Anthony Leung Shing, Country Senior Partner PwC Mauritius, livre son analyse du Budget 2022-23, présenté mardi 7 juin par le ministre des Finances, Renganaden Padayachy.

Publicité

By Anthony Leung Shing

Country Senior Partner

PwC Mauritius

With war in Ukraine and COVID-19 still circulating, the outlook remains uncertain. Much of the headlines in recent times have been on rising commodity prices and protests against erosion in purchasing power. The inflation rate is worryingly high, while the growth rate is decelerating. The Minister of Finance, Economic Planning and Development (the ‘Minister’) presented his Budget 2022 - 2023, ‘With the People, for the People’, in light of those challenges.

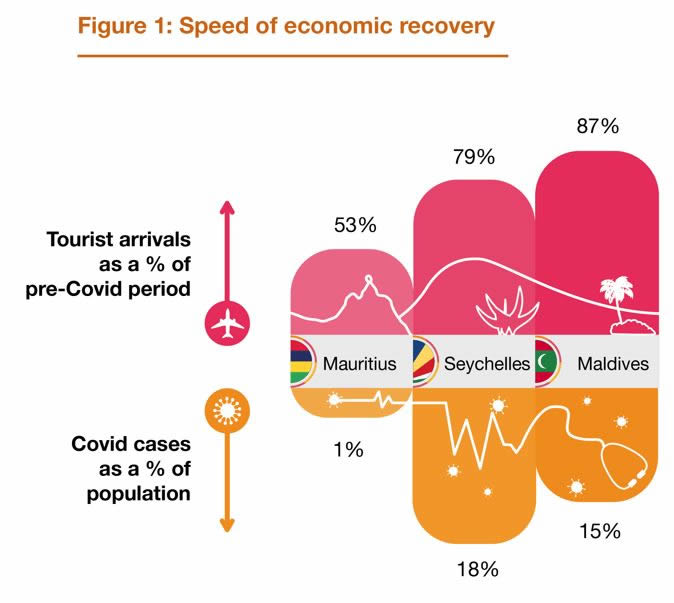

In 2021-22, the economy rebounded with a 6.9% GDP growth, helped by the reopening of the borders in October 2021. The Government prioritised the containment of the pandemic over faster economic recovery as our borders remained closed for longer, together with more stringent health protocols on arrival. Whilst Mauritius observed a lower number of COVID cases in 2022 with only 1% of its population being infected (Maldives 15% and Seychelles 18%), the level of tourism arrivals lags behind as the country reached 53% of its pre-pandemic level compared to Maldives (87%) and Seychelles (79%) (refer to Figure 1).

Whilst tourist arrivals are expected to reach its pre-pandemic level in 2023, ongoing restrictions on social gatherings, nightclubs, beaches as well as the COVID-19 Act 2020 continue to hamper full recovery and it is critical that these are removed the soonest.

The economy was buoyant in 2021-22, with tax revenues being virtually on target and, although there was some overspending in recurrent expenditure, the Budget deficit was contained at 5% of GDP. Looking ahead, the Government continues to rely on economic growth to boost revenues as opposed to containing expenditure.

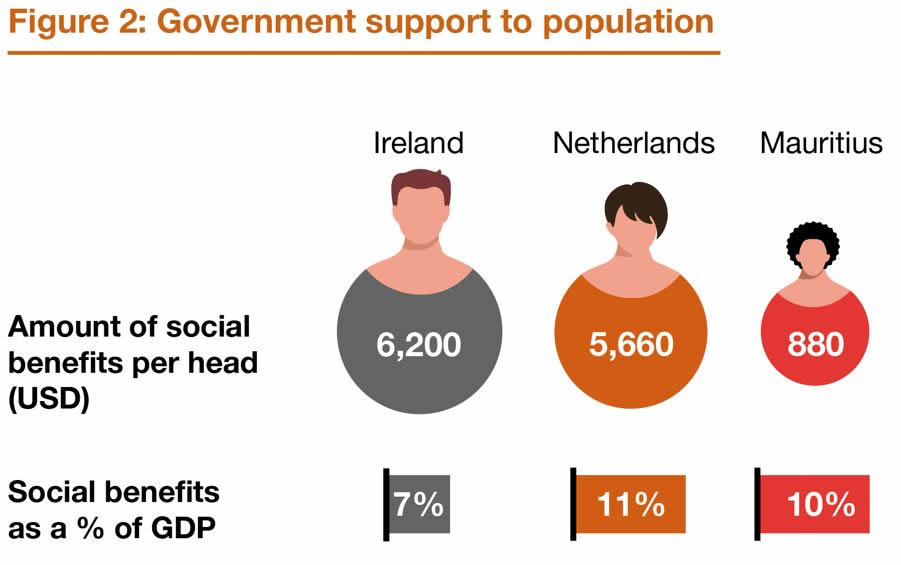

Given the rampant inflationary context, we anticipated some populist cost of living policies and the Budget sought to address those concerns with direct support to households, price control, and social aid. However, more could have been done to better optimise spending. For example, Mauritius spends 10% of its GDP in subsidies and social benefits, representing a per capita amount of $880. The country’s per capita amount is low (refer to Figure 2) compared to countries with a similar allocation (amount per capita: Ireland $6,200 and Netherlands $5,660) and, to provide more meaningful support to those in real need, Mauritius needs to adopt a targeted approach as opposed to universal benefit.

The Government’s main economic thrust in this Budget is around stimulating growth through food security and the green economy. The Minister announced a multitude of measures including tax holidays on integrated agricultural morcellement, subsidy on farming, duty-free electric cars, and reduced loan rate for photovoltaic systems. The use of such market-based policy measures to influence the behaviour of consumers and businesses is welcome, but their effectiveness will depend on the speed of their roll-out. At PwC, we have always advocated for greater private-public sector collaboration, and the announcement of PPP projects to develop scrapyard, composting units and student accommodation is a step in the right direction to alleviate the burden of government.

As the theme ‘With the People, for the People’ suggests, the Budget heavily focused on the people and there was a lack of sectoral measures. Some of the new ones include the chartering of two regional feeder vessels (Manufacturing), the granting of additional marketing budget (Tourism) or the introduction of a national payment card (Financial Services). These measures are no game changer in the absence of clear reforms!

With business confidence low and the country in need of investments, the Minister did well not to introduce new or increase taxes on income. The country’s attractiveness has been eroded in recent times and the status quo of this Budget will help maintain some confidence. With the lack of skills in emerging industries, we need a paradigm shift to attract international talents. More flexibility around the premium travel visa for entrepreneurs, as well as the young professional occupation permit, will help to improve arrivals. Today, expatriates account for 3% of the Mauritian population compared with 25% in Singapore and 80% in Dubai and we need to open our economy to boost our productive capacity (refer to Figure 3). However, higher personal taxes (specifically the solidarity levy) continue to hamper our competitiveness to bring talents.

Overall, the Budget contains a series of micro measures for the people, with no real game changer for businesses. The Government appears to rely on the economic recovery to drive activity levels, with some policy measures targeted to promote specific industries. Although maintaining the status quo in taxes is welcome, we were expecting more to improve the country’s attractiveness to talents. The danger ahead remains the high rate of inflation, which may undermine investments and consumption. A downturn in these two factors will slow down economic activity and will lead us in troubled waters!

Notre service WhatsApp. Vous êtes témoins d`un événement d`actualité ou d`une scène insolite? Envoyez-nous vos photos ou vidéos sur le 5 259 82 00 !

![[Info Soirée] : « Gro lafoul dan Champ de Mars demin »](https://defimedia.info/sites/default/files/styles/square_thumbnail/public/thumbnail_217.jpg?itok=0qBrEzjq)