital. Endowed with poor human capital, no country in today’s dog-eat-dog world can comfortably find itself in a good stead to compete. Poor human resources combined with lop-sided industrial relations legislations are certainly not a recipe for modernization and growth. The quality of human capital matters enormously if we do want to break out of the middle income trap. The unfortunate thing about building a dependable human capital stock is the very long gestation period of investment in human resources. This is a problem readily remediable. Just open up; import the talent and the skills.

Two other factors, amongst others like innovation, that are critically important for the sustenance of competitiveness are the exchange rate of the rupee and wage levels in the economy. For quite some years in the past we have had a strong rupee. Capital inflows in the equity market and in other areas of the economy appreciated both the share prices and the exchange rate of the rupee which, in turn, attracted more investors thus carrying the exchange rate of the rupee considerably away from its fair value. The sustained large current account deficit for several years reflected the extent to which the rupee had deviated from its fair value. As is well known, an overvalued exchange rate encourages consumption, particularly of imported goods, and is a deflationary factor as far as the domestic economy is concerned. Sustained over a long period of time, an overvalued exchange rate undermines the competitiveness of the export sector. In our situation, competitiveness was further aggravated by an anachronistic system of determining wages and salaries that completely ignores the health of the economy. It’s a system that works like drug. The more you give the shots, the more you get addicted - until you drop dead.

There is a correct value of the exchange rate of the rupee that balances the needs of growth on the one hand and consumption on the other. In 2015, there was a consequential re-alignment of the exchange rate of the rupee. The structure of the Mauritian economy has evolved over the years. In this regard, I need to underscore one point for the benefit of the business community present here tonight: an exchange rate level that is good for our exports sector is not necessarily good for the financial sector and an exchange rate that is good for the financial sector is not necessarily good for our exports sector. Both sectors are vitally important though for Mauritius. In the mind of central bankers, there is not an optimal, model-produced exchange rate level. Our aim at the Bank is to have an exchange rate that is broadly stable at an adaptive and equilibrium level.

Yet, the exchange rate of the rupee is often singled out of all the key macro-economic variables and blamed for all the sins in the economy. What about the inordinate, unrelated-to-productivity increases in wages and salaries at regular intervals that also undermine competitiveness of the economy? Don’t they impact on the exchange rate of the rupee? Yes, they do. We have a system of review of wages and salaries that needs to be scrapped, a system that worked as long as the exchange rate of the rupee was administratively determined by the Bank on a daily basis in the days of exchange control. I understand that if one wishes to gain the badge of social membership in the country, one should avoid reference to this administrative arrangement of determining wages and salaries so adorable to so many. What is needed is a new non-distortionary formula – a formula that respects prevailing economic conditions. Problem is, we want to eat the cake and have it at the same time. Full-time obfuscators make us all believe six impossible things before breakfast and a dozen more before dinner.

By any cannon of logic, the current account deficit in our balance of payments is large and not sustainable, more so when viewed in the context of emerging risks and challenges. Do people realize that they buy things they don’t need with money they don’t have? Households have come to despise the past and neglect the future. The lessons of the dead and the desires of the unborn are both ignored. Instead, all that seems to matter is consumption, here and now. A large part of what people spend in this country is indeed financed by the savings of the rest of the world. The rest of the world saves; we spend their savings merrily. When everybody is making money in a euphoric situation, nobody is concerned about looking closely at where the money is coming from – or even if it is real or fictitious money as was the case in the Super Cash Back Gold scheme.

This is a kind of consumer behaviour that takes me back to a conversation between Sherlock Holmes and Dr Watson:

They are both camping out and well protected against the wind and the chill of the night inside a tent in a forest. In the middle of the night, Sherlock Holmes wakes up and gives Dr Watson a nudge.

“Watson,” he says, look up in the sky and tell me what you see.”

“I see millions of stars, Holmes,” says Watson.

“And what do you conclude from that, Watson?”

Watson thinks for a moment. “Well,” he says, “astronomically, it tells me that there are millions of galaxies and potentially billions of planets. Astrologically, I observe that Saturn is in Leo. Horologically, I deduce that the time is approximately a quarter past three. Meteorologically, I suspect that we will have a beautiful day tomorrow. Theologically, I see God is all too powerful, and we are small and insignificant. Uh, what does it tell you Holmes?”

“Watson, you idiot! Someone has stolen our tent!”

Fortunately, we have a number of exporting firms in the private sector that have given their best possible shots and strived to survive in an extremely difficult world economic environment. Fortunately, the Government and private sector enterprises made joint efforts to diversify the source-markets for our tourism industry. And fortunately, our banking industry is well capitalized. But the economy has drifted to a higher level of vulnerability lately. The matrix of deficit and debt, wage levels and interest rate levels, growth, current account deficit and regulatory policies is a conundrum of our time - a Rubik’s cube of tricky policy moves.

Until recently, regulatory and supervisory systems were designed to retrospectively identify at what point in time, so to say, a thief stole your money, not to alert you when he is actually stealing it. The rogue banker could beat the system and beat the house as well. A bad bank anywhere can affect good banks everywhere. In the wake of the financial crisis and given the rising frequency of destabilizing shocks to financial systems the world over, regulatory and supervisory systems have undergone significant improvements. The Bank has made important strides in the improvement of its regulatory and supervisory system. One of the initiatives that the Bank has taken relates to stress testing of banks. This is a highly technical forward-looking exercise whereby the financial position of a bank is projected under a baseline scenario and an adversely stressed scenario. The objective is to examine if the bank has the financial muscle and strength to withstand shocks.

The Bank, along with the prized assistance of an econometrician, Associate Professor, Jameel Khadaroo, of the University of Mauritius, has developed a stress testing framework for producing a suite of macro-prudential models for in-house use by the staff of the Bank. The findings of the last stress testing exercise indicated that the domestic banking sector is indeed strong and resilient to shocks with some grey areas that need close monitoring. I need to share with the audience two more findings: a reduction in interest rates sustained over a long period of time with a view to stimulating the economy tends to raise credit risk, measured in terms of non-performing loans in sectors like manufacturing, construction and personal. A depreciation of the rupee aiming to promote the export sectors reduces credit risk in the manufacturing and tourism sectors but it increases the credit risk to the trade sector because of our dependence on imports.

Six months have gone by since the protocol on the Double Tax Avoidance Agreement was signed. It was feared that the revision of the Agreement would trigger a flight of Global Business deposits. At the end of March 2016, aggregate deposit liabilities of the banking industry stood at Rs855 billion, out of which GBC deposits were Rs320 billion. Rather than dropping as initially feared, GBC deposits had gone up to Rs350 billion by the end of September last. Even after allowing for exchange rate effects GBC deposits have increased considerably in the last six months. The rising level of GBC deposits, despite the signing of the protocol, does not go to say that the Bank or anyone of us should be complacent about. With the expiry of the grandfathering clause by 2019, the risk of an erosion of the deposit base of banks is clear and present unless all participants in our jurisdiction come up with innovative and meaningful business strategies. Already, there are indications of a growing demand for Mauritius to position itself as treasury centres for multinationals operating in Africa. A few international banks are actually engaged in promoting this business. The Bank of Mauritius stands ready to support such initiatives.

A drop in GBC deposits would deprive the country of foreign exchange inflows for the financing of the current account deficit. The Bank had feared that a drop in GBC deposits would adversely impact on the liquidity positions of banks. A large scale drain of liquidity, if unmatched by sufficient liquid assets, generally leads to a crisis. The Bank conducted stress test to assess the impact of a potential sudden Global Business deposits flight on the banking industry. The stress-test revealed that, in a worst case scenario, banks have adequate liquid assets to meet sudden withdrawal of GBC deposits. This, too, should not leave us complacent.

Ours is a jurisdiction that still is viable and has a bright future provided there is a coherent national strategy to chalk out a path for sustained growth and development. The Bank of Mauritius along with some banks is already engaged in this pathfinding exercise.

Ladies and gentlemen, I come from a family wherein each of the kids had to have a guru, a wise person to teach and guide them in life. One of the stories told to me by my guru in the early 1950s was about Siddhartha Gautama. Siddhartha became the Buddha, later in life. At his birth, a soothsayer had foretold that Siddhartha would either become a ruler of the world or an enlightened person. Siddhartha’s father had locked him in the palace to make sure that he followed the path of power and rule the world. One day, Siddhartha happened to venture out of the palace. He encountered a corpse. This encounter turned him into a seeker of truth. Many of us - in fact, too many of us - from the lowest to the highest levels, dream of becoming a ruler. We do come across corpses; we walk over them.

I have tried to offer an honest, heartfelt and engaging message, which is true to both the spirit and the contents that drive the message. The devil is so entirely in the details, nuance and caveats that the message sometimes tends to get lost. I sense that all too often, the message gets trivialized, too. And when the chickens come home to roost, the eyeballs get focused on the vault of the Bank for bail outs. It’s a vault tightly guarded by the Board of Directors and Monetary Policy Committee members of the Bank of Mauritius.

The Board of Directors, the Members of the Monetary Policy Committee, the staff of the Bank of Mauritius and my wife join me in wishing you all and your families Happy Holidays and the very best for 2017.

Thank you